By Nathalie Marins, Ricardo Summa & Daniel Consul (Guest bloggers)Currency devaluations can disrupt developing economies by raising import costs and food prices, which in turn reduces real wages. This impact is particularly detrimental to lower-income households, which typically allocate a substantial portion of their income to essential goods. Consequently, when the local currency weakens, governments encounter increased political pressure due to rising prices that erode purchasing power. Throughout 2024, the Brazilian real faced a continuous process of depreciation that intensified in December, prompting headlines accusing recent fiscal policy decisions of triggering a full-blown currency crisis. However, a closer look at the data suggests that external financial factors, monetary and

Read More »Articles by Matias Vernengo

Serrano, Summa and Marins on Inflation, and Monetary Policy

February 28, 2025[embedded content]

This is the full round table on Inflation and Monetary Policy organized by the Bucknell Institute for Public Policy (BIPP), with Franklin Serrano, Ricardo Summa and Nathalie Marins.

What is heterodox economics?

February 20, 2025New working paper published by the Centro di Ricerche e Documentazione Piero Sraffa. From the abstract: This paper critically analyzes Geoffrey Hodgson’s definition of heterodox economics as the refutation of the orthodox view that emphasizes utility maximization as its main theoretical core, and his view that it is the fragmentation of heterodox economics that explains its subsidiary role within the profession. Hodgson’s views led to a series of responses, that criticize his definition, but also present significant problems of their own. The limitations of Hodgson and his critics’ views are contrasted with an alternative definition that emphasizes the importance of conflictive distribution and the principle of effective demand in the long run. The idea of a broad tent, from a

Read More »The 8th Godley-Tobin Lecture

February 13, 2025Registration for the Zoom meeting here. After registering, you will receive a confirmation email containing information about joining the meeting.

Read More »Milei and real wages in Argentina

January 31, 2025I was interviewed by Max Jerneck for his podcast, and he alerted me to

this figure (see below), which apparently come from the Universidad

Francisco Marroquín in Guatemala, that has made the rounds, and has been

used by right-wing think tanks. If you were to believe this, real wages fell after Milei’s assumption. This is obviously sheer ignorance, or, more likely, an attempt to misinform and create doubts about the real effects of his policies. I had read a recent report by Centro de Economía Política Argentina (CEPA), and Julia Strada was very nice sending me the data for their own calculations based on the official INDEC data (note that this is not the issue, real wages dd fall, and recovered somewhat, but are below the initial level).The problem with the graph, is that it starts

Are we on the verge of a debt crisis?

January 8, 2025This was my presentation at the Political Economy Research Institute (PERI) last summer. I was supposed to revise it, but never found the time. So it is now available on Substack. Fundamentally says that the current situation is very different than the debt crisis of the 1980s, and the period between the Tequila, in 94/95 and the Argentine Convertibility default in 2001/02.

Read More »Podcast on the first year of Milei’s government in Argentina

January 2, 2025[embedded content]PS: A comment about it appeared in a recent Guardian editorial. There is too much optimism about Milei ‘success’ in containing inflation, but also a lot of misunderstanding why he managed, and whether it is sustainable.

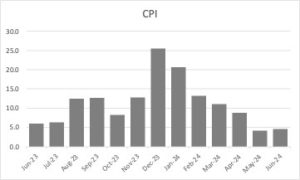

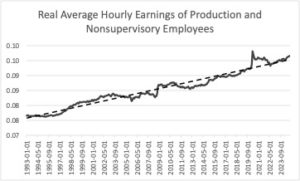

Read More »Inflation, real wages, and the election results

December 11, 2024Almost everybody these days accepts at face value that the result of the election was heavily determined by negative perceptions about Bidenomics, and that, in turn, resulted from inflation. Inflation was high (it wasn’t, at least not that much), and people were pissed off. This is not just Larry Summers, who had argued (incorrectly in my view) that inflation was caused the large fiscal packages of an excessive generous government.In the heterodox camp, many have suggested that more should have been done to control greedy corporations, that caused inflation by hiking their mark ups. In this view, price controls might have been helpful (often some examples of other countries, like Spain are used). While some of these would have been good, they depend on the previous existence of national

Read More »Very brief note on the Brazilian real and the fiscal package

December 2, 2024The Brazilian real depreciated last week (full meltdown might be a bit of a hyperbole), and in many quarters there has been a suggestion that it is now undervalued, and that would somehow be connected to the dangers associated with the fiscal position, and the willingness of the Lula government to push the spending cuts, and the tax changes, with cuts for those at the bottom of the income distribution and hikes at the other end (more on the fiscal story in a bit).The obvious reason for this is that the Brazilian basic interest rate was coming down from its post-pandemic high, and probably, and in spite of all the pressure from progressives and heterodox economists, it was a bit too low. As it can be seen, as the SELIC rate came down, the exchange rate started, eventually, to depreciate.

