– by New Deal democrat The news about initial and continuing jobless claims was almost all good this week. Initial claims declined -2,000 to 231,000, and the four-week moving average declined -4,750 to 231,500, the lowest since early June. Continuing claims increased by 13,000 to 1.868 million: As usual, more important for forecasting purposes are the YoY% changes. In that regard, initial claims were down -1.3%, and the four-week moving average down -5.6%. While continuing claims remained higher by 2.7%, this is the lowest YoY% increase in 18 months: All of these forecasts continued economic growth. Additionally, the hypothesis that the increase in late spring and early summer was due to unresolved post-pandemic seasonality appears

Topics:

NewDealdemocrat considers the following as important: jobless claims, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

The news about initial and continuing jobless claims was almost all good this week.

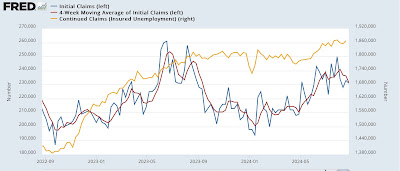

Initial claims declined -2,000 to 231,000, and the four-week moving average declined -4,750 to 231,500, the lowest since early June. Continuing claims increased by 13,000 to 1.868 million:

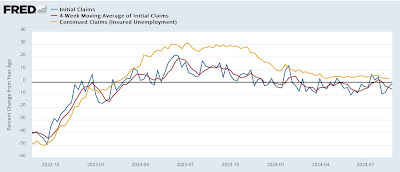

As usual, more important for forecasting purposes are the YoY% changes. In that regard, initial claims were down -1.3%, and the four-week moving average down -5.6%. While continuing claims remained higher by 2.7%, this is the lowest YoY% increase in 18 months:

All of these forecasts continued economic growth. Additionally, the hypothesis that the increase in late spring and early summer was due to unresolved post-pandemic seasonality appears firmly confirmed as is the fact that the temporary increase to 250,000 in late July was due to Hurricane Beryl’s affect on Texas claims. I won’t bother with the graph, but initial claims in Texas have returned to normal levels. The only negative in this entire report is that continuing claims in Texas remain elevated by about 20,000 YoY, or 14.5%.

That continuing claims in Texas remain elevated is likely to show up in next week’s employment report, as to which here is the latest updated forecast:

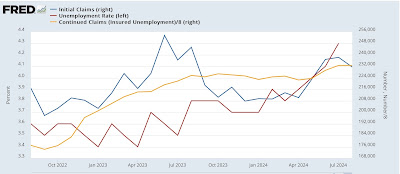

On a monthly basis, initial claims have continuously remained lower than they were a year ago. For almost all of the past 60 years, this would reliably forecast that the unemployment rate would not rise higher than it was last autumn, i.e., roughly 3.8%. It is almost certain that the additional increase in the unemployment rate is related to diminished employment prospects for recently arrived immigrants. Because of the continued Beryl effect in Texas, the increase in continuing claims there is likely to be reflected in an increase in the number of total unemployed in the August jobs report next week.

Finally, in review of the near new record highs in the stock market this week, here is my updated “quick and dirty” short leading forecast for the economy, which relies upon stock prices and jobless claims (YoY, inverted in the graph below):

The quick and dirty model indicates not a hint of recession.

“Jobless claims still a positive, even with some lingering Hurricane Beryl after-effects in Texas,” Angry Bear by New Deal democrat