AB: I tend to believe the Pandemic caused more economic upheaval than Wall Street blowing up the economy and Main Street paying for WS’s pennies on the dollar gambling with CDS, naked CDS, etc. in the derivatives market. More was made available in 2020 onward by the government to lessen the impact of the Pandemic. This softened the blow pf the Pandemic and the economic shutdown. With the FED holding the reins on the FED Rate, timing is important as to when the rate will be lowered. Hopefully, it is soon. ~~~~~~~~ Evidence of manager wage growth rising while typical workers’ wage growth slows . . . Elise Gould Economic Policy Institute Over the last few months, there’s been much talk about the return to normal in the labor market. A

Topics:

Angry Bear considers the following as important: labor, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

AB: I tend to believe the Pandemic caused more economic upheaval than Wall Street blowing up the economy and Main Street paying for WS’s pennies on the dollar gambling with CDS, naked CDS, etc. in the derivatives market. More was made available in 2020 onward by the government to lessen the impact of the Pandemic. This softened the blow pf the Pandemic and the economic shutdown.

With the FED holding the reins on the FED Rate, timing is important as to when the rate will be lowered. Hopefully, it is soon.

~~~~~~~~

Evidence of manager wage growth rising while typical workers’ wage growth slows . . .

Elise Gould

Economic Policy Institute

Over the last few months, there’s been much talk about the return to normal in the labor market. A normal rate of job openings, hires, and quits. Unemployment back to pre-pandemic levels for a sustained period and the stability of the prime-age employment-to-population ratio at an even slightly higher rate than pre-pandemic. Will a return to “normal” also mean wages for the vast majority rise slower and that those with more power exert their leverage through faster wage gains? Recent evidence shows a worrying trend emerge: Wage growth for production/nonsupervisory workers has slowed while manager wage growth has mildly accelerated.

