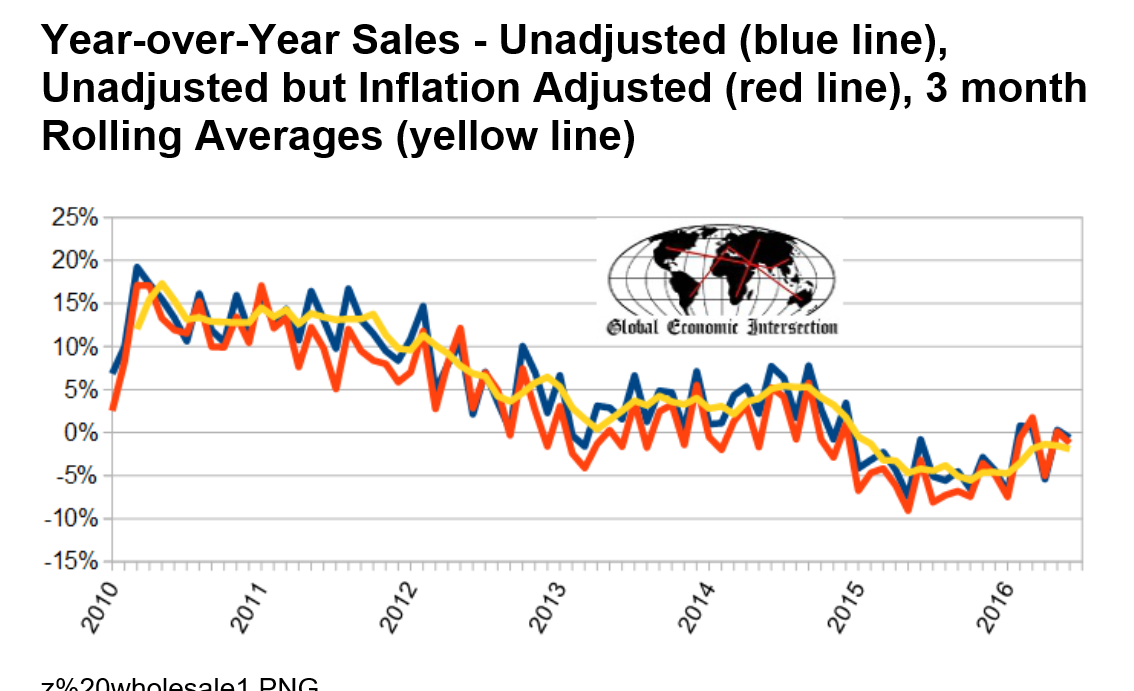

Unadjusted sales rate of growth decelerated 0.9 % month-over-month. unadjusted sales year-over-year growth is down 0.6 % year-over-year unadjusted sales (but inflation adjusted) down 1.2 % year-over-year the 3 month rolling average of unadjusted sales decelerated 0.4 % month-over-month, and down 1,9 % year-over-year. Very modest household credit expansion coincided with very weak growth for the last several quarters: From the NY Fed: Household Debt Balances Increase Slightly, Boosted By Growth In Auto Loan And Credit Card Balances The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which reported that household debt increased by billion (a 0.3 percent increase) to .29 trillion during the second quarter of 2016. This moderate growth was driven by increases in auto loan and credit card debt, which increased by billion and billion respectively. Mortgage debt declined by billion in the second quarter, after a 0 billion increase in the first quarter, and student loan balances were roughly flat. Meanwhile, this quarter saw improvements in overall delinquency rates and another historical low (over the 18 years of the data sample) in new foreclosures. … Read more at http://www.calculatedriskblog.com/#le2jQT0ugvGRLrDT.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

unadjusted sales rate of growth decelerated 0.9 % month-over-month. unadjusted sales year-over-year growth is down 0.6 % year-over-year unadjusted sales (but inflation adjusted) down 1.2 % year-over-year the 3 month rolling average of unadjusted sales decelerated 0.4 % month-over-month, and down 1,9 % year-over-year.

Very modest household credit expansion coincided with very weak growth for the last several quarters:

From the NY Fed: Household Debt Balances Increase Slightly, Boosted By Growth In Auto Loan And Credit Card Balances

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which reported that household debt increased by $35 billion (a 0.3 percent increase) to $12.29 trillion during the second quarter of 2016. This moderate growth was driven by increases in auto loan and credit card debt, which increased by $32 billion and $17 billion respectively. Mortgage debt declined by $7 billion in the second quarter, after a $120 billion increase in the first quarter, and student loan balances were roughly flat. Meanwhile, this quarter saw improvements in overall delinquency rates and another historical low (over the 18 years of the data sample) in new foreclosures. …

Read more at http://www.calculatedriskblog.com/#le2jQT0ugvGRLrDT.99