– by New Deal democrat I saw a graph within the past few days (which unfortunately I did not make a copy of) indicating Biden’s polling problems are not against Trump per se so much as they are the failure of Biden to consolidate support among young voters, especially voters of color, vs. Trump’s having already consolidated his base support. One reason, is the huge generational divide in how the Israel/Palestine issue is viewed. But the other is that, for all the ballyhoo about jobs created and the low unemployment rate, in the sector of the most important purchase most people will ever make – housing – the news has been awful, and still is. Let’s take an example out of thin air with nice round numbers. Let’s say a young couple want to

Topics:

NewDealdemocrat considers the following as important: housing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

I saw a graph within the past few days (which unfortunately I did not make a copy of) indicating Biden’s polling problems are not against Trump per se so much as they are the failure of Biden to consolidate support among young voters, especially voters of color, vs. Trump’s having already consolidated his base support.

One reason, is the huge generational divide in how the Israel/Palestine issue is viewed. But the other is that, for all the ballyhoo about jobs created and the low unemployment rate, in the sector of the most important purchase most people will ever make – housing – the news has been awful, and still is.

Let’s take an example out of thin air with nice round numbers. Let’s say a young couple want to purchase a $200,000 home with 10% down and take a 30 year mortgage at the prevailing rate. How have they fared since January 2021?

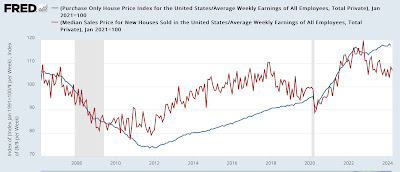

Even taking into account the average weekly earnings of an American worker, as measured by the FHFA pushing index the price of an existing home (blue in the graph below) has increased by 18% during the Biden Administration. The median price of a new single family home (red), similarly adjusting for wages, is about 8% higher (after being about 15% higher several years ago):

Our hypothetical young couple,*even after adjusting for increased earnings,* would have to put $23,600 down vs. $20,000 down in January 2021 for an existing home, and $21,600 down for a new $200,000 single family home.

Not only has their down payment cost increased substantially, but the 30 year mortgage has increased from an average 2.74% in January 2021 to 7.06% last month – close to a new high for the entire Millennium:

That means our couple’s monthly mortgage payment has increased from $734 in January 2021 to $1,293 for the median priced single family home, and $1,422 for the average existing home!

Even renting is not such a bargain, because the CPI for rent has increased 5.8% in real terms after adjusting for the average weekly wage increase, and is also at a new high:

Simply put, for younger persons looking to move into their first apartment, or move out of an apartment into a house, or move up to a bigger sized house, the economy during Biden’s tenure has not been helpful to say the least.