Read More »Milei’s Psycho Shock Therapy

November 24, 2024My short piece for Dollars & Sense on Milei’s economic program is out now, here. An early version is available here. Btw, this is the 50th anniversary issue. By coincidence, 20 years ago, a piece of mine on Brazil (and the Lula government back then) was also published on Dissent on their 50th anniversary issue.The Milei piece was written in June and revised around September. Now it seems more clear that they might receive some fresh money from the IMF, which will allow them to continue to pushing the adjustment well into next year, and, perhaps beyond. Note that this is exactly what the same team during the Macri administration. Try to cut spending in domestic currency (now more drastically) and, hence, debt in pesos, and increasing indebtedness in dollars. The money will probably come

Read More »Elon Musk (& Vivek Ramaswamy) on hardship, because he knows so much about it

November 22, 2024I noted (here on the blog and also here) that I didn’t think predictions about inflation acceleration and a recession as a result of a a second Trump presidency seemed probable. Yes, he would cut social spending, but would likely expand defense spending, and the tariffs would have a level effect on prices, but not a persistent one on the rate of change (inflation). This was before the rant by Elon Musk on spending cuts and the need for real hardship. Elon suggested cuts of 2 trillion dollars which would obviously, if they were to pass, cause a major recession (I discussed that on the Rick Smith Show). Now Elon and Ramaswamy suggest cuts of about 500 billion. Still a huge number, more than 1.5% of GDP, that would certainly provoke a recession. They say (read it in full here):They suggest

Read More »The second coming of Trumponomics

November 10, 2024Donald Trump will be the first president since Grover Cleveland, also a New Yorker, to have two non consecutive terms in the presidency. The reasons for this are beyond my abilities to analyze, but it is clear that he did get the votes of people in the lower levels of income, that had voted for Biden in 2020 (but not for Hillary in 2016) and went decisively for Trump. One may say that the populist vote in favor of tariffs, often associated with working class interests, was part of the explanation. But Bidenomics (on that see this and this) had incorporated that and more.I do think that economic factors were central for the outcome of the election. However, I think there is a simplification in suggesting it was inflation. Many people have suggested that, including many progressives, like,

Read More »Currency substitution in Argentina

November 4, 2024"I have invited an economist that was active in the dollarization of Ecuador to illustrate the wonders of the process." A paper with Santiago Graña on dollarization in Argentina published in the PSL Quarterly Review. From the abstract:Currency substitution defined as the use of foreign currency in the domestic economy is a relatively common phenomenon in developing countries. While mainstream economics has analyzed it in some detail, the same is not the case in heterodox economics. This paper proposes an analytical approach to evaluate the effects of currency substitution and its relationship with exchange rate dynamics; it provides an empirical investigation of orthodox and alternative views for the case of Argentina. The orthodox view emphasizes the role of fiscal deficits financed by

Read More »Paul Davidson (1930-2024) and Post Keynesian Economics

October 26, 2024Paper on Paul with Tom Palley and Jamie Galbraith published by ROKE. From the abstract:"Paul Davidson was a critical figure in the preservation of John Maynard Keynes’s ideas, sticking with them when they were out of fashion. He was also key to the survival of the Post Keynesian school. Davidson endorsed Keynes’s liquidity preference theory of interest, and he emphasized fundamental uncertainty as a central feature of economic reality, essential to making sense of a monetary economy. His greatest legacy is the Journal of Post Keynesian Economics, the intellectual home for a generation of Post Keynesian economists. Without his efforts, the heterodox economics community would be significantly smaller than it is now."Full paper available here.

Read More »The Economist and the American Economy

October 24, 2024It takes something for me to say that The Economist is probably right. Sure enough the cover of The Economist, which has led to many critiques, sarcastic comments, and plain mockery by some friends on the left, was a bit hyperbolic. But the main argument of the piece — basically that the American economy did pretty well in the recovery from the Pandemic, and that the United States has done well when compared to other advanced economies, and better than it did in the last few recoveries, which is not the case with China, which still grows faster, but has slowed down — is correct.Regarding the recovery, it is clear that the US has outperformed most economies, and it is also true that to a great extent that is due to the fiscal packages from the Pandemic, including the Biden ones, that

