– by New Deal democrat The Bonddad Blog New Deal democrat has been writing and featured at Angry Bear for years now. His economic outlooks have been accurate with few exceptions. As always the US economy is independent of us in the short term. Read on as NDd’s remarks are focusing on a sound labor market. ~~~~~~~~ As I wrote Friday, the news from the employment report was almost all good. Let’s follow up on the most important points today. First, the thre month average of new jobs added rose to a 12 month high, meaning Q1 of this year was the best quarter since Q1 of last year (dark blue, below, vs. monthly jobs light blue): And the unemployment rate ticked down 0.1%, meaning that the three month average is 3.8%, or 0.3% higher

Topics:

NewDealdemocrat considers the following as important: 2024, March Jobs, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

New Deal democrat has been writing and featured at Angry Bear for years now. His economic outlooks have been accurate with few exceptions. As always the US economy is independent of us in the short term. Read on as NDd’s remarks are focusing on a sound labor market.

~~~~~~~~

As I wrote Friday, the news from the employment report was almost all good. Let’s follow up on the most important points today.

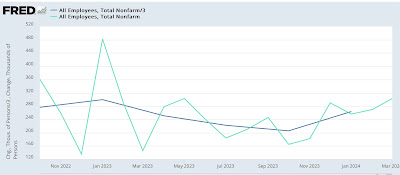

First, the thre month average of new jobs added rose to a 12 month high, meaning Q1 of this year was the best quarter since Q1 of last year (dark blue, below, vs. monthly jobs light blue):

And the unemployment rate ticked down 0.1%, meaning that the three month average is 3.8%, or 0.3% higher than the 12 month low of 3.5% set one year ago:

This means that the Sahm rule is not close to being triggered.

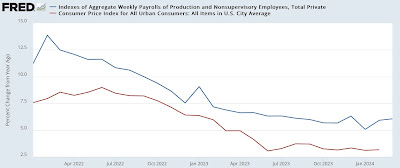

And while average hourly wages for nonsupervisory personnel decelerated further to 4.2%, this remains very high by the standards of the past 40 years:

Remember that typically inflation increases faster than wages in the year heading into a recession. So with inflation at 3.1% YoY, this is not in play.

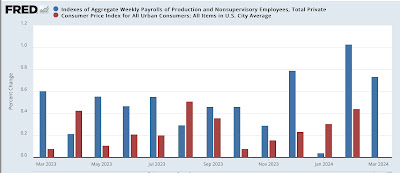

As I wrote last month, real aggregate payroll growth has a flawless record going back over 50 years of distinguishing expansion from recession. At 6.1% growth YoY, this is 3.0% higher than the last CPI reading:

It also made a new all-time high in real terms (not shown). Further, the monthly trend has been increasing in the past few months, so unless there is a big spurt in inflation, we are going to set yet another new record high this month:

All of this is simply potent evidence of an employment economy that is humming along.

Last month I wrote that the Household survey contained some numbers that were simply recessionary. Let’s update that.

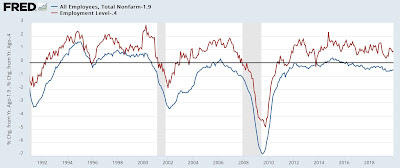

In contrast to the Establishment survey, which showed 1.9% growth YoY, which is healthier than almost all times during the past 25 years, the Household survey remained stuck at 0.4% growth YoY. Here’s the longer term graph, normed to the current YoY numbers:

This metric does remain recessionary, but I expect it to resolve in the direction of the Establishment survey.

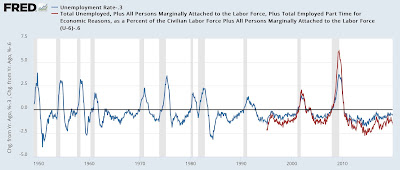

As indicated, the unemployment rate was 0.3% higher than one year ago. The U6 underemployment rate was higher by 0.6%:

Over the 30 year history of the U6 rate, this has heretofore meant recession. In the case of the U3 rate, there have been a number of instances where it just meant slow growth, although it too more often than not meant a recession was on the way.

Unless we start seeing weekly unemployment claims heading higher, I expect the unemployment rate to remain stable or even decline slightly in the months ahead. This will make the YoY comparisons better, removing that metric from one of any concern.

So, while some poor spots remain, as I wrote on Friday, this employment report made the “soft landing” scenario the default setting going forward.

Scenes from the February jobs report: yes, the Household Survey really was recessionary, Angry Bear, by New Deal democrat