The charts of all the components look just as bad.And note the collapse after oil capex collapsed:HighlightsThe small business optimism index rose 0.2 points in May to 93.8, slightly extending April’s 1 point bounce back from 2-year lows but remaining well below the 42-year average of 98. Four of the 10 components of the index showed gains in May, two were unchanged and four declined. Expectations that the economy will improve posted the largest gain, rising 5 points but remaining quite negative at minus 13. The two strongest components both declined, with plans to increase capital outlays falling 2 points to a still very solid 23, and job openings hard to fill was also down 2 points to 27, though business owners still find this as their fourth most important business problem. Plans to increase employment did rise 1 point, however, to 12. While earnings trends, the most pessimistic of the components, fell 1 point to minus 20, more business owners thought that now was a good time to expand, up by 1 point to 9.After the promising April release, May is coming back down as suspected, with a lot of help from higher gas prices, which likely will show up as reduced savings.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

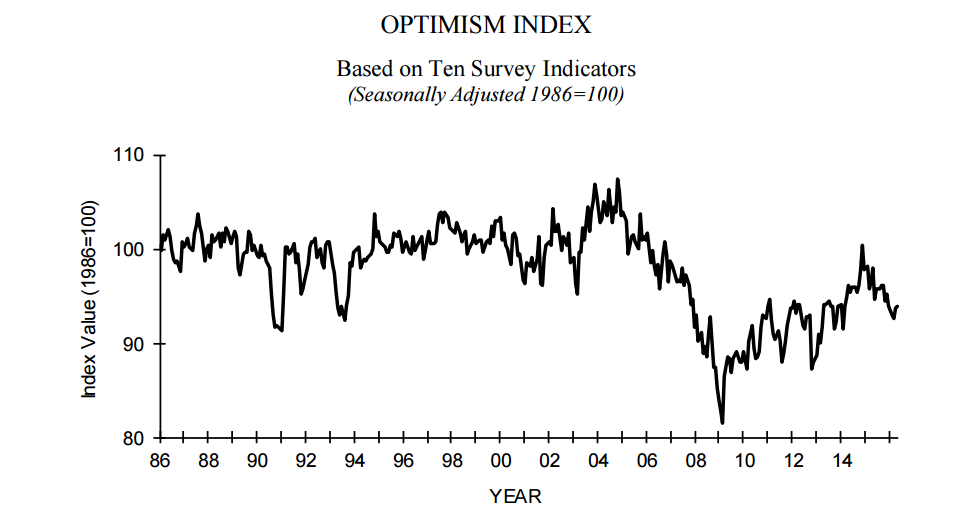

The charts of all the components look just as bad.

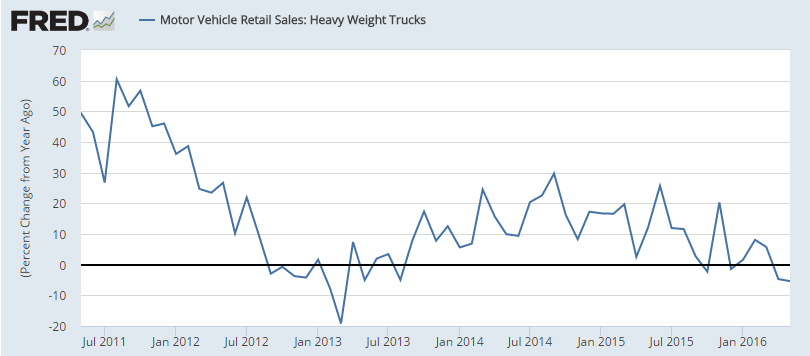

And note the collapse after oil capex collapsed:

Highlights

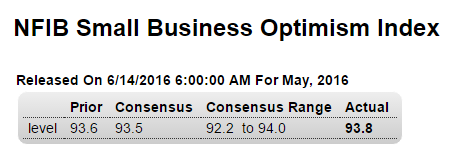

The small business optimism index rose 0.2 points in May to 93.8, slightly extending April’s 1 point bounce back from 2-year lows but remaining well below the 42-year average of 98. Four of the 10 components of the index showed gains in May, two were unchanged and four declined. Expectations that the economy will improve posted the largest gain, rising 5 points but remaining quite negative at minus 13. The two strongest components both declined, with plans to increase capital outlays falling 2 points to a still very solid 23, and job openings hard to fill was also down 2 points to 27, though business owners still find this as their fourth most important business problem. Plans to increase employment did rise 1 point, however, to 12. While earnings trends, the most pessimistic of the components, fell 1 point to minus 20, more business owners thought that now was a good time to expand, up by 1 point to 9.

