Reasons to dislike DSGE models There are many reasons to dislike current DSGE models. First: They are based on unappealing assumptions. Not just simplifying assumptions, as any model must, but assumptions profoundly at odds with what we know about consumers and firms … Second: Their standard method of estimation, which is a mix of calibration and Bayesian estimation, is unconvincing … Third: While the models can formally be used for norma- tive purposes, normative implications are not convincing … Fourth: DSGE models are bad communication devices … Olivier Blanchard And still Blanchard and other mainstream economists seem to be impressed by the ‘rigour’ brought to macroeconomics by New-Classical-New-Keynesian DSGE models and its rational expectations and micrcofoundations — Blanchard even hopes that although current DSGE models are ‘flawed,’ in the future they can ‘fulfil an important need in macroeconomics, that of offering a core structure around which to build and organise discussions.’ It is difficult to see how. Take the rational expectations assumption for example. Rational expectations in the mainstream economists’s world implies that relevant distributions have to be time independent. This amounts to assuming that an economy is like a closed system with known stochastic probability distributions for all different events.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Reasons to dislike DSGE models

There are many reasons to dislike current DSGE models.

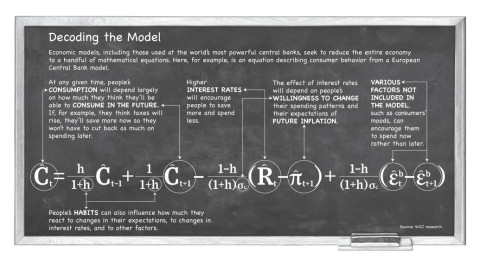

First: They are based on unappealing assumptions. Not just simplifying assumptions, as any model must, but assumptions profoundly at odds with what we know about consumers and firms …

Second: Their standard method of estimation, which is a mix of calibration and Bayesian estimation, is unconvincing …

Third: While the models can formally be used for norma- tive purposes, normative implications are not convincing …

Fourth: DSGE models are bad communication devices …

And still Blanchard and other mainstream economists seem to be impressed by the ‘rigour’ brought to macroeconomics by New-Classical-New-Keynesian DSGE models and its rational expectations and micrcofoundations — Blanchard even hopes that although current DSGE models are ‘flawed,’ in the future they can ‘fulfil an important need in macroeconomics, that of offering a core structure around which to build and organise discussions.’

It is difficult to see how.

Take the rational expectations assumption for example. Rational expectations in the mainstream economists’s world implies that relevant distributions have to be time independent. This amounts to assuming that an economy is like a closed system with known stochastic probability distributions for all different events. In reality it is straining one’s beliefs to try to represent economies as outcomes of stochastic processes. An existing economy is a single realization tout court, and hardly conceivable as one realization out of an ensemble of economy-worlds, since an economy can hardly be conceived as being completely replicated over time. It is — to say the least — very difficult to see any similarity between these modelling assumptions and the expectations of real persons. In the world of the rational expectations hypothesis we are never disappointed in any other way than as when we lose at the roulette wheels. But real life is not an urn or a roulette wheel. And that’s also the reason why allowing for cases where agents make ‘predictable errors’ in DSGE models doesn’t take us any closer to a relevant and realist depiction of actual economic decisions and behaviours. If we really want to have anything of interest to say on real economies, financial crisis and the decisions and choices real people make we have to replace the rational expectations hypothesis with more relevant and realistic assumptions concerning economic agents and their expectations than childish roulette and urn analogies.

Take the rational expectations assumption for example. Rational expectations in the mainstream economists’s world implies that relevant distributions have to be time independent. This amounts to assuming that an economy is like a closed system with known stochastic probability distributions for all different events. In reality it is straining one’s beliefs to try to represent economies as outcomes of stochastic processes. An existing economy is a single realization tout court, and hardly conceivable as one realization out of an ensemble of economy-worlds, since an economy can hardly be conceived as being completely replicated over time. It is — to say the least — very difficult to see any similarity between these modelling assumptions and the expectations of real persons. In the world of the rational expectations hypothesis we are never disappointed in any other way than as when we lose at the roulette wheels. But real life is not an urn or a roulette wheel. And that’s also the reason why allowing for cases where agents make ‘predictable errors’ in DSGE models doesn’t take us any closer to a relevant and realist depiction of actual economic decisions and behaviours. If we really want to have anything of interest to say on real economies, financial crisis and the decisions and choices real people make we have to replace the rational expectations hypothesis with more relevant and realistic assumptions concerning economic agents and their expectations than childish roulette and urn analogies.

‘Rigorous’ and ‘precise’ DSGE models cannot be considered anything else than unsubstantiated conjectures as long as they aren’t supported by evidence from outside the theory or model. To my knowledge no in any way decisive empirical evidence has been presented.

No matter how precise and rigorous the analysis, and no matter how hard one tries to cast the argument in modern mathematical form, they do not push economic science forwards one single millimeter if they do not stand the acid test of relevance to the target. No matter how clear, precise, rigorous or certain the inferences delivered inside these models are, they do not per se say anything about real world economies.

Proving things ‘rigorously’ in DSGE models is at most a starting-point for doing an interesting and relevant economic analysis. Forgetting to supply export warrants to the real world makes the analysis an empty exercise in formalism without real scientific value.