I learn from Brad DeLong (nickname delong run) that Paul Schmelzing has gone to a truly heroic effort and estimated safe real interest rates since 1310! The main point is the long slow decline (it is ironic that one of the stylized growth “facts” is that there is no clear trend in real interest rates. Brad discusses this at length at his SubStack. Oddly, although he is one of the Efficient Markets Hypothesis’s worst enemies not named Robert Shiller, he uses an Euler curve as his benchmark model. I believe that the Euler curve has nothing useful to tell us about consumption/savings decisions in the real world (that it is not at all a useful approximation to reality – no link as Google has converted my classic Google site to a worthless new

Topics:

Robert Waldmann considers the following as important: history, US/Global Economics

This could be interesting, too:

Ken Melvin writes A Developed Taste

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

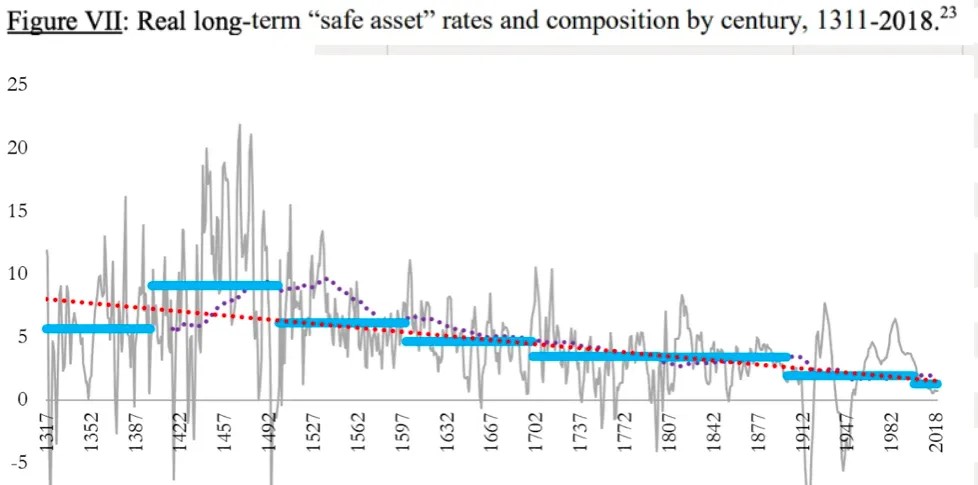

I learn from Brad DeLong (nickname delong run) that Paul Schmelzing has gone to a truly heroic effort and estimated safe real interest rates since 1310!

The main point is the long slow decline (it is ironic that one of the stylized growth “facts” is that there is no clear trend in real interest rates. Brad discusses this at length at his SubStack. Oddly, although he is one of the Efficient Markets Hypothesis’s worst enemies not named Robert Shiller, he uses an Euler curve as his benchmark model.

I believe that the Euler curve has nothing useful to tell us about consumption/savings decisions in the real world (that it is not at all a useful approximation to reality – no link as Google has converted my classic Google site to a worthless new Google site).

I have thoughts. First I think a model of consumption which actually fits the data is based on habit formation and myopia (it is consistent with bassically all of the evidence alleged to suggest that models based on rational intertemporal optimization have some similarity to reality). Here the idea basically is that consumption depends on a moving average of income as behavior changes slowly due to “habits” (this is originally developed by Stephen Marglin the utterly isolated Marxist at the Harvard Economics Department). Basically the (empirically accurate) assertion is that savings rates are high if current income is high compared to past income and not if current income is high compared to future (rationally) expected income. This suggests that there is a higher saving rate in China than in the USA (duh) which is a complete mystery to those who rely on the standard model (so standard macro has nothing to say about the biggest macroeconomic issue in the world (by far)).

So back to the graph. One sees reduced interest rates during a period of increasing real GDP per capita growth rates. Not a mystery at all if one uses a simply investment+savings supply and demand model with a model of savings which has some connection with actual data.

Of course there is also the demand side. This was a period of an increased capital to labor ratio which was (back in the 19th century) expected to cause a dramatic decline in the return on capital and real interest rates (modern growth theory all starts from the question of why real interest rates haven’t fallen more).

Moving on (that is falling into contradictions) I think classical economics is useful if one considers the centuries of data available to Adam Smith. In particular Smith through Marx it was assumed that workers were paid subsistence wages (this fits the data available to Smith through early Marx) and consume all of their income. Only property owners save (somehow sometime in the 19th century the presumed factors of production went from labor, capital, and land to just labor and capital — ask Brad about how, when and why that happened). The reduction in the fraction of people on the edge of subsistence with resulting some saving by workers might be relevant to the very most recent centuries in the time series. More importantly the distribution of income by factor of production was always relevant.

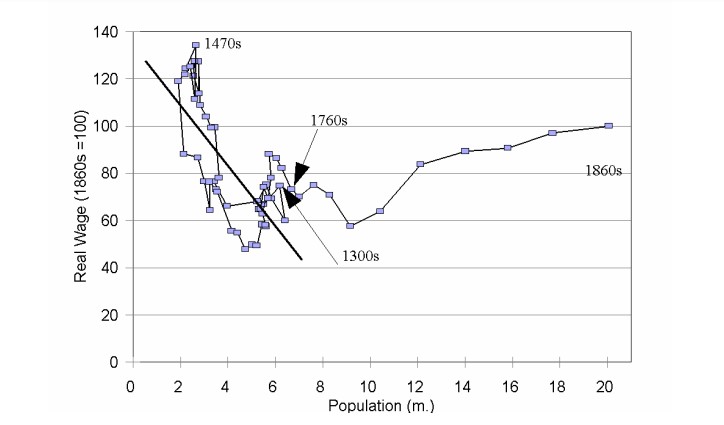

I think this might help explain the other dramatic feature of the series – the extraordinarily high interest rates in the 1400s. Other heroic economic historian Greg Clark has an even longer series for real wages.

The period of high real interest rates was also a period of high real wages. This was presumably due to the major labor supply shock due to the plague (with a really longgg lag). Now for standard theory this is backwards – other things equal low labor supply should cause a low return on capital and low interest rates. With a classical savings rule (workers consume all of their income) there is also an effect on the supply of savings with high wages causing low saving. Still makes the puzzle more puzzling.

My guess is that this had something to do with the renaissance not the aesthetically important events in Northern Italy but the general increase in trade and commerce whick implied investment in ships and stuff. But I find myself hampered by ignorance of economic history.

Then roughly after 1492 there was money supply shock with new world gold and silver (and Filipino silver). Given the fact that the medium of exchange was metal coins (and the extreme nominal rigidity mentioned above) this should have caused the dramatic decline in real interest rates from the 1500s to the 1500s which is shown in the data.