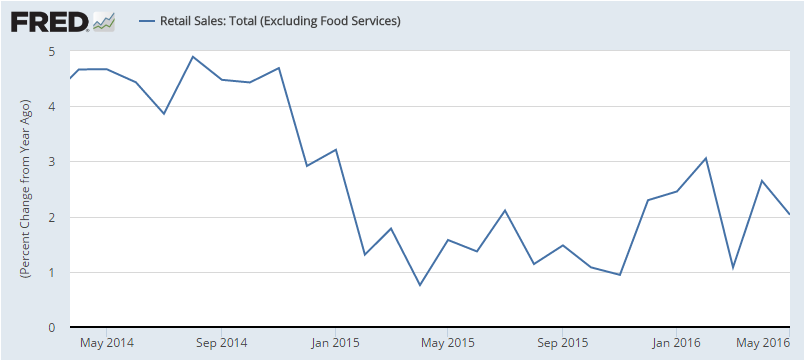

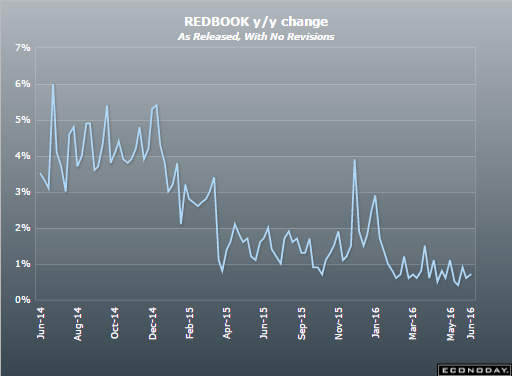

After the promising April release, May is coming back down as suspected, with a lot of help from higher gas prices, which likely will show up as reduced savings. And the year over year down trend continues, with growth at very low levels, after peaking when oil capex collapsed: Highlights

Highlights

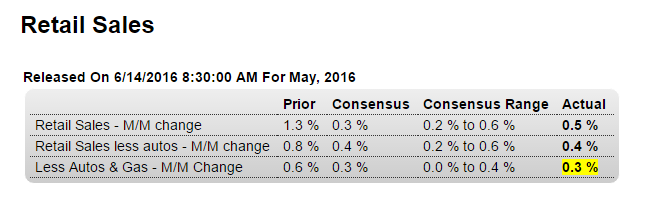

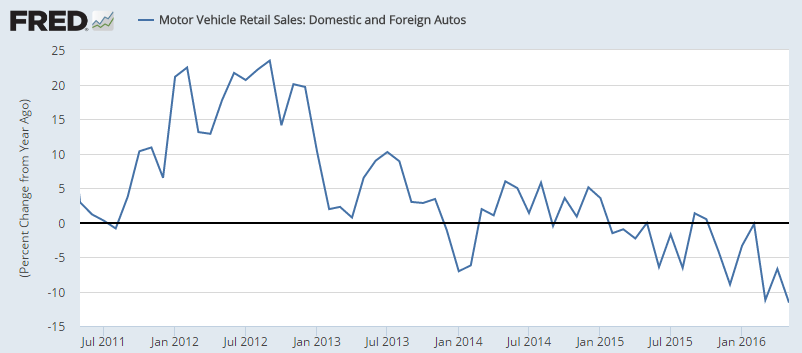

Consumer spending proved to be the biggest surprise of April and is at least a pleasant surprise in May. Retail sales rose a very solid and better-than-expected 0.5 percent with strength evident, though to a less degree than in April, through the balance of the report. Auto sales did give a boost to total sales but sales ex-auto, up 0.4 percent, were nearly as solid. Gasoline, reflecting higher prices, once again gave an outsized boost to sales though the gain for sales excluding autos and gas is respectable at plus 0.3 percent. The gain excluding gas alone also came in at 0.3 percent.

Year-on-year rates, however, moderated several tenths in May and are at very soft levels. Total year-on-year sales are up only 2.5 percent with ex-auto ex-gas at plus 4.1 percent and ex-gas alone at plus 3.7 percent.

