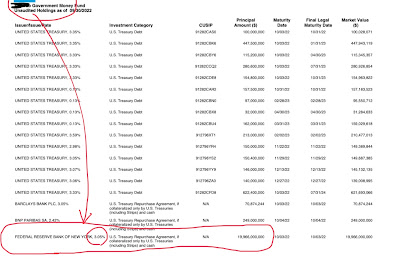

Seems to be some confusion out there so here you can see in this Government Money Market Mutual fund prospectus that the Fed has created a new govt obligation for USD savers to save in… They have b (fund’s largest holding) in a RRP with the FRBNY at the 3.05% RRP rate: This is going to go up towards 4% in two weeks then towards 5% in December… ??♂️??♂️This RRP asset has been created as an alternative to a depository account at a system Depository Institution for USD savers because those institutions don’t have a high enough value of regulatory assets to allow these USD balances to be on deposit there… due to the regulatory asset value reduction effects of the Fed’s own policy rate increases themselves…Rube Goldberg arrangements but it’s still understandable…

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Seems to be some confusion out there so here you can see in this Government Money Market Mutual fund prospectus that the Fed has created a new govt obligation for USD savers to save in…

They have $20b (fund’s largest holding) in a RRP with the FRBNY at the 3.05% RRP rate:

This is going to go up towards 4% in two weeks then towards 5% in December… ??♂️??♂️

This RRP asset has been created as an alternative to a depository account at a system Depository Institution for USD savers because those institutions don’t have a high enough value of regulatory assets to allow these USD balances to be on deposit there… due to the regulatory asset value reduction effects of the Fed’s own policy rate increases themselves…

Rube Goldberg arrangements but it’s still understandable…