Read More »IMF surcharges

October 12, 2024A long demand by progressive economists demanding the end of the surcharges that the IMF imposed on developing countries has had a positive outcome, with the executive board reducing them. The statement by Kristalina Georgieva can be read here. A strong effort on this by Joe Stiglitz, Martín Gúzman, Kevin Gallagher, Mark Weisbrot, to cite a few should be noted. I had recently signed the letter below favoring this policy."Dear International Monetary Fund Board of Directors,This Friday October 11, 2024, the International Monetary Fund (IMF) is expected to announce reforms to its policy on charges and especially surcharges, which levies extra fees on countries whose debts have surpassed certain size and time thresholds. We the undersigned urge the IMF to meaningfully reform its policies,

Read More »More on the possibility and risks of a recession

September 6, 2024So both the (inverted) yield curve and the Sahm rule indicate a recession. This together with two months of slower employment creation, and the slightly higher unemployment rate, has many wondering whether the economy will crash soon. I discussed before — a while ago, before the pandemic recession, that had nothing to do with the yield curve — why an inverted yield curve doesn’t necessarily mean a forthcoming recession. The Sahm rule, like the inverted yield curve has an impressive track record. It suggests that if three month moving average of the rate of unemployment rises 0.5 or more above the minimum of the same averages for the previous twelve months a recession is under way. Figure below, although scale doesn’t help, shows that we are at 0.57 for last August [ominous music

Read More »Two letters to The Economist about Donald Harris and what they reveal about ideology

September 5, 2024Spaghetti economics: Shootout at Harvard Square There were two letters about the poorly written (not the English, always impeccable, contrasting to my spaghetti English, which is always slightly off, like the Westerns) piece that The Economist had on Donald Harris. One by Robert Blecker, Steve Fazzari and Peter Ho, setting the record straight on the breadth and depth of Harris’ contributions to economics. On this, they echo what the Post said about Harris’ policy advice in his native Jamaica. The subtitle of the Post piece said: "An unconventional economist at Stanford, Donald J. Harris pushed strikingly nonideological economic solutions to the nation of his birth." Harris was (and still is, from what I can assume) a reasonable man, both as a scholar concerned with knowledge, and as a

Read More »Milei, Mankiw, and pagliarism in economics

August 26, 2024I start teaching this week (tomorrow). One of the things we are encouraged to discuss with students is the issue of academic misconduct. One of those problems that always existed, and not just among students, and it is hard to say whether things are better or worse than before, even though everyone thinks it has worsened. Certainly AI has made things even more complicated. At least in my classes, AI has limited impact, since it is an average of what is out there, and that is conventional economics.Economics, as a field, is also not particularly good, with fewer retractions than other fields. Carmen Reinhart and Ken Rogoff was never retracted, even though the mistake was acknowledged. More recently Francesca Gino and Dan Ariely were caught, essentially, fabricating data, and putting in

Read More »Pluralism & teaching in economics

August 22, 2024[embedded content]

My colleague and friend Geoff Schneider on teaching and pluralism in economics. He was the director of the Teaching & Learning Center at Bucknell, when I arrived here, and I learned quite a bit from him. At any rate, worth watching it.

Challenges and Perspectives of International Monetary Policy

August 19, 2024[embedded content] Carlos Pinkusfeld interviews Ramaa Vausdevan (Colorado State University) and Franklin Serrano (Federal University of Rio de Janeiro) to discuss the complex challenges of monetary policy in the international arena. Exploring issues such as financial globalization, the influence of large economies on the global monetary system, and the implications for developing countries, the experts offer important perspectives on the role of central banks and the effectiveness of monetary policies in the globalized economy. This is an essential debate for those who want to understand the direction of the world economy in a context of dynamic changes and growing uncertainty.

Read More »30 years of the Real Plan: Unoriginal Lessons from Latin American Stabilizations

August 4, 2024Original thoughts The 30 year anniversary of the stabilization plan that controlled high inflation in Brazil, the so-called Real Plan, just passed earlier in July. I wanted to write something about it, but it got buried with other things. Here just some very short reflections. There was a huge coverage in the media and several new books and papers written about it, including by several of the actual participants of the stabilization plan. If I have to leave one impression beyond the problems of all the mythology making, and the self-congratulatory mood of the whole thing, is that most of the analysts, including the economists that designed the plan, unlearned what they knew back then. People start defending some ideas because they are convenient, and next thing they end up believing

Read More »Sharing Central Banks’ costs and profits of monetary policy in the euro area

August 3, 2024By Sergio CesarattoA debate has developed in Europe (on Vox.eu and elsewhere) on the fiscal costs related to the interest payments that central banks in the eurozone are bestowing on commercial banks, a result of the way monetary policy is currently conducted. The implementation of monetary policy currently revolves around the ECB’s direct control of the interest rate paid on an abundant excess of bank reserves (relative to mandatory reserve requirements) (see Cesaratto 2020, chapter 7). This excess is the result of past quantitative easing (QE) operations whereby the eurozone’s national central banks (NCBs) bought government and corporate bonds by issuing reserves (liquidity). At the ECB’s current target rate of 3.75 per cent, banks are collecting considerable sums, more than 118 billion

Read More »Very brief comments on Venezuela

July 31, 2024The election in Venezuela is always contentious. I’ve written quite a bit about it over the years (see everything here; on the previous presidential election see here). Some have decided already that is a fraud, and sustain that the previous ones were also, although that is far from clear, and most likely Maduro (let alone Chávez did win all the previous elections). This time around things are less clear. First of all, the opposition seemed more unified, even with the disqualification of Maria Corina Machado, a mistake by Maduro, both from a general preoccupation with democracy, and also, because the actual opposition candidate, Edmundo González Urrutia, might have been more effective.In my view, the only way to know what happened one would have to check the data, and that is still not

Read More »Argentina on the verge

July 25, 2024The big question in the case of Argentina, as always is when it will explode. If the current developments are an indicator of anything, it should be sooner rather than later. Note that the fundamental problems regarding the possible crisis and default are associated to the external debt in dollars (one has to repeat this all the time). It does not mean that there weren’t other problems with the Argentine economy, but the domestic issues do NOT lead to a default (yes, that means the fiscal problems).In spite of all the criticism of the Fernández government, and some of that is certainly correct (but not the fact that they didn’t do fiscal adjustment or not enough industrial policy; it’s the reserves idiot!), the increase in debt happened all during the Macri administration (2015-2019).

Read More »A bad day for whom? The Left for one

July 22, 2024I blink, you lose! Will Rogers supposedly said that he was not a member of any organized political party. He completed that noting he was a Democrat. That feeling is alive and well among Dems. The confusion caused by Biden’s withdrawal seems to have led to many peculiar views among pundits and public intellectuals. Two typical reactions are the ones that are certain that Biden would have lost, and now with Kamala the election is in the bag, and the ones that suggest that the lefties in the party were wrong in supporting Biden. It’s true that Biden was trailing in the polls, but it is unclear that he had already lost (although the chances were high), and even less that Harris will win for sure. I hope she does, to be clear, given the alternative.But it seems only reasonable to assume that

Read More »Development Finance, External Constraints and Effective Demand in Maria da Conceição Tavares’ Thought

July 19, 2024Xxx A panel about Maria da Conceição Tavares with talks by three of her disciples and students, Ricardo Bielschowsky, Carlos Medeiros and Franklin Serrano.

Read More »Podcast with about the never ending crisis in Argentina

July 1, 2024[embedded content]

Podcast with about the never ending crisis in Argentina with Fabián Amico, and myself and interview by Carlos Pinkusfeld Bastos and Caio Bellandi from the Lado B do Rio Revista, and sponsored by the Centro Celso Furtado (Carlos is the director). In Portuguese (but fine if you speak Spanish or at least Portuñol).

Trumponomics vs. Bidenomics: The good, the bad and the stupid

June 27, 2024The debate between Biden and Trump is on everybody’s mind. And for good reason, the future of the global economy, and the well being of the planet are always at stake in American elections. I, of course, will restrict my brief comments here to the economy, and what the alternatives might entail. But the analysis of the impacts of both programs, if one can talk of programs per se, is very poor, to say the least.Broadly speaking there has been increasing agreement on a tougher policy with respect to China, what Jake Sullivan referred to as a New Washington Consensus. Many see this as a revival of industrial policy. This is of course suggests some continuity with the Trump policies, even though I would suggest that only with Biden there was a clear plan to re-shore manufacturing jobs,

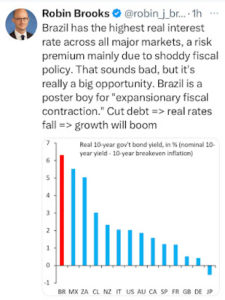

Read More »Brief note on public debt and interest rates in Brazil

June 26, 2024Robin Brooks, previously the chief economist at from the Institute of International Finance (IFF), and now at Brookings, suggests Brazil needs austerity, and, here is the punch line, that would promote growth (laugh track here).The notion that it is the fiscal balances that determine the interest rate on public debt, and that fiscal deficits and high debt must imply high interest rates has no correlation with reality. Imagine the rate of interest that Japan would have if that was correct. In the case of Brazil the higher interest rates are entirely associated to Central Bank decisions.In fact, if one looks at the correlation between interest rate and the size of public debt as a share of GDP, the correlation is weak, statistically insignificant, and negative. That is, higher debt is

Read More »

-300x208.png)

-300x208.png)