The reality of how money is created Everything we know is not just wrong – it’s backwards. When banks make loans, they create money. This is because money is really just an IOU. The role of the central bank is to preside over a legal order that effectively grants banks the exclusive right to create IOUs of a certain kind, ones that the government will recognise as legal tender by its willingness to accept them in payment of taxes. There’s really no limit on how much banks could create, provided they can find someone willing to borrow it. They will never get caught short, for the simple reason that borrowers do not, generally speaking, take the cash and put it under their mattresses; ultimately, any money a bank loans out will just end up back in some bank again. So for the banking system as a whole, every loan just becomes another deposit. What’s more, insofar as banks do need to acquire funds from the central bank, they can borrow as much as they like; all the latter really does is set the rate of interest, the cost of money, not its quantity. Since the beginning of the recession, the US and British central banks have reduced that cost to almost nothing. In fact, with “quantitative easing” they’ve been effectively pumping as much money as they can into the banks, without producing any inflationary effects.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

The reality of how money is created

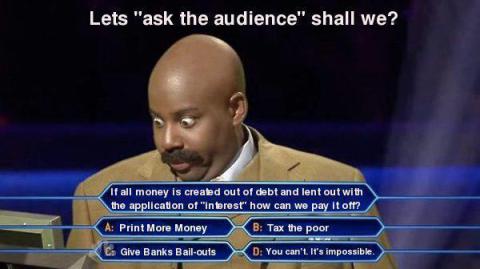

Everything we know is not just wrong – it’s backwards. When banks make loans, they create money. This is because money is really just an IOU. The role of the central bank is to preside over a legal order that effectively grants banks the exclusive right to create IOUs of a certain kind, ones that the government will recognise as legal tender by its willingness to accept them in payment of taxes.

There’s really no limit on how much banks could create, provided they can find someone willing to borrow it. They will never get caught short, for the simple reason that borrowers do not, generally speaking, take the cash and put it under their mattresses; ultimately, any money a bank loans out will just end up back in some bank again. So for the banking system as a whole, every loan just becomes another deposit. What’s more, insofar as banks do need to acquire funds from the central bank, they can borrow as much as they like; all the latter really does is set the rate of interest, the cost of money, not its quantity. Since the beginning of the recession, the US and British central banks have reduced that cost to almost nothing. In fact, with “quantitative easing” they’ve been effectively pumping as much money as they can into the banks, without producing any inflationary effects.

What this means is that the real limit on the amount of money in circulation is not how much the central bank is willing to lend, but how much government, firms, and ordinary citizens, are willing to borrow. Government spending is the main driver in all this … So there’s no question of public spending “crowding out” private investment. It’s exactly the opposite.

Sounds odd, doesn’t it?

This guy must sure be one of those strange and dangerous heterodox cranks?

Well, maybe you should reconsider …

The reality of how money is created today differs from the description found in some economics textbooks:

• Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

• In normal times, the central bank does not fix the amount of money in circulation, nor is central bank money ‘multiplied up’ into more loans and deposits …

Most of the money in circulation is created, not by the printing presses of the Bank of England, but by the commercial banks themselves: banks create money whenever they lend to someone in the economy or buy an asset from consumers. And in contrast to descriptions found in some textbooks, the Bank of England does not directly control the quantity of either base or broad money. The Bank of England is nevertheless still able to influence the amount of money in the economy. It does so in normal times by setting monetary policy — through the interest rate that it pays on reserves held by commercial banks with the Bank of England. More recently, though, with Bank Rate constrained by the effective lower bound, the Bank of England’s asset purchase programme has sought to raise the quantity of broad money in circulation. This in turn affects the prices and quantities of a range of assets in the economy, including money.Michael McLeay, Amar Radia and Ryland Thomas

Bank of England’s Monetary Analysis Directorate