Over much of the current economic recovery, lower-wage workers experienced faster wage growth than other groups. They lost their jobs in greater numbers during the pandemic. However, a policy response matching the scale of the problem translated into a tremendous bounce back in jobs. It also meant, workers who lost their jobs were not as desperate to take the first one when those jobs returned. Employers were scrambling to attract and retain workers, leading to faster wage growth for those lower-wage workers with historically less bargaining power.

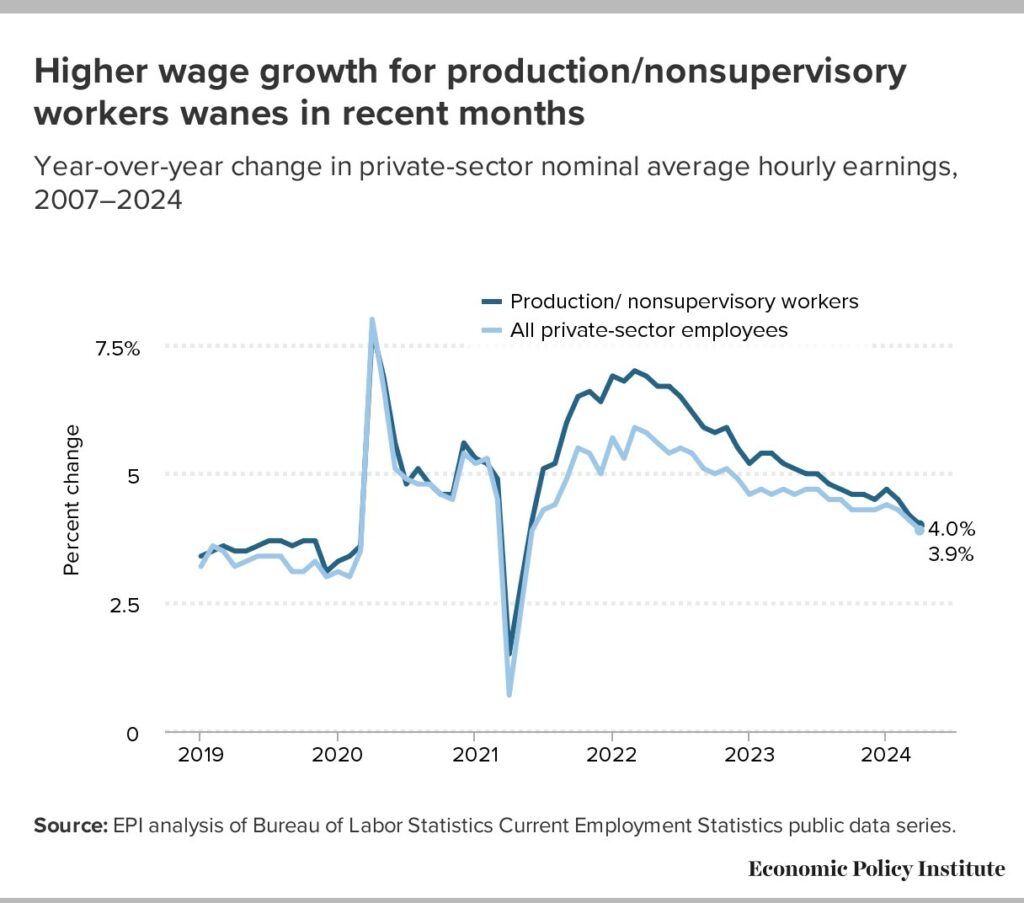

A similar, though more muted, phenomenon happened for production/nonsupervisory workers (roughly the bottom 82% of the wage distribution). Hourly wages for production/nonsupervisory workers started growing faster than overall private-sector wages in mid-2021, as shown in Figure A below.

By March 2022, year-over-year hourly wages grew 7.0% for production/nonsupervisory workers, compared with 5.9% overall. Over the last two years, nominal wage growth for both groups of workers has decelerated, but the deceleration is more pronounced among production/nonsupervisory workers. The latest April 2024 data show that production/nonsupervisory workers are still experiencing slightly faster year-over-year wage growth than the overall private sector, but that’s likely to reverse soon given recent trends.

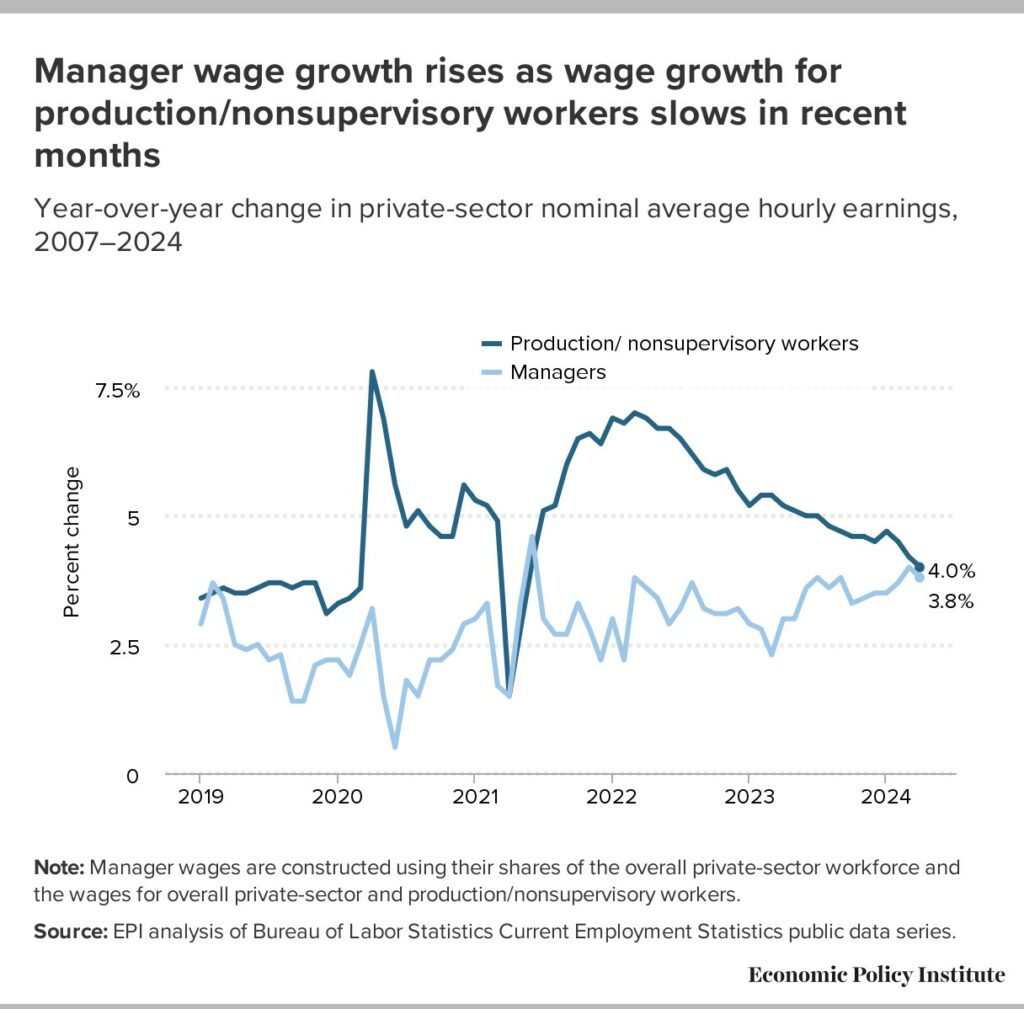

Additionally, we can impute average hourly wages for managers using their shares of the overall private-sector workforce and the wages for overall private and production/nonsupervisory workers. When we do the calculation, we see a mild acceleration in managerial wage growth over the last few months. However, the series is notably volatile (see Figure B).

The wage differential between typical workers and managers will be important to watch in Friday’s jobs report as well as future months. While the return to normal may be welcome in other metrics, it would not be welcome to see managerial pay growth exceeding growth for non-managers such that rising inequality rears its ugly head again.