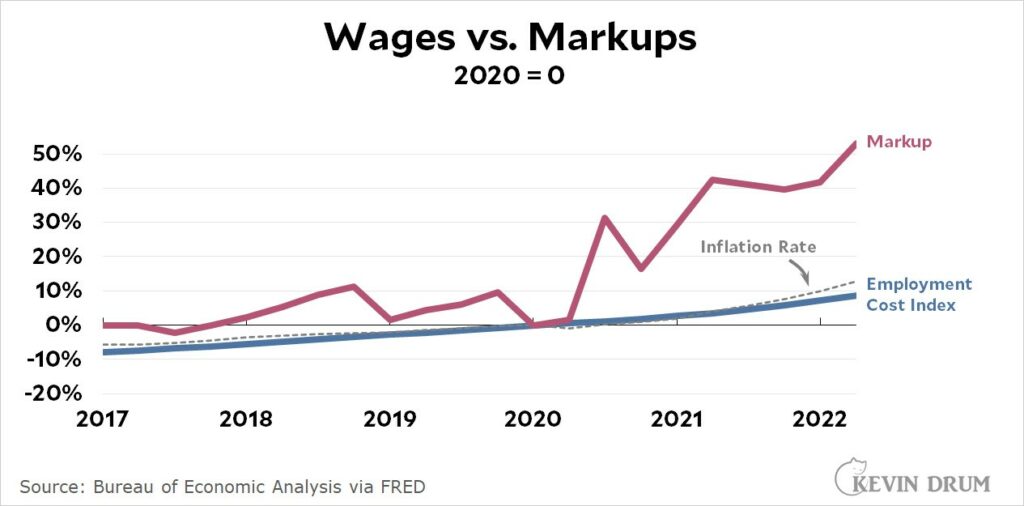

Courtesy of EMicheal in comments. Kind of the point, I have been making for a while now. Labor wages are not the big driver of inflation. Corporations are increasing non-cost related prices and blaming it on inflation. But it’s not because of inflation. It is a cause of inflation. The public newscasters are selling their wares, ignorance, or lies on TV or the internet. It is a deliberate miscasting of the economic issues. Prices are rising not because of worker related wages. Labor income is increasing at a rate more slowly than inflation. Raw materials are not the prime driver pricing either. Companies are raising prices above and beyond costs because they can. No reason needed. And all of us are paying the price. Kevin Drum . . .

Topics:

run75441 considers the following as important: Hot Topics, politics, US EConomics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Courtesy of EMicheal in comments. Kind of the point, I have been making for a while now. Labor wages are not the big driver of inflation.

Corporations are increasing non-cost related prices and blaming it on inflation. But it’s not because of inflation. It is a cause of inflation. The public newscasters are selling their wares, ignorance, or lies on TV or the internet. It is a deliberate miscasting of the economic issues.

Prices are rising not because of worker related wages. Labor income is increasing at a rate more slowly than inflation. Raw materials are not the prime driver pricing either. Companies are raising prices above and beyond costs because they can. No reason needed. And all of us are paying the price. Kevin Drum . . .

The blue line represents the total cost of employing labor including wages and benefits. Since 2020 it’s risen at less than the rate of inflation.

The red line represents after-tax profits as a share of gross value added or markup. Before 2020 it rose roughly in line with inflation, but since 2020 it’s skyrocketed by more than half. (you can see the underlying numbers at this table.

You have seen me write on occasion; direct labor wages are a small part of the cost of manufacturing.

“A measure of US profit margins has reached its widest since 1950, suggesting that the prices charged by businesses are outpacing their increased costs for production and labor.

After-tax profits as a share of gross value added for non-financial corporations, a measure of aggregate profit margins, improved in the second quarter to 15.5% — the most since 1950 — from 14% in the first quarter, according to Commerce Department figures published Thursday.

The surge in profits during the pandemic era has fueled a debate about whether price-gouging companies carry a share of the blame for high inflation — an argument pushed by President Joe Biden’s Democrats. Most economists have been skeptical about the idea.”

Meanwhile, Fed Chairman Powell is tightening the screws on Labor and the US.