Existing home sales decline to recessionary levels; prices have clearly turned down; low inventory still a problem – by New Deal democrat As I wrote earlier this morning, my primary interest in existing home sales at this point is prices. [Note: graphs below for sales and prices does not include October] For the record, existing home sales fell to a new 2.5 year low (i.e., since the teeth of the pandemic lockdowns) of 4.430 million annualized: Before the pandemic, the last time the number was this low was in 2012. Further, this is down -19.5% YoY, -26.4% from their recent secondary February high, and -35.3% below their October 2020 expansion high. This is the kind of number I would expect at the cusp of a recession. More importantly,

Topics:

NewDealdemocrat considers the following as important: existing home sales, politics, Taxes/regulation, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Existing home sales decline to recessionary levels; prices have clearly turned down; low inventory still a problem

– by New Deal democrat

As I wrote earlier this morning, my primary interest in existing home sales at this point is prices. [Note: graphs below for sales and prices does not include October]

For the record, existing home sales fell to a new 2.5 year low (i.e., since the teeth of the pandemic lockdowns) of 4.430 million annualized:

Before the pandemic, the last time the number was this low was in 2012. Further, this is down -19.5% YoY, -26.4% from their recent secondary February high, and -35.3% below their October 2020 expansion high. This is the kind of number I would expect at the cusp of a recession.

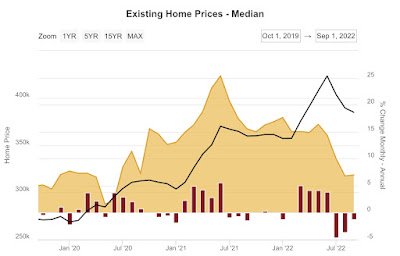

More importantly, median prices declined seasonally by -1.5% for the month to $379,100. This is “only” 6.6% higher than one year ago, and is the slowest YoY% increase in over 2 years:

The highest YoY% change in the past 12 months was +17.6% in January. This is the third month in a row that the rate of change has declined by over 50%, my rule of thumb for when a seasonally-adjusted data set would turn down.

In short, I think we can safely say that existing home prices, were we able to seasonally adjust, have turned down from a peak during summer.

Inventory is also not seasonally adjusted. This turned down m/m, but YoY is -0.8% lower:

We are nowhere near solving the low inventory problem that we have had since even before the pandemic hit.

“September existing home sales and prices decline,” Angry Bear, angry bear blog