Almost a century and a half after Léon Walras founded neoclassical general equilibrium theory, economists still have not been able to show that markets move economies to equilibria. What we do know is that — under very restrictive assumptions — unique Pareto-efficient equilibria do exist. But what good does that do? As long as we cannot show, except under exceedingly unrealistic assumptions, that there are convincing reasons to suppose there are forces which lead economies to equilibria – the value of general equilibrium theory is nil. As long as we cannot really demonstrate that there are forces operating — under reasonable, relevant and at least mildly realistic conditions — at moving markets to equilibria, there cannot really be any sustainable reason for anyone to pay any interest or attention to this theory. A stability that can only be proved by assuming “Santa Claus” conditions is of no avail. Most people do not believe in Santa Claus anymore. And for good reasons. Santa Claus is for kids. Continuing to model a world full of agents behaving as economists — “often wrong, but never uncertain” — and still not being able to show that the system under reasonable assumptions converges to equilibrium (or simply assume the problem away), is a gross misallocation of intellectual resources and time.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Almost a century and a half after Léon Walras founded neoclassical general equilibrium theory, economists still have not been able to show that markets move economies to equilibria. What we do know is that — under very restrictive assumptions — unique Pareto-efficient equilibria do exist.

But what good does that do? As long as we cannot show, except under exceedingly unrealistic assumptions, that there are convincing reasons to suppose there are forces which lead economies to equilibria – the value of general equilibrium theory is nil. As long as we cannot really demonstrate that there are forces operating — under reasonable, relevant and at least mildly realistic conditions — at moving markets to equilibria, there cannot really be any sustainable reason for anyone to pay any interest or attention to this theory. A stability that can only be proved by assuming “Santa Claus” conditions is of no avail. Most people do not believe in Santa Claus anymore. And for good reasons. Santa Claus is for kids.

Continuing to model a world full of agents behaving as economists — “often wrong, but never uncertain” — and still not being able to show that the system under reasonable assumptions converges to equilibrium (or simply assume the problem away), is a gross misallocation of intellectual resources and time.

In case you think this verdict is only a heterodox idiosyncrasy, here’s what one of the world’s greatest microeconomists — Alan Kirman — writes in his thought provoking paper The intrinsic limits of modern economic theory:

If one maintains the fundamentally individualistic approach to constructing economic models no amount of attention to the walls will prevent the citadel from becoming empty …

[The results of Sonnenchein (1972), Debreu (1974), Mantel (1976) and Mas Collel (1985)] shows clearly why any hope for uniqueness or stability must be unfounded …

The idea that we should start at the level of the isolated individual is one which we may well have to abandon … we should be honest from the outset and assert simply that by assumption we postulate that each sector of the economy behaves as one individual and not claim any spurious microjustification …

Economists therefore should not continue to make strong assertions about this behaviour based on so-called general equilibrium models which are, in reality, no more than special examples with no basis in economic theory as it stands.

Getting around Sonnenschein-Mantel-Debreu using representative agents may be — from a purely formalistic point of view — very expedient. But relevant and realistic? No way!

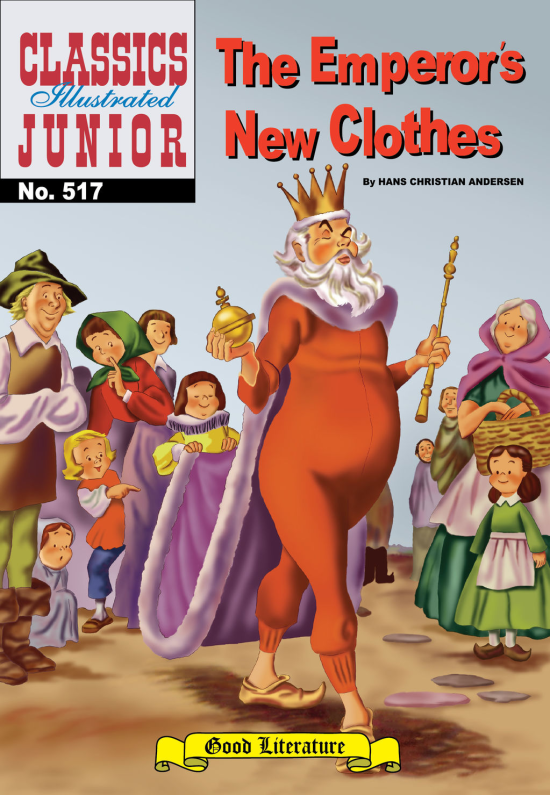

Although garmented as a representative agent, the emperor is still naked.