‘New Keynesian’ price stickiness ‘New Keynesian’ macroeconomists have for years been arguing (e.g. here) about the importance of the New Classical Counter Revolution in economics. ‘Helping’ to change the way macroeconomics is done today — with rational expectations, Euler equations, intertemporal optimization, and microfoundations — their main critique of New Classical macroeconomics is that it didn’t incorporate price stickiness into the Real Business Cycles models developed by the New Classicals. So — the ‘New Keynesians’ adopted the methodology suggested by the New Classcials and just added price stickiness! But does putting a sticky-price DSGE lipstick on the RBC pig really help? It sure doesn’t! A pig with lipstick is still a pig: I regard the term

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

‘New Keynesian’ price stickiness

‘New Keynesian’ macroeconomists have for years been arguing (e.g. here) about the importance of the New Classical Counter Revolution in economics. ‘Helping’ to change the way macroeconomics is done today — with rational expectations, Euler equations, intertemporal optimization, and microfoundations — their main critique of New Classical macroeconomics is that it didn’t incorporate price stickiness into the Real Business Cycles models developed by the New Classicals. So — the ‘New Keynesians’ adopted the methodology suggested by the New Classcials and just added price stickiness!

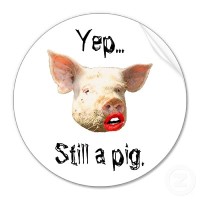

But does putting a sticky-price DSGE lipstick on the RBC pig really help?

But does putting a sticky-price DSGE lipstick on the RBC pig really help?

It sure doesn’t!

A pig with lipstick is still a pig:

I regard the term “sticky prices” and other similar terms as very unhelpful and misleading; they are a kind of mental crutch that economists are too ready to rely on as a substitute for thinking about what are the actual causes of economic breakdowns, crises, recessions, and depressions. Most of all, they represent an uncritical transfer of partial-equilibrium microeconomic thinking to a problem that requires a system-wide macroeconomic approach. That approach should not ignore microeconomic reasoning, but it has to transcend both partial-equilibrium supply-demand analysis and the mathematics of intertemporal optimisation.