KFF Health News: In 2010 President Barack Obama signed legislation to create the Consumer Financial Protection Bureau. Its purpose he said “the new agency had one priority . . . looking out for people, not big banks, not lenders, not investment houses.” But people . . . Since then, the CFPB has done its share of policing mortgage brokers, student loan companies, and banks. More recently, the U.S. health care system has turned tens of millions of Americans into debtors. The CFPB financial watchdog is increasingly working to protect beleaguered patients, adding hospitals, nursing homes, and patient financing companies to the list of institutions regulators are probing. Just how big is the problem of medical debt? Most consumers with

Topics:

Angry Bear considers the following as important: Healthcare, law, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

KFF Health News: In 2010 President Barack Obama signed legislation to create the Consumer Financial Protection Bureau. Its purpose he said “the new agency had one priority . . . looking out for people, not big banks, not lenders, not investment houses.” But people . . .

Since then, the CFPB has done its share of policing mortgage brokers, student loan companies, and banks. More recently, the U.S. health care system has turned tens of millions of Americans into debtors. The CFPB financial watchdog is increasingly working to protect beleaguered patients, adding hospitals, nursing homes, and patient financing companies to the list of institutions regulators are probing.

Just how big is the problem of medical debt?

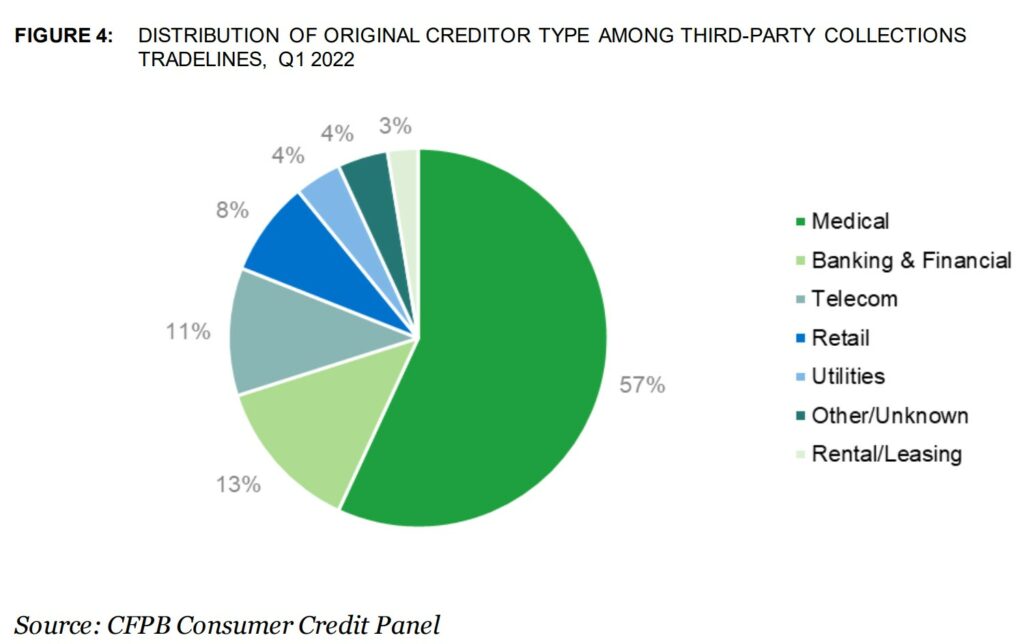

Most consumers with collection tradelines on their credit files have medical debt, followed by debt from financial institutions, telecommunications services, and retail products. As seen in Figure 4, as of 2022, medical bills made up 57 percent of third-party collections tradelines in the CFPB’s CCP. Several debt types may be underreported because they are furnished by the creditor and do not appear as collections tradelines.

A large majority of the industry’s revenue is generated by firms contracting with creditors and debt buyers to collect their debts on a contingency fee basis. The CFPB’s survey of mass market credit card issuers for the 2021 Consumer Credit Card Market Report found that in 2019 and 2020, the surveyed issuers placed 18 percent of post charge-off inventory with third-party collectors on average, with the majority of these third-party debt collectors employing a contingency fee model. In contingency fee collections, the creditor and the collector each receive a share of the amount collected. CFPB research found that contingency-fee-based debt collectors typically furnish non-financial accounts, such as medical, telecommunications, and utilities accounts, to the nationwide consumer reporting agencies (NCRAs).

In the more recent years, the CFPB has penalized medical debt collectors, issued stern warnings to health care providers and lenders targeting patients, and published reports on how the health care system is undermining the financial security of Americans.

