One of the biggest issues in the US is who lives in poverty and how it is determined. People get upset when there are people living on food stamps. Unfortunately, many of us do not know how the government does determine poverty. I am hoping this may explain it somewhat. This report is providing estimates of two measures of poverty: the Official Poverty measure and the more recent Supplemental Poverty Measure (SPM). Used since the 1960s, the Official Poverty measure defines poverty by comparing pretax money income to a national poverty threshold adjusted by family composition. The Supplemental Poverty Measure (SPM) was first released in 2011 and is produced in collaboration with the Bureau of Labor Statistics (BLS). The SPM extends the

Topics:

Bill Haskell considers the following as important: census, Poverty, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

One of the biggest issues in the US is who lives in poverty and how it is determined. People get upset when there are people living on food stamps. Unfortunately, many of us do not know how the government does determine poverty. I am hoping this may explain it somewhat.

This report is providing estimates of two measures of poverty: the Official Poverty measure and the more recent Supplemental Poverty Measure (SPM).

Used since the 1960s, the Official Poverty measure defines poverty by comparing pretax money income to a national poverty threshold adjusted by family composition.

The Supplemental Poverty Measure (SPM) was first released in 2011 and is produced in collaboration with the Bureau of Labor Statistics (BLS). The SPM extends the Official Poverty measure by accounting for several government programs that are designed to assist low-income families but are not included in Official Poverty measure calculations.

The SPM also accounts for geographic variation in housing expenses when calculating poverty thresholds and includes federal and state taxes, work expenses, and medical expenses.

This report presents estimates using the official poverty measure and the SPM for calendar year 2023. The estimates contained in the report are based on information collected in the 2024 and earlier Current Population Survey Annual Social and Economic Supplements (CPS ASEC) conducted by the Census Bureau.

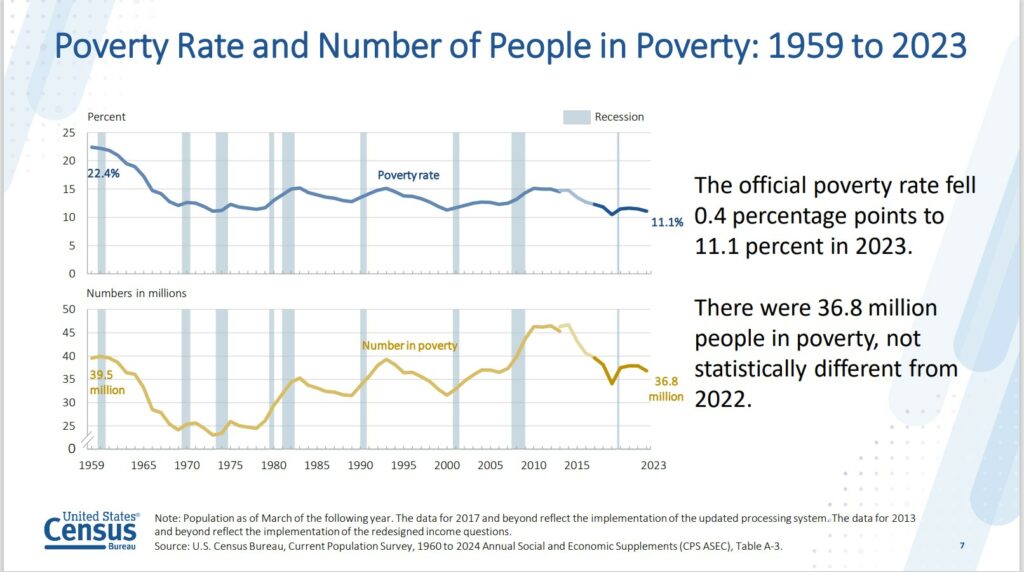

Figure 1 (above): In 2023, the Official Poverty rate fell 0.4 percentage points to 11.1 percent. There were 36.8 million people in poverty in 2023 which was not statistically different from 2022 (Figure 1 and Table A-1).

In 2023, the official poverty rate fell 0.4 percentage points to 11.1 percent. This was the first statistically significant change in the official poverty rate since 2020 (Figure 1 and Table A-1). There were 36.8 million people in poverty in 2023. This was not statistically different from 2022.

