Gradual deceleration looks to be continuing:Growth here had been increasing, helping to offset the decline in govt. deficit spending, but after the oil capex collapse this measure of credit growth leveled off:Real estate as well as consumer loan growth have also leveled off:This story is all about income here as well. The consumer has been hit hard twice due to the recession and then tax hikes and it’s all ratcheted down a notch each time. Even in the prior recession personal income didn’t go down, as it has twice just in the last 8 years. So if you look at the total growth from 2007 to 2016 it’s pretty much in line with the reduced rate of growth of output and the lower levels of employment:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

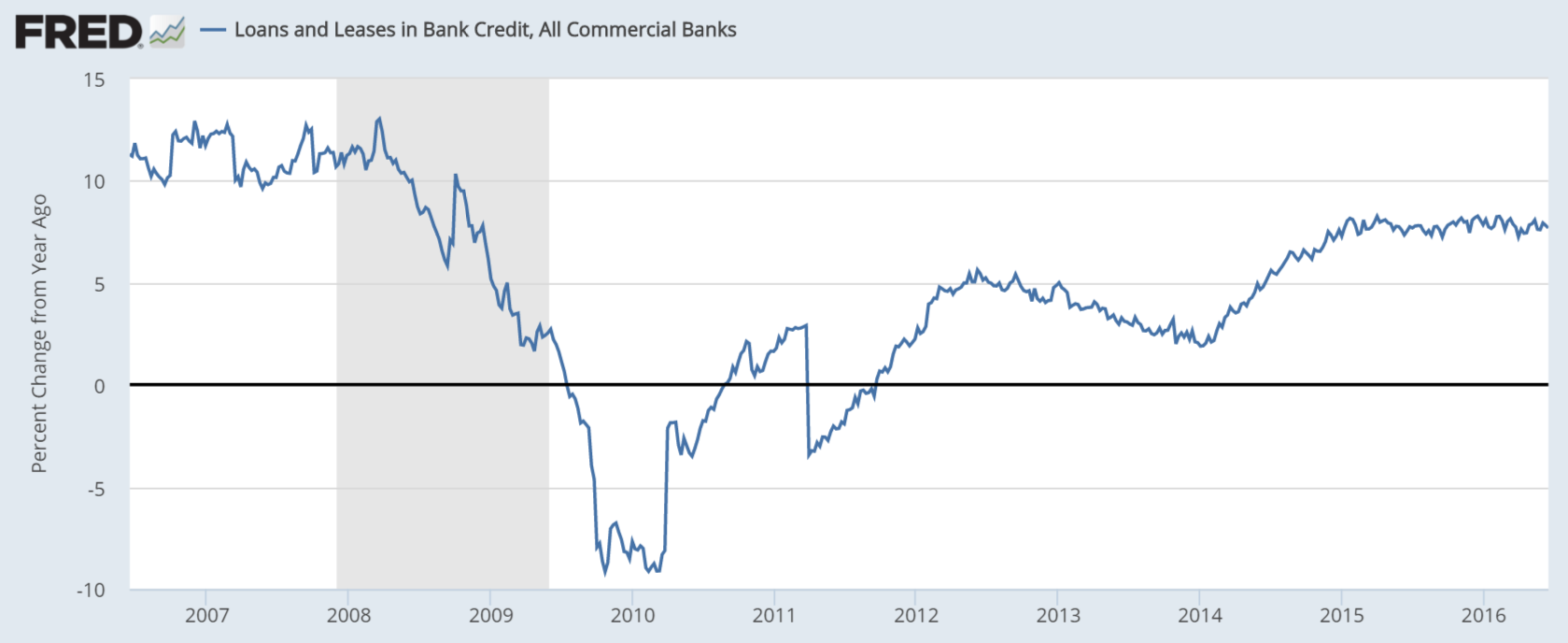

Gradual deceleration looks to be continuing:

