Applied econometrics — a messy business Do you believe that 10 to 20% of the decline in crime in the 1990s was caused by an increase in abortions in the 1970s? Or that the murder rate would have increased by 250% since 1974 if the United States had not built so many new prisons? Did you believe predictions that the welfare reform of the 1990s would force 1,100,000 children into poverty? If you were misled by any of these studies, you may have fallen for a pernicious form of junk science: the use of mathematical modeling to evaluate the impact of social policies. These studies are superficially impressive. Produced by reputable social scientists from prestigious institutions, they are often published in peer reviewed scientific journals. They are filled

Topics:

Lars Pålsson Syll considers the following as important: Statistics & Econometrics

This could be interesting, too:

Lars Pålsson Syll writes Keynes’ critique of econometrics is still valid

Lars Pålsson Syll writes The history of random walks

Lars Pålsson Syll writes The history of econometrics

Lars Pålsson Syll writes What statistics teachers get wrong!

Applied econometrics — a messy business

Do you believe that 10 to 20% of the decline in crime in the 1990s was caused by an increase in abortions in the 1970s? Or that the murder rate would have increased by 250% since 1974 if the United States had not built so many new prisons? Did you believe predictions that the welfare reform of the 1990s would force 1,100,000 children into poverty?

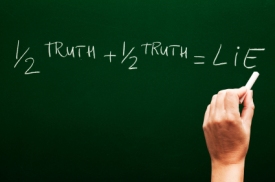

If you were misled by any of these studies, you may have fallen for a pernicious form of junk science: the use of mathematical modeling to evaluate the impact of social policies. These studies are superficially impressive. Produced by reputable social scientists from prestigious institutions, they are often published in peer reviewed scientific journals. They are filled with statistical calculations too complex for anyone but another specialist to untangle. They give precise numerical “facts” that are often quoted in policy debates. But these “facts” turn out to be will o’ the wisps …

These predictions are based on a statistical technique called multiple regression that uses correlational analysis to make causal arguments … The problem with this, as anyone who has studied statistics knows, is that correlation is not causation. A correlation between two variables may be “spurious” if it is caused by some third variable. Multiple regression researchers try to overcome the spuriousness problem by including all the variables in analysis. The data available for this purpose simply is not up to this task, however, and the studies have consistently failed.

Mainstream economists often hold the view that if you are critical of econometrics it can only be because you are a sadly misinformed and misguided person who dislikes and does not understand much of it.

As Goertzel’s eminent article shows, this is, however, nothing but a gross misapprehension.

To apply statistical and mathematical methods to the real-world economy, the econometrician has to make some quite strong, limiting, and unreal assumptions (completeness, homogeneity, stability, measurability, independence, linearity, additivity, etc., etc.)

To apply statistical and mathematical methods to the real-world economy, the econometrician has to make some quite strong, limiting, and unreal assumptions (completeness, homogeneity, stability, measurability, independence, linearity, additivity, etc., etc.)

Building econometric models can’t be a goal in itself. Good econometric models are means that make it possible for us to infer things about the real-world systems they ‘represent.’ If we can’t show that the mechanisms or causes that we isolate and handle in our econometric models are ‘exportable’ to the real world, they are of limited value to our understanding, explanations or predictions of real-world economic systems.

Real-world social systems are usually not governed by stable causal mechanisms or capacities. The kinds of ‘laws’ and relations that econometrics has established, are laws and relations about entities in models that presuppose causal mechanisms and variables — and the relationship between them — being linear, additive, homogenous, stable, invariant and atomistic. But — when causal mechanisms operate in the real world they only do it in ever-changing and unstable combinations where the whole is more than a mechanical sum of parts. Since econometricians haven’t been able to convincingly warrant their assumptions of homogeneity, stability, invariance, independence, and additivity as being ontologically isomorphic to real-world economic systems, I remain doubtful of the scientific aspirations of econometrics.

There are fundamental logical, epistemological and ontological problems in applying statistical methods to a basically unpredictable, uncertain, complex, unstable, interdependent, and ever-changing social reality. Methods designed to analyse repeated sampling in controlled experiments under fixed conditions are not easily extended to an organic and non-atomistic world where time and history play decisive roles.

Econometric modelling should never be a substitute for thinking. From that perspective, it is really depressing to see how much of Keynes’ critique of the pioneering econometrics in the 1930s-1940s is still relevant today. And that is also a reason why social scientists like Goertzl and yours truly keep on criticizing it.

The general line you take is interesting and useful. It is, of course, not exactly comparable with mine. I was raising the logical difficulties. You say in effect that, if one was to take these seriously, one would give up the ghost in the first lap, but that the method, used judiciously as an aid to more theoretical enquiries and as a means of suggesting possibilities and probabilities rather than anything else, taken with enough grains of salt and applied with superlative common sense, won’t do much harm. I should quite agree with that. That is how the method ought to be used.

Keynes, letter to E.J. Broster, December 19, 1939