Building materials have been very weak, down a steep 1.8 percent for the third straight monthly decline and pointing to moderation in residential investment. General merchandise was also down in the month as were sales at department stores.

The strength in the report is centered once again in nonstore retailers where sales, reflecting big gains for ecommerce, rose 1.3 percent on top of the prior month’s 2.5 percent surge. Year-on-year, nonstore retailers lead the way with at 12.2 percent pace. Restaurants, a key discretionary category, continue to show strength with an 8 tenths gain on the month and a year-on-year rate of 6.5 percent.

Strength is definitely the theme of this report, one that ultimately reflects strength in the labor market and which is pointing squarely to another strong month for total consumer spending in May. The outlook for the second quarter just got an upgrade and will keep alive chances for a rate hike at the July FOMC.

This came out last week:

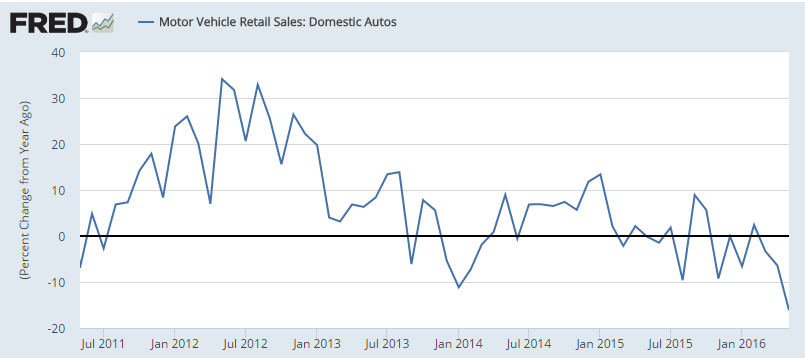

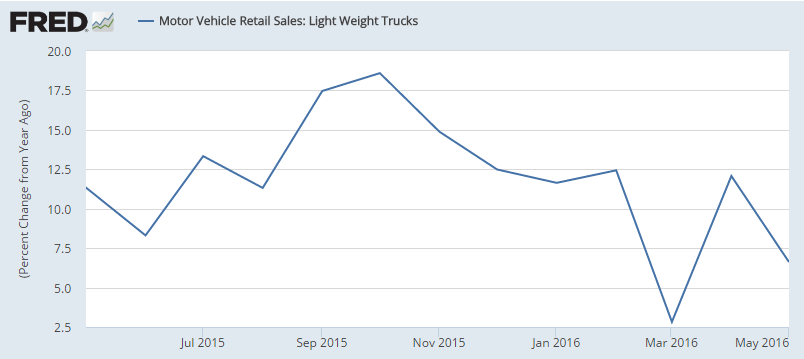

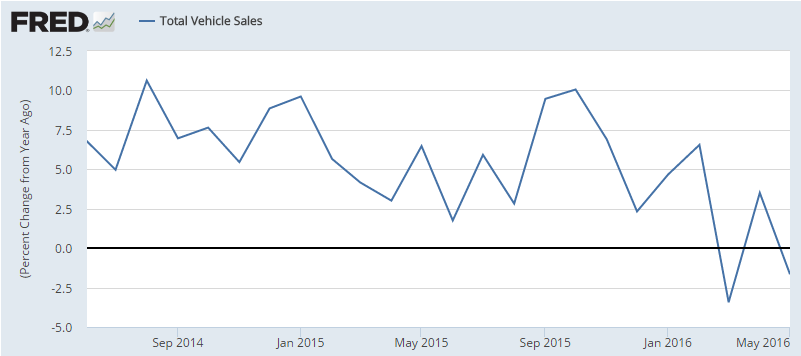

This was where the growth was coming from, and it’s been decelerating as total vehicle sales stagnated:

Still no sign of life here:

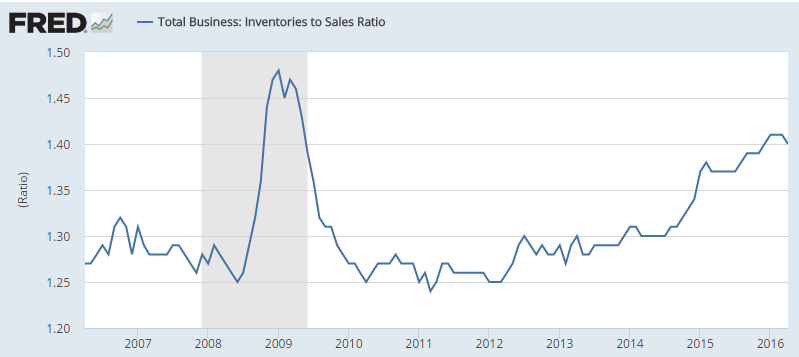

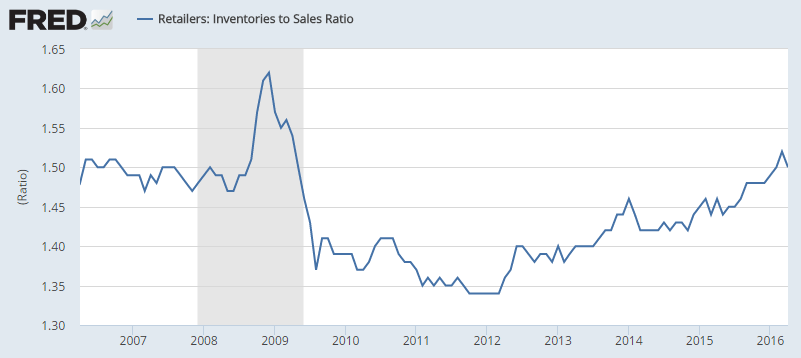

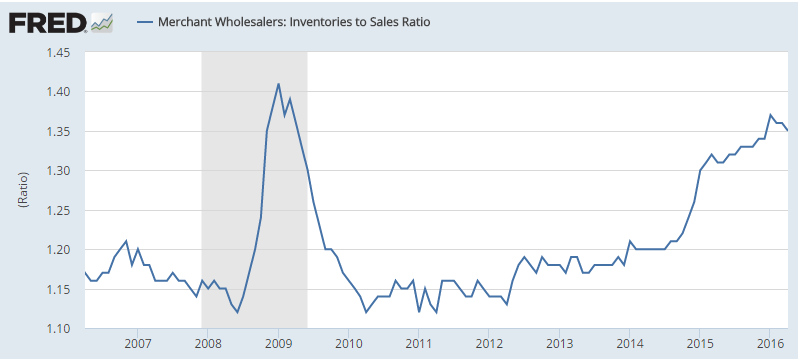

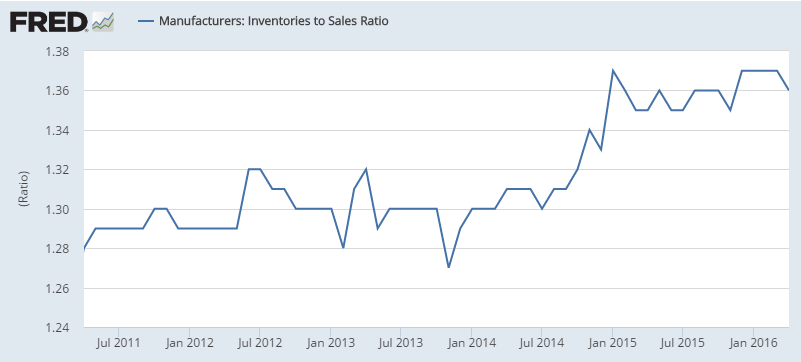

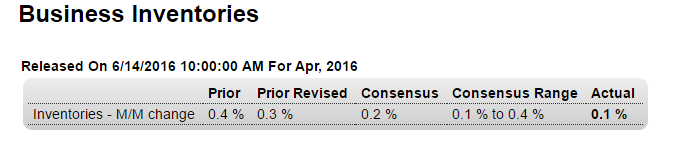

This is an April number, and inventories were still excessive, likely resulting in output cutbacks:

Highlights

The strength of April now includes business inventories where strong sales limited the build to only 0.1 percent. Business sales jumped 0.9 percent to pull the inventory-to-sales ratio, which had been climbing, down to 1.40 from 1.41. Retail inventories slipped 0.1 percent in April and aren’t likely to build much at all in May given this morning’s strength in the retail sales report. Factory inventories also slipped 0.1 percent with the May outlook to turn on tomorrow’s industrial production report. The negative in April is in wholesale inventories which rose 0.6 percent. Inventory builds are only wanted when there’s strength in sales which, though starting the year off slowly, may now be picking up.