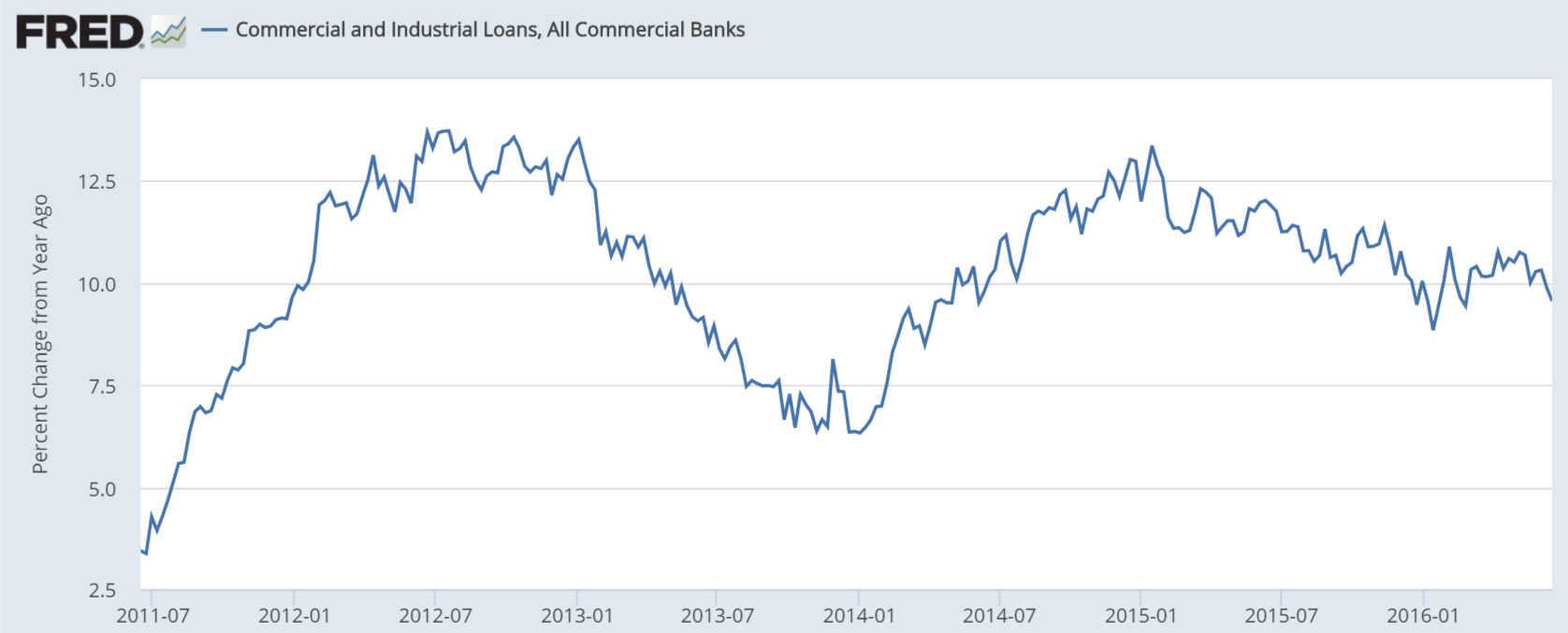

Growth here had been increasing, helping to offset the decline in govt. deficit spending, but after the oil capex collapse this measure of credit growth leveled off:

