Summary:

Down from the post-Covid bounce but not in any kind of collapse: More evidence we had a soft landing, cushioned by the rate hikes that supported personal income. And no sign the rate hikes have slowed lending. If anything looks like they support it: Back to pre-Covid levels of GDP growth:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

Down from the post-Covid bounce but not in any kind of collapse: More evidence we had a soft landing, cushioned by the rate hikes that supported personal income. And no sign the rate hikes have slowed lending. If anything looks like they support it: Back to pre-Covid levels of GDP growth:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

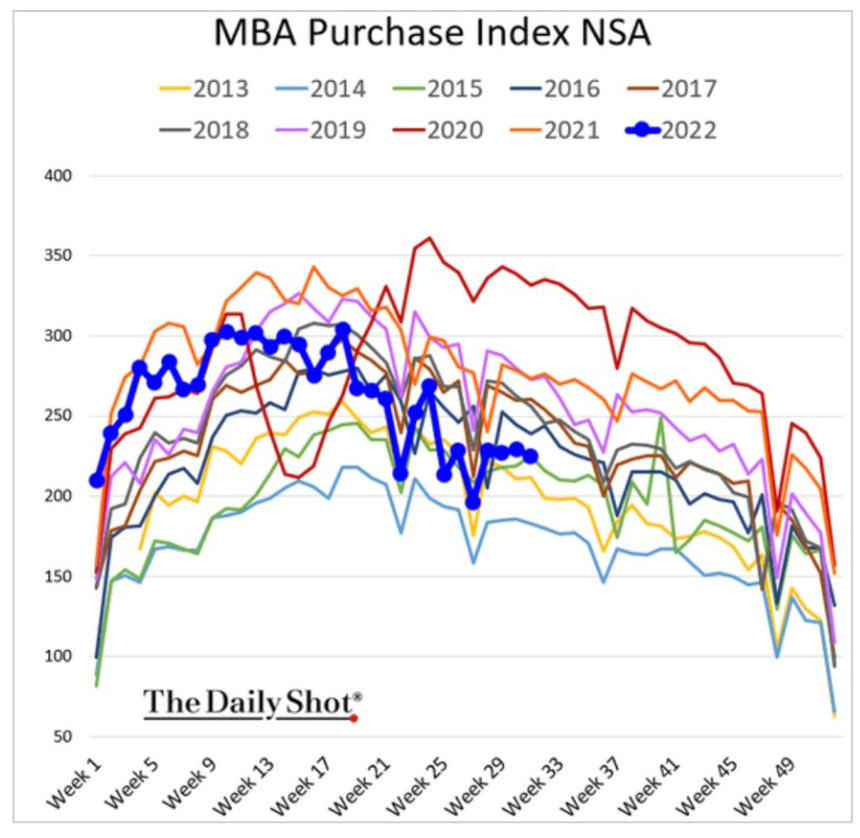

Down from the post-Covid bounce but not in any kind of collapse:

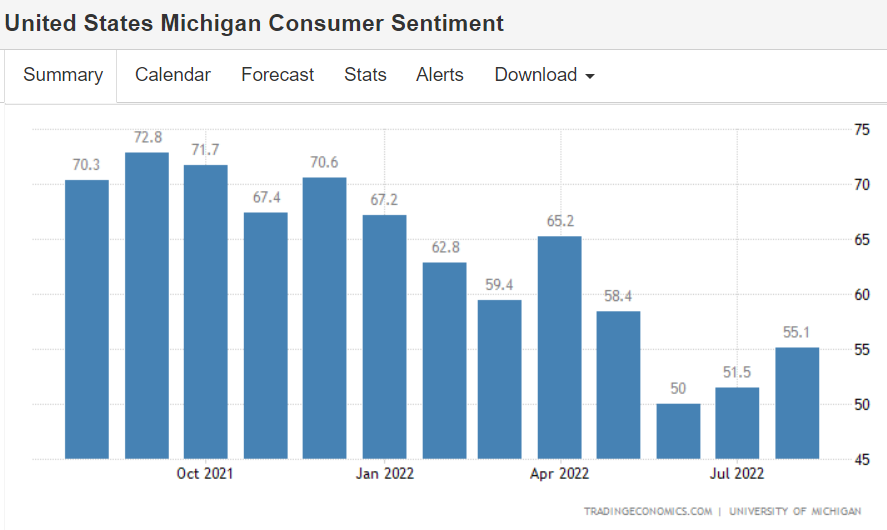

More evidence we had a soft landing, cushioned by the rate hikes that supported personal income.

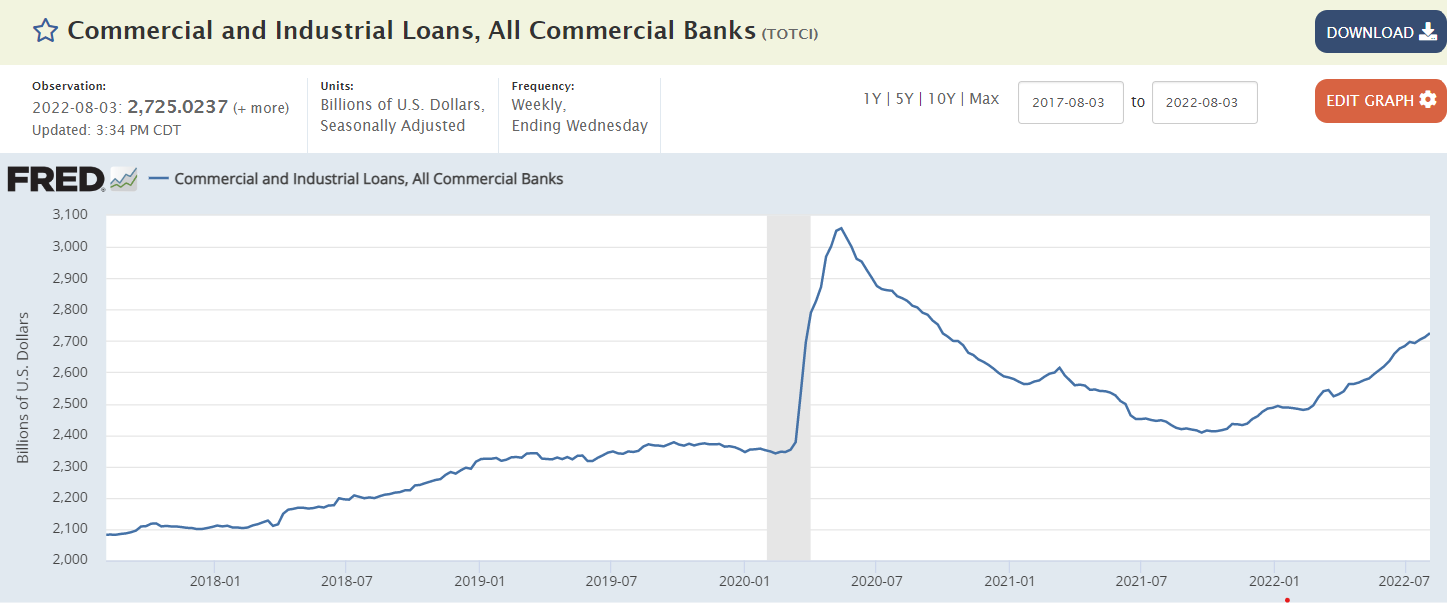

And no sign the rate hikes have slowed lending. If anything looks like they support it:

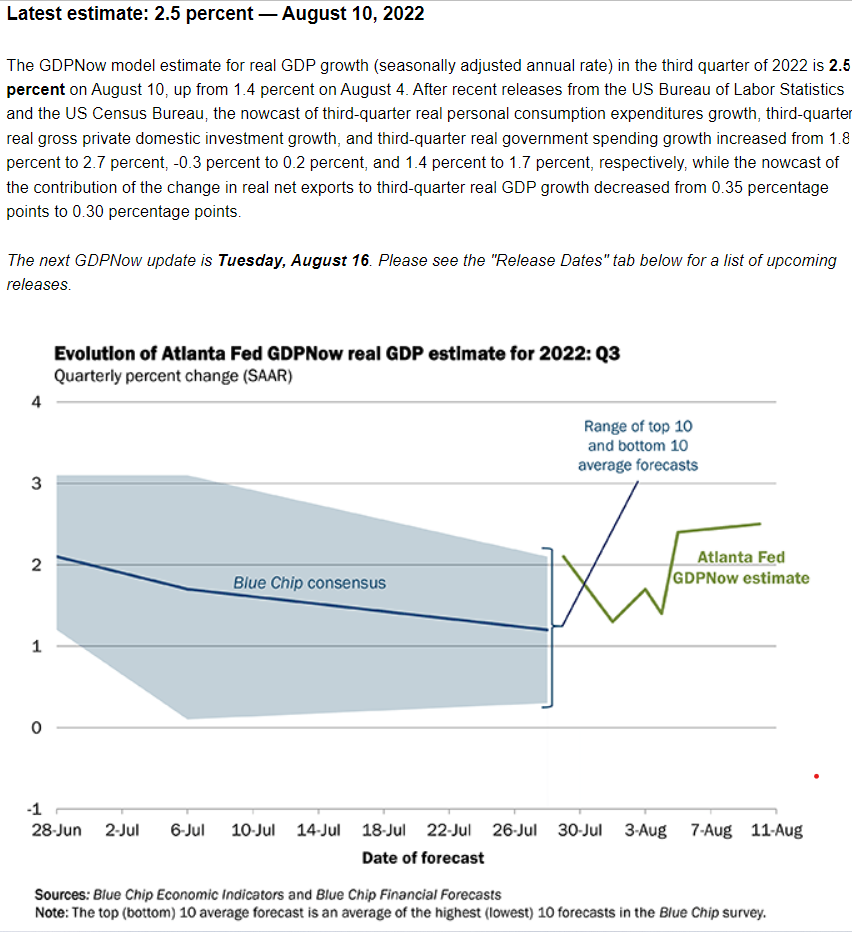

Back to pre-Covid levels of GDP growth: