By Antonio Ciaccia 46brooklyn Research A January Unlike Any Other In case you didn’t notice from our last report on new year price changes, at the end of December 2023, many insulin vials and pens took significant (i.e., 75%+) list price decreases. Given much of the early 2024 attention on brand drug list price increases, it bears repeating that insulins in 2024 are largely a quarter of the price they were in 2023. This cratering of prices for a number of high-profile brand products in unison with others (e.g. respiratory inhalers) is largely unprecedented. The significance cannot be overstated. Arguably, no products have more exemplified the drug pricing dysfunction of the United States than insulins over the last 30 (and arguably, 100)

Topics:

Angry Bear considers the following as important: 340B, 46brooklyn Research, Healthcare, Humalog

This could be interesting, too:

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes RFK Jr. blames the victims

Joel Eissenberg writes The branding of Medicaid

Bill Haskell writes Why Healthcare Costs So Much . . .

by Antonio Ciaccia

46brooklyn Research

A January Unlike Any Other

In case you didn’t notice from our last report on new year price changes, at the end of December 2023, many insulin vials and pens took significant (i.e., 75%+) list price decreases. Given much of the early 2024 attention on brand drug list price increases, it bears repeating that insulins in 2024 are largely a quarter of the price they were in 2023. This cratering of prices for a number of high-profile brand products in unison with others (e.g. respiratory inhalers) is largely unprecedented.

The significance cannot be overstated. Arguably, no products have more exemplified the drug pricing dysfunction of the United States than insulins over the last 30 (and arguably, 100) years. As we are often reminded, the original insulin patent was sold for a $1 (even if the patent in question was essentially a patent for ground-up animal pancreas; US Patent #1469994).

Yet, despite insulin’s meager origins and the proliferation of diabetes diagnoses – which today impacts more than 38 million people in just the U.S. alone – thanks to congressional investigations, media reporting, manufacturer disclosures, and loads of research, we know that the real story of insulin pricing has become healthcare’s sad version of “Where’s the beef?”

Here at 46brooklyn Research, we too have used insulin as the bloated punching bag that it deserves to be, because as list prices and net prices for insulin have diverged over the years, the full value of the growing drugmaker discounts were often not making their way to the end payer.

As such, we have focused on insulin as an example to demonstrate how drugmaker rebates are really just “money from sick people.” This is because drugmaker rebates are little more than money collected by government programs, pharmacy benefit managers (PBMs), rebate aggregators, insurers, and/or plan sponsors – on prescription drugs taken by sick people – that are often used for purposes other than lowering the cost of the medicine for that sick patient, like say to lower premiums for all people covered by the plan.

As we showed in 2021 (and as was expertly highlighted by USA Today at the time), the rebate system imposes great financial harm on those burdened with insulin dependency and the other corresponding costs associated with diabetes management. To quote from our 2021 report:

“What our models show us is that patients are over-paying for vital prescription drugs. In the current “Money from Sick People” environment, a patient expends $1,906.72 annually per year on Lantus alone (absent any premiums they have to pay, and without consideration for diabetic supplies they’ll need to use Lantus properly). The health plan’s total net expenses are -$1.078.72. That is to say, the health plan made around a thousand dollars off the sick patient’s drugs. They did this by collecting and banking rebates during the first four months of the year, and then using those rebates – plus the rest of the rebates that they generate over the remainder of the year – to pay for the expenses to the pharmacy to acquire and dispense the drug (and it just so happens that they have some money left over at the end).”

Because of the severity of the insulin pricing problem, we always intended to revisit it to demonstrate other ways money from sick people works. So, before drug pricing critics move onto the next shiny object and insulin fades into the rearview of our collective understanding of drug pricing dysfunction, as a result of these list price decreases (which also reduces the rebates they’ll produce), we invite you to join us in another look at how our system’s addiction to discounts distorts the marketplace and creates winners and losers among drug channel participants and end payers.

In today’s report, we take you into the abyss of the 340B program – a Sarlacc pit of drug pricing complexity that few dare to enter – to provide a new lens with which to understand how patients can be adversely impacted by a system built on special deals.

If you are already familiar with the 340B program’s mechanics, feel free to skip ahead to the Our Analysis section, but if you aren’t, we highly recommend reading the below section on The Origin of the 340B Program.

With that, we give you:

Money From Sick People, Part II: The 340B Story

The origin of the 340B program

Typically, when prescription drug rebates are discussed and debated, the common tug of war lives between drug manufacturers and PBMs. Because PBMs represent so many covered lives, drugmakers understandably want PBMs to cover the medicines that they produce. For medicines within competitive classes, PBMs can use their leverage to shake down manufacturers for big rebates in exchange for coverage and preferential treatment for those medicines. While this may lower the net prices of medicines relative to their list prices, it is often argued that the pressure for bigger rebates and other like-discounts disincentivizes manufacturers from lowering list prices, and in fact, could pressure them to do the opposite. This dynamic also arguably results in perverse incentives for PBMs, who stand to bring in more money off medicines with higher list prices (and higher rebates). Thus, you have controversies brewing at the federal level today where there appears to be tailwinds behind efforts to “delink” PBM compensation from the list prices of medicines.

While legacy PBMs are getting their deserved moment in the sun for their role in distorting this marketplace and arbitraging drugmaker discounts, in fairness, they aren’t the only ones with their hands in the drug pricing cookie jar.

As many have probably heard, under the Inflation Reduction Act (IRA), Medicare starts getting their own penalties and rebates from drug manufacturers. While the way the IRA goes about harvesting those rebates in Medicare may differ. Rebates and special deals for government programs in the U.S. is hardly new. For those who don’t know, thanks to the Omnibus Budget Reconciliation Act of 1990 (OBRA ‘90), Medicaid programs also get their own rebates from drug manufacturers through the Medicaid Drug Rebate Program (MDRP).

When Congress enacted the MDRP, they decided not to directly negotiate/set drug prices (like much of the rest of the western world). Rather, they decided to obtain retrospective discounts off manufacturer-set list prices. An Office of the Inspector General (OIG) report in 1990 makes it clear (in our view at least) brand price negotiation was under consideration at the time, but ultimately other controls (i.e., rebates) were selected.

What OBRA ‘90 did in establishing the MDRP was to set a formula to determine the Medicaid rebate amounts.

The formula states that Medicaid was due a manufacturer rebate on the drug on the basis of:

(1) A percentage of the drug’s price (not the typical wholesale acquisition cos [WAC] list price, but average manufacturer price [AMP]) OR Medicaid would get the best price negotiated; and

(2) Medicaid would get additional rebates if the price of a drug rose faster than inflation.

Note that the law required manufacturers to report both the AMP and the “best price” to the government for the purposes of calculating the Medicaid rebate.

So, while the government was not necessarily involved in negotiating prices, they’d get the benefit of negotiated prices from the competitive market (via the “best price” provision). As well as the benefits of a penalty (a disincentive) to not raise drug prices too much (at least not higher than the rate of other goods and services). Regardless of the details, in practice, the precedent was set, Medicaid programs would be required by law to get the “best price” in the market.

As a consequence of this formula, drug manufacturers pulled back on purchase discounts offered to select healthcare providers (they didn’t want to give Medicaid the best price they were giving to providers).

Obviously, a local hospital has a far smaller footprint than a state Medicaid program. Are we really surprised manufacturers acted in this way under this new law? The pull-back on drugmaker discounts to healthcare providers as a result of the MDRP best price birthed calls for adjustments in Congress.

Creation of the 340B Program

In 1992, Congress passed the Public Health Service Act. Contained within this act is Section 340B, which established a program whereby select healthcare groups (what we call Covered Entities) could purchase drugs cheaper than market rates – rates equivalent to what Medicaid got in terms of rebates.

The creation of the 340B program and its extension of government-mandated discounts to Covered Entities was a stealthy way for former Senator Ted Kennedy and the balanced budget congressional Republicans of the 1990s to offer a new entitlement program at no readily-discernable federal budget impact (at least on paper). By effectively stating,

“providers, you can buy drugs at the same net prices we the government get for Medicaid.”

They did not need to apportion any meaningful budgetary funding for the program, while at the same time, rectifying the problem in the minds of the impacted healthcare providers who got access to buy cheap drugs again.