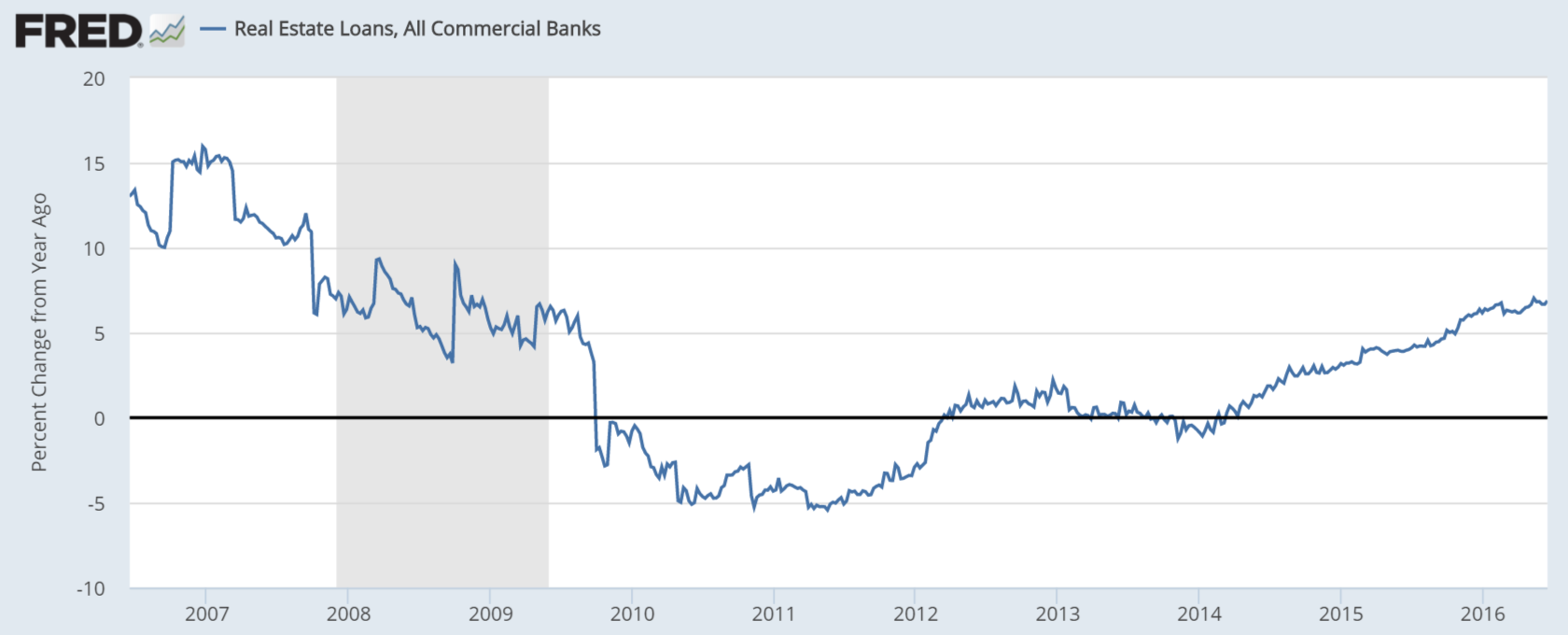

Real estate as well as consumer loan growth have also leveled off:

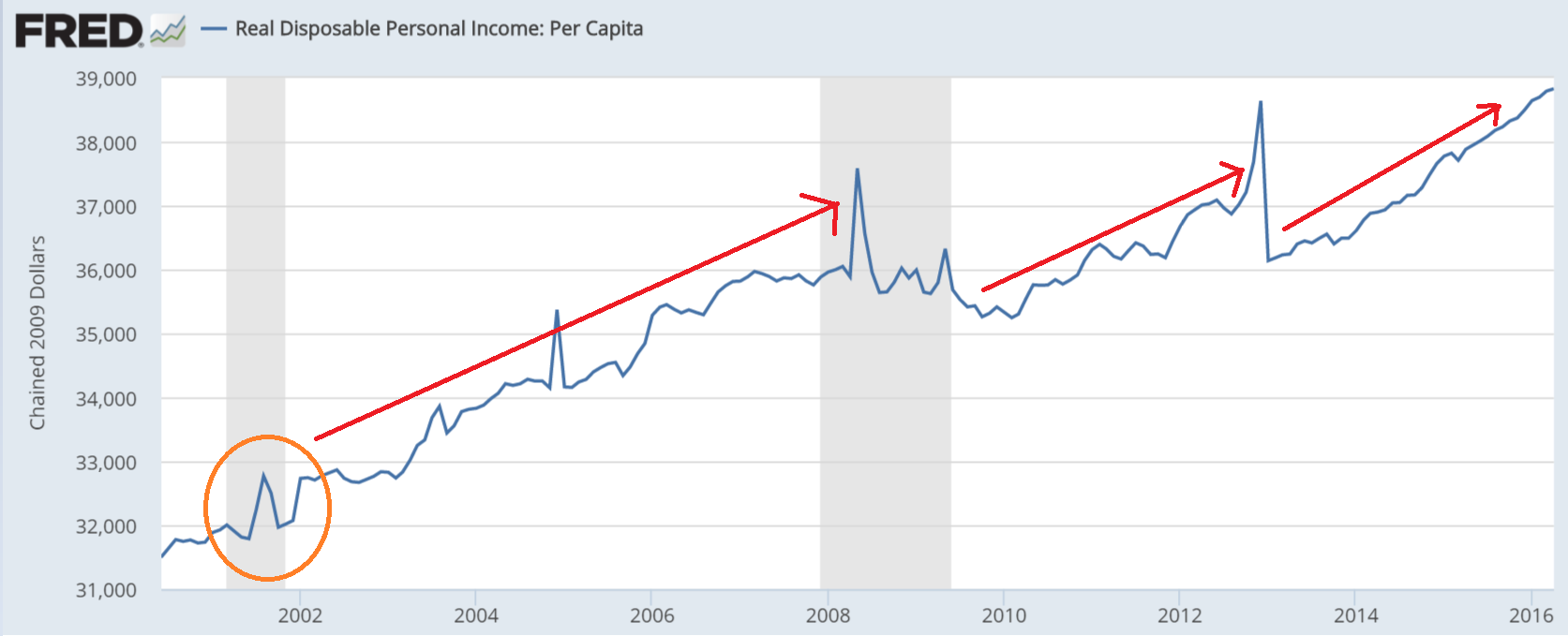

This story is all about income here as well. The consumer has been hit hard twice due to the recession and then tax hikes and it’s all ratcheted down a notch each time. Even in the prior recession personal income didn’t go down, as it has twice just in the last 8 years.

So if you look at the total growth from 2007 to 2016 it’s pretty much in line with the reduced rate of growth of output and the lower levels of employment: