How true is Friedman’s permanent income hypothesis? Noah Smith has an article up on Bloomberg View on Milton Friedman’s permanent income hypothesis (PIH). Noah argues that almost all modern macroeconomic theories are based on PIH, especially used in formulating the consumption Euler equations that make up a vital part of ‘modern’ New Classical and New Keynesian macro models. So, what’s the problem? Well, only that PIH according to Smith is ‘most certainly wrong.’ Chris Dillow has commented on Noah’s PIH critique, arguing that although Noah is right he overstates the newness of the evidence against the PIH. In fact, we’ve known it was flawed ever since the early 80s. He also overstates the PIH’s intellectual hegemony. The standard UK undergraduate textbook says: “One strong prediction of the simple PIH model … is that changes in income that are predictable from past information should have no effect on current consumption. But there is by now a considerable body of work on aggregate consumption data that suggests this is wrong…This is an important result for economic policy because it suggests that changes in income as a result, say, of tax changes can have a marked effect on consumption and hence on economic activity.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

How true is Friedman’s permanent income hypothesis?

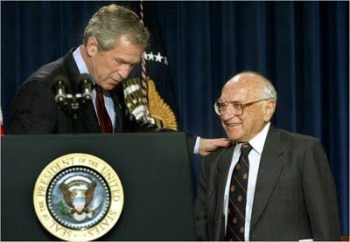

Noah Smith has an article up on Bloomberg View on Milton Friedman’s permanent income hypothesis (PIH). Noah argues that almost all modern macroeconomic theories are based on PIH, especially used in formulating the consumption Euler equations that make up a vital part of ‘modern’ New Classical and New Keynesian macro models.

Noah Smith has an article up on Bloomberg View on Milton Friedman’s permanent income hypothesis (PIH). Noah argues that almost all modern macroeconomic theories are based on PIH, especially used in formulating the consumption Euler equations that make up a vital part of ‘modern’ New Classical and New Keynesian macro models.

So, what’s the problem? Well, only that PIH according to Smith is ‘most certainly wrong.’

Chris Dillow has commented on Noah’s PIH critique, arguing that although Noah is right

he overstates the newness of the evidence against the PIH. In fact, we’ve known it was flawed ever since the early 80s. He also overstates the PIH’s intellectual hegemony. The standard UK undergraduate textbook says:

“One strong prediction of the simple PIH model … is that changes in income that are predictable from past information should have no effect on current consumption. But there is by now a considerable body of work on aggregate consumption data that suggests this is wrong…This is an important result for economic policy because it suggests that changes in income as a result, say, of tax changes can have a marked effect on consumption and hence on economic activity.” (Carlin and Soskice, Macroeconomics: Imperfections, Institutions and Policies, p 221-22)”

Dillow then goes on arguing that PIH is not always wrong, that it is useful, and that it is basically all about ‘context’ and that this reinforces what Dani Rodrik has written in Economics Rules (p 5-6) :

Different social settings require different models. Economists are unlikely ever to uncover universal, general-purpose models. But in part because economists take the natural sciences as their example, they have a tendency to misuse models. They are prone to mistake a model for the model, relevant and applicable under all conditions. Economists must overcome this temptation.

Well yours truly thinks that on this issue both Noah and Chris are not critical enough.

Let me elaborate, and start with Carlin & Soskice and then move over to Rodrik and his smorgasbord view on economic models.

Wendy Carlin’s and David Soskice‘s macroeonomics textbook Macroeconomics: Institutions, Instability, and the Financial System (Oxford University Press 2015) builds more than most other intermediate macroeconomics textbooks on supplying the student with a ‘systematic way of thinking through problems’ with the help of formal-mathematical models.

They explicitly adapt a ‘New Keynesian’ framework including price rigidities and adding a financial system to the usual neoclassical macroeconomic set-up. But although I find things like the latter amendment an improvement, it’s definitely more difficult to swallow their methodological stance, and especially their non-problematized acceptance of the need for macroeconomic microfoundations.

From the first page of the book they start to elaborate their preferred 3-equations ‘New Keynesian’ macromodel. And after twenty-two pages they have already come to specifying the demand side with the help of the Permanent Income Hypothesis and its Euler equations.

But if people — not the representative agent — at least sometimes can’t help being off their labour supply curve — as in the real world — then what are these hordes of Euler equations that you find ad nauseam in these ‘New Keynesian’ macromodels gonna help us?

My doubts regarding macro economic modelers’ obsession with Euler equations is basically that, as with so many other assumptions in ‘modern’ macroeconomics, Euler equations, and the PIH that they build on, don’t fit reality.

In the standard neoclassical consumption model — underpinning Carlin’s and Soskice’s microfounded macroeconomic modeling — people are basically portrayed as treating time as a dichotomous phenomenon – today and the future — when contemplating making decisions and acting. How much should one consume today and how much in the future? The Euler equation used implies that the representative agent (consumer) is indifferent between consuming one more unit today or instead consuming it tomorrow. Further, in the Euler equation we only have one interest rate, equated to the money market rate as set by the central bank. The crux is, however, that — given almost any specification of the utility function – the two rates are actually often found to be strongly negatively correlated in the empirical literature!

From a methodological pespective yours truly has to conclude that Carlin’s and Soskice’s microfounded macroeconomic model is a rather unimpressive attempt at legitimizing using fictitious idealizations — such as PIH and Euler equations — for reasons more to do with model tractability than with a genuine interest of understanding and explaining features of real economies.

Re Dani Rodrik‘s Economics Rules, there sure is much in the book I like and appreciate.But there is also a very disturbing apologetic tendency in the book to blame all of the shortcomings on the economists and depicting economics itself as a problem-free smorgasbord collection of models. If you just choose the appropriate model from the immense and varied smorgasbord there’s no problem. It is as if all problems in economics were conjured away if only we could make the proper model selection.

Underlying Rodrik and other mainstream economists views on models is a picturing of models as some kind of experiments. I’ve run into that view many times over the years when having discussions with mainstream economists on their ‘thought experimental’ obsession — and I still think it’s too vague and elusive to be helpful. Just repeating the view doesn’t provide the slightest reasont to believe it.

Limiting model assumptions in economic science always have to be closely examined since if we are going to be able to show that the mechanisms or causes that we isolate and handle in our models are stable in the sense that they do not change when we ‘export’ them to our ‘target systems,’ we have to be able to show that they do not only hold under ceteris paribus conditions and hence only are of limited value to our understanding, explanations or predictions of real economic systems.

Mainstream economists usually do not want to get hung up on the assumptions that their models build on. But it is still an undeniable fact that theoretical models building on piles of known to be false assumptions — such as PIH and the Euler equations that build on it — in no way even get close to being scientific explanations. On the contrary. They are untestable and hence totally worthless from the point of view of scientific relevance.

Conclusion: mainstream macroeconomics, building on the standard neoclassical consumption model with its Permanent Income Hypothesis and Euler equations, has to be replaced with something else. Preferably with something that is both real and relevant, and not only chosen for reasons of mathematical tractability.