A Plus and a Minus to the 340B Program

To be clear, participants in the 340B program (i.e., Covered Entities and their affiliated partners) make money off the system the old fashion way – buying the drug cheap and selling it high. Because the 340B program is a discount on drug purchases, Congress effectively created a complex subsidy for 340B Covered Entities achieved through requirements imposed on drug manufacturers. Via the 340B program, Covered Entities are able to purchase drug inventory at a significant reduction in cost, beyond what they would otherwise negotiate in the typical commercial marketplace (i.e., “best price”).

After securing low-cost inventory, which itself frees up the business’s carrying costs, Covered Entities rely upon the second source of their subsidy — privately insured individuals — to generate revenue on these discounted drug purchases. This funding (i.e., the profit between sale price and purchase price – loyal 46brooklyn readers might be thinking of the familiar term, “spread”) enables Covered Entities to deliver care to the uninsured or underinsured. As stated within an old Health Resources and Services Administration’s (HRSA) Hemophilia Treatment Center Manual,

“If the covered entities were not able to access resources freed up by the drug discounts when they apply for grants and bill private health insurance, their programs would receive no assistance from the enactment of Section 340B and there would be no incentive for them to become covered entities.”

So for those who were previously unfamiliar with the mechanics of Medicaid rebates and the 340B program, hopefully this gives a better understanding of how these government entitlement programs impact the drug pricing landscape. With the goals of Medicaid and 340B essentially concentrated on the noble purpose to provide healthcare for those who otherwise would not be able to afford it, the rub becomes how the programs go about achieving those ends — which is to draw its financial lifeblood from the list prices of medicines and the spreads harvested from patients and plan sponsors instead of more traditional budgeting means. And regardless of the return on investment received from Medicaid and 340B, the prevailing wisdom is that somehow, the yielded rebate dollars occur with no costs to the system.

Sounds all pretty amazing, right? We can fund big programs like Medicaid and 340B by just hitting up the drug manufacturers for discounts off their prices, and that way, it doesn’t cost the rest of us anything. And now with Medicare getting their own rebates through the IRA, it begs a larger question: if we could just drive more discounts from drug manufacturers, what other sorts of cool stuff could we then get for free?

Of course, it doesn’t really work this way. In fact, it was clear pretty much from the beginning that there was a link between these government programs and the rest of the market. There is no secret drug money tree that keeps replenishing itself (outside of Woonsocket, that is). These discounts may not have a direct, easy-to-decipher cost on the front end, but somewhere, somehow, this money has an origin story.

And much like our Money from Sick People tale from 2021, the drug discounts that underpin the Medicaid and 340B programs don’t come without a cost either. The old saying goes, “there’s no such thing as a free lunch.” So when it comes to 340B, let’s see who is getting to feast and who is picking up the tab.

Our analysis

As with any good analysis, we need to start with some data and some assumptions. Fortunately for us, all of our data for this analysis of the flow of dollars within the 340B program is publicly sourced, so feel free to check our work, and thank those who make drug pricing data more available and accessible to the public.

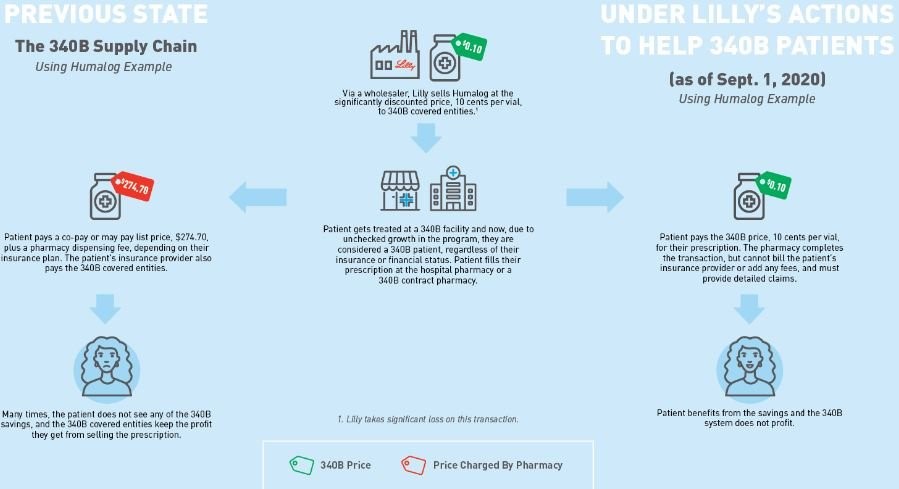

Our first assumption is to establish what the 340B price for insulin actually is. Fortunately for us, Eli Lilly told us the 340B price experience for their drug Humalog (as of Sept. 1, 2020). As can be seen below in Figure 2, Eli Lilly (who would know best) told us the list price (i.e., wholesale acquisition cost, or WAC ) for insulin was $274.70 for a 10 mL vial. That same vial could be acquired through the 340B program for just $0.10 (an effective 100% discount).

Now, this is the price of insulin as of September 2020 according to Lilly, but we believe it still holds valid through the end of 2023. There were no WAC list price changes for Humalog between September 2020 and 2023 (except of course for 76% decrease in WAC list price on 12/30/2023 – see our Brand Drug List Price Change Box Score). Because there were no list price changes, we think it’s reasonable to say this graphic is valid for the years of 2020 through 2023 (except for the 30th and 31st of December 2023). Nevertheless, we’ll endeavor to keep our timeline close to this date as the purpose of this report is more demonstrative than quantitative.

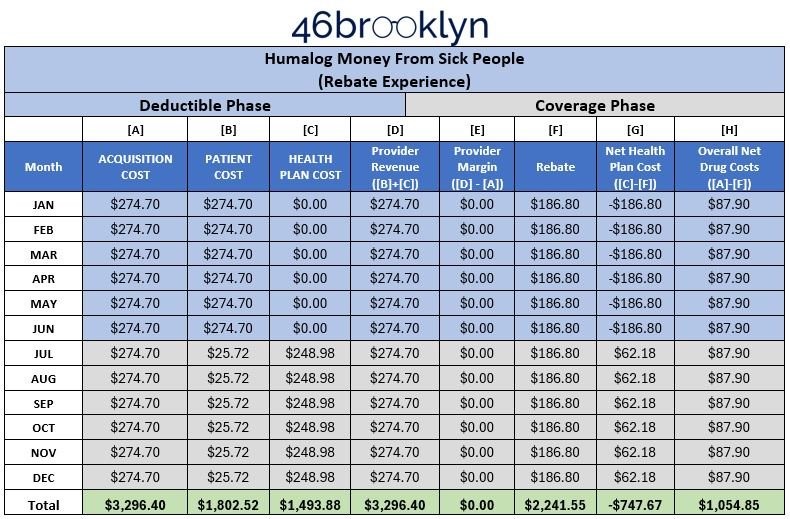

Our next assumption is to establish what the average deductible amount is in the U.S. We need this value, because it establishes how much money a patient will have to pay directly for their healthcare products and services – in our case, the drug Humalog – before they get the benefit of their insurance copayment. Thanks to the Kaiser Family Foundation 2020 Employer Health Benefits Survey, we sourced this at $1,644 annually for 2020 (aligned to the date of Eli Lilly graphic in Figure 2).

Next, we need to know what Humalog costs – what it costs for the insulin package to the health system, and what a patient pays to get that package after they’ve met their deductible. Fortunately, this was recently looked into through our team’s consulting work at 3 Axis Advisors, where using our recently-released World Insulin Price Comparison Map, we can see that the typical package cost for a vial of Humalog vial is $262 in the U.S., with a typical patient pay obligation of $25.72. The cost of the vial of pens reported there is at least in line with our own visualizations at 46brooklyn. This assumes Medicaid managed care organizations are reasonable proxies to the commercial market, and also in line with other previous disclosures on price.

Now, the astute reader will note that $262 relative to the WAC list price of $274.70 is roughly a $10 underpayment to pharmacy. For the sake of making all of this easier, we’re going to go with the $274.70 number for both the reimbursement and acquisition cost number (but there is almost certainly a lesson there about underwater reimbursement on brand name drugs to pharmacies). In choosing to make the number $10 higher we’ve avoiding discussing underwater payments to pharmacies on brand name drugs which we promise to revisit at a later point (so forgive us for trying to simplify the math a little here).

Lastly, we need to know what kind of rebates Humalog can generate. Lucky for us again, this information came to light at the start of 2021 via the U.S. Senate Finance Committee’s investigation into insulin costs, where it was stated,

“Eli Lilly prepared widely divergent rebate bids within a few months of each other for Humulin and Humalog to a commercial health plan in Puerto Rico called SIS (22%), Cigna (45%-55% depending on formulary placement), a PBM in Puerto Rico called Abarca Health (up to 54%), and Optum’s Part D business (68%).”

Eli Lilly is the manufacturer of Humalog. If the offer of rebates years ago was 68% to one of the largest PBMs (pre-2020), it seems reasonable to assume those rebates were available until the end of 2023 (when the WAC list price decreases occurred). In fact, based on what we know about the general growth of rebates over time and recent reporting on Lantus’ net price (another insulin), we would believe the number to be a conservative estimate for the sake of this analysis (which is roughly aligned to what we know about insulin prices in 2020-2021). To be clear, the WAC for Humalog didn’t change from May 2017 to December 2023, and a 68% value of the wholesale acquisition cost (WAC) equals $186.80 today based on the $274.70 list price, leaving Humalog’s estimated net price at $87.90 (what we feel is a conservative estimate).

Crunching the numbers

With those assumptions out of the way, and our data points gathered, we can re-construct our Money from Sick People Model #1 demonstrating how the cost for insulin is generally experienced by people with diabetes over the year, as well as the rebates PBMs, rebate aggregators, and/or health plans are recognizing on each prescription of Humalog. Note, we are grouping PBMs, rebate aggregators, and health plans together in our model because it is largely irrelevant which entity is taking the money, and well, they’re increasingly the same organization. We construct this model again because we used a different insulin the first time around and just want to make sure the previous learnings from Lantus hold true for Humalog too (spoiler: they do).

Once this model is constructed, we can then compare the existing flow of money for Humalog relative to the 340B Covered Entity provider experience. From there, we analyze the impact of shifting the after-the-fact Humalog rebates from the health insurer/PBM/rebate aggregator to an upfront discount to a healthcare provider through the 340B program. And boy, does it change the Money from Sick People Model in meaningful ways (except for maybe the patient).

Results

We start by reproducing the Money from Sick People experience for people getting insulin through their traditional health insurance plan without any of the complicating factors that 340B can add into the transaction. Meaning the chart below demonstrates the typical flow of money for the purchase of Humalog under commercial insurance.

As can be seen in Figure 3 below, although Humalog is a different insulin from our November 2021 rebate analysis (which used Lantus). The results are more or less the same. PBMs/insurance companies/rebate aggregators actually make money on people getting their insulin filled thanks to drugmaker rebates, deductibles, and cost sharing.

As can be seen below, the health plans pay out (Column [C]) less than they collect in rebates (Column [F]). Ergo money made (Column [G] is reported as a negative number, reflecting lower costs than what was paid out).

While the results of Figure 3 are expected – patients paying $1,802.52 for a drug that their plan/PBM receives $747.67 in profit for – it is a nice form of validation for our prior work with Lantus that the Money from Sick People moniker was appropriately applied to how rebates are generated and flow within traditional commercial pharmacy transactions.

With this confirmation in hand, we can move forward with re-imagining how the flow of dollars works when a 340B Covered Entity is dispensing the insulin to a person with insurance (Figure 4).

~~~~~~~~

I am going to stop here tonight. Been battling Shingles and I am getting tired. The above explanation shows the typical flow of money for the purchase of Humalog under commercial insurance.

~~~~~~~~

Welcoming a New Year with new drug prices — 46brooklyn Research, Antonio Ciaccia

Flash finding: How drug money from sick people really works, 46brooklyn Research, Antonio Ciaccia

Money from Sick People Part III: Why is U.S. drug pricing policy designed to exploit patients? 46brooklyn Research, Antonio Ciaccia