More recently and in a bold and ambitious move, the agency is developing rules to bar medical debt from consumer credit reports. This sweeping change could make it easier for Americans burdened by medical debt to rent a home, buy a car, even get a job. Those rules are expected to be unveiled later in 2024. Rohit Chopra, the director of the CFPB whom President Joe Biden tapped to head the watchdog agency in 2021 added . . .

“Everywhere we travel, we hear about individuals who are just trying to get by when it comes to medical bills. American families should not have their financial lives ruined by medical bills.”

The CFPB’s turn toward medical debt has stirred opposition from collection industry officials, who say the agency’s efforts are misguided.

“There’s some concern with a financial regulator coming in and saying, ‘Oh, we’re going to sweep this problem under the rug so that people can’t see that there’s this medical debt out there,'” said Jack Brown III, a longtime collector and member of the industry trade group ACA International.

Brown and others question whether the agency has gone too far on medical billing. ACA International has suggested collectors could go to court to fight any rules barring medical debt from credit reports.

At the same time, the U.S. Supreme Court is considering a broader legal challenge to the agency’s funding that some conservative critics and financial industry officials hope will lead to the dissolution of the agency.

But CFPB’s defenders say its move to address medical debt simply reflects the scale of a crisis that now touches some 100 million Americans and that a divided Congress seems unlikely to address soon.

“The fact that the CFPB is involved in what seems like a health care issue is because our system is so dysfunctional that when people get sick and they can’t afford all their medical bills, even with insurance, it ends up affecting every aspect of their financial lives,” said Chi Chi Wu, a senior attorney at the National Consumer Law Center.

CFPB researchers documented how unpaid medical bills were historically the most common form of debt on consumers’ credit reports, representing more than half of all debts on these reports. But the agency found that medical debt is typically a poor predictor of whether someone is likely to pay off other bills and loans.

Medical debts on credit reports are also frequently riddled with errors, according to a CFPB analyses of consumer complaints. The agency found most often the issues with bills bring the wrong amount, has already been paid, or should be billed to someone else. Chopra said in an interview with KFF Health News.

“There really is such high levels of inaccuracy. We do not want to see the credit reporting system being weaponized to get people to pay bills they may not even owe.”

The aggressive posture reflects Chopra, who cut his teeth helping to stand up the CFPB almost 15 years ago and made a name for himself going after the student loan industry.

Targeting for-profit colleges and lenders, Chopra said he was troubled by an increasingly corporate higher-education system that was turning millions of students into debtors. Now, he said, he sees the health care system doing the same thing, shuttling patients into loans and credit cards and reporting them to credit bureaus. Chopra . . .

“If we were to rewind decades ago, we saw a lot less reliance on tools that banks used to get people to pay.”

The push to remove medical bills from consumer credit reports culminates two years of intensive work by the CFPB on the medical debt issue.

The agency warned nursing homes against forcing residents’ friends and family to assume responsibility for residents’ debts. An investigation by KFF Health News and NPR documented widespread use of lawsuits by nursing homes in communities to pursue friends and relatives of nursing home residents.

The CFPB also has highlighted problems with hospitals providing financial assistance to low-income patients. Regulators last year flagged the dangers of loans and credit cards that health care providers push on patients, often saddling them with more debt.

And regulators have gone after medical debt collectors. In December, the CFPB shut down a Pennsylvania company for pursuing patients without ensuring the debts were accurate.

A few months before, the agency fined an Indiana company working with medical debt for violating collection laws. Regulators said the company had “risked harming consumers by pressuring or inducing them to pay debts they did not owe.”

With their business in the crosshairs, debt collectors warn the crack down on credit reporting and other collection tools may prompt more hospitals and doctors to demand patients pay upfront for care.

There are some indications this is happening already, as hospitals and clinics push patients to enroll in loans or credit cards to pay their medical bills.

Scott Purcell, CEO of ACA International, said it would be wiser for the federal government to focus on making medical care more affordable. “Here we’re coming up with a solution that only takes money away from providers. If Congress was involved, there could be more robust solutions.”

Chopra doesn’t dispute the need for bigger efforts to tackle health care costs. Adding . . .

“Of course, there are broader things that we would probably want to fix about our health care system. This is having a direct financial impact on so many Americans.”

The CFPB can’t do much about the price of a prescription or a hospital bill, Chopra continued. What the federal agency can do, he said, is protect patients if they can’t pay their bills.

Why the Consumer Financial Protection Bureau is tackling medical debt. Shots – Health News from NPR, Noam Levey and heard on The Morning Edition.