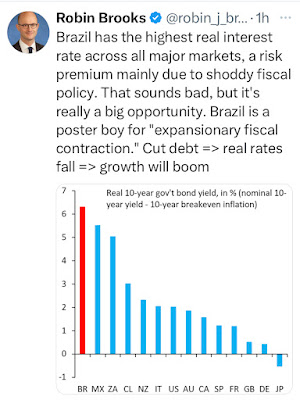

Robin Brooks, previously the chief economist at from the Institute of International Finance (IFF), and now at Brookings, suggests Brazil needs austerity, and, here is the punch line, that would promote growth (laugh track here).The notion that it is the fiscal balances that determine the interest rate on public debt, and that fiscal deficits and high debt must imply high interest rates has no correlation with reality. Imagine the rate of interest that Japan would have if that was correct. In the case of Brazil the higher interest rates are entirely associated to Central Bank decisions.In fact, if one looks at the correlation between interest rate and the size of public debt as a share of GDP, the correlation is weak, statistically insignificant, and negative. That is, higher debt is

Topics:

Matias Vernengo considers the following as important: Brazil, Brooks, IFF, Interest rates

This could be interesting, too:

Matias Vernengo writes The behavior of the nominal exchange rate between the Brazilian Real and the dollar in 2024

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

Merijn T. Knibbe writes Monetary developments in the Euro Area, september 2024. Quiet.

Robin Brooks, previously the chief economist at from the Institute of International Finance (IFF), and now at Brookings, suggests Brazil needs austerity, and, here is the punch line, that would promote growth (laugh track here).

The notion that it is the fiscal balances that determine the interest rate on public debt, and that fiscal deficits and high debt must imply high interest rates has no correlation with reality. Imagine the rate of interest that Japan would have if that was correct. In the case of Brazil the higher interest rates are entirely associated to Central Bank decisions.

In fact, if one looks at the correlation between interest rate and the size of public debt as a share of GDP, the correlation is weak, statistically insignificant, and negative. That is, higher debt is associated with lower interest rates by the central bank.

Let alone that the idea of expansionary fiscal contraction has been completely debunked with the austerity policies that followed the European crisis more than a decade ago. Ask Tories in the UK how well that worked!