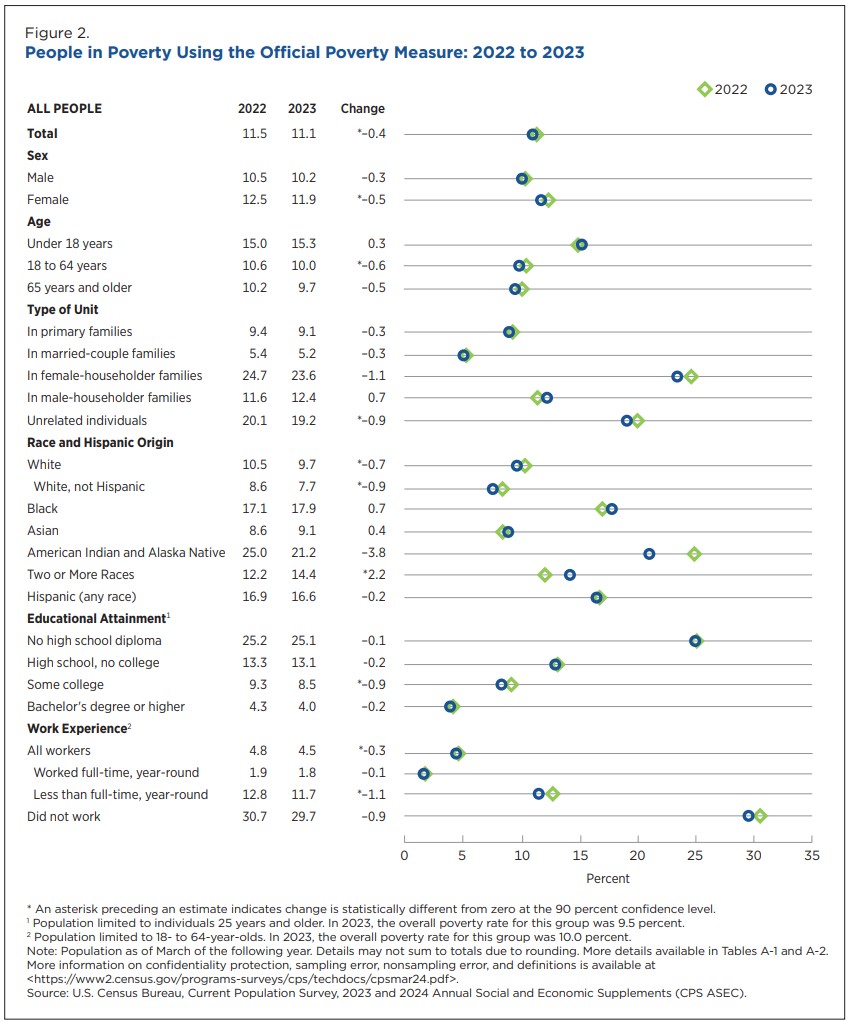

Of the demographic groups presented in Figure 2, only one group (individuals reporting Two or More Races) experienced an increase in poverty in 2023. The official poverty rates for the other demographic groups either decreased or were not statistically different from 2022. Other estimates for additional demographic and family groups in the report “Poverty in the United States: 2023” (census.gov) are available in Tables A-1 and A-2).

First, what is the “Supplemental Poverty Measure?” Best to explain what it does first. The SPM addresses numerous concerns of official-measure critics. Its intent is to provide an improved statistical picture of poverty. The SPM income or resource measure is cash income plus in-kind government benefits (such as food stamps and housing subsidies). This is minus nondiscretionary expenses (taxes, MOOP expenses, and work expenses).

The SPM thresholds are based on a broad measure of necessary expenditures such as food, clothing, shelter, and utilities (FCSU) which are based on recent and annually updated expenditure data. The SPM thresholds are adjusted for geographic differences in the cost of living. The SPM uses a broader unit of analysis that treats cohabiters and their relatives in a more satisfactory way.

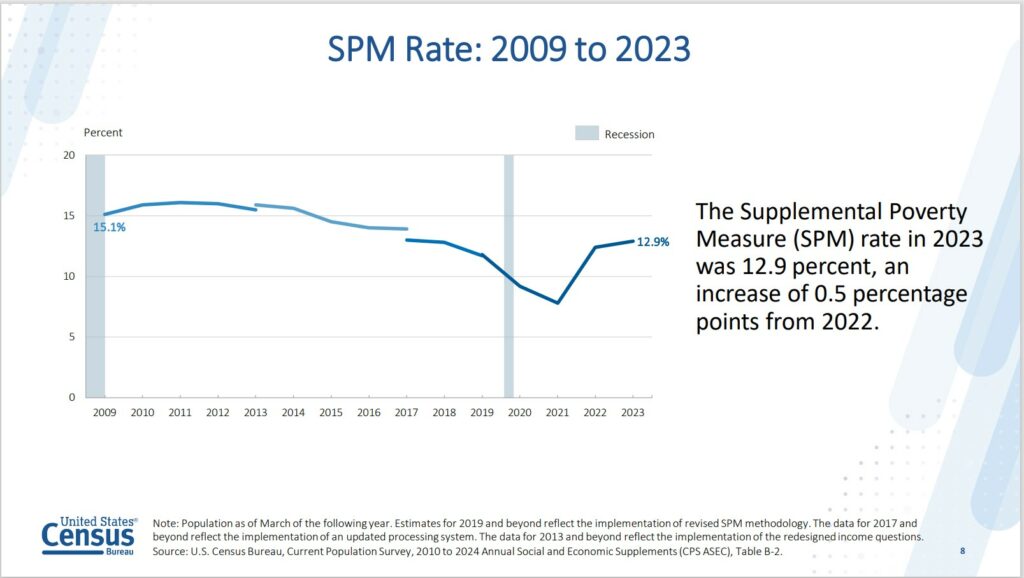

The SPM rate in 2023 was 12.9 percent, an increase of 0.5 percentage points from 2022 (Figure 4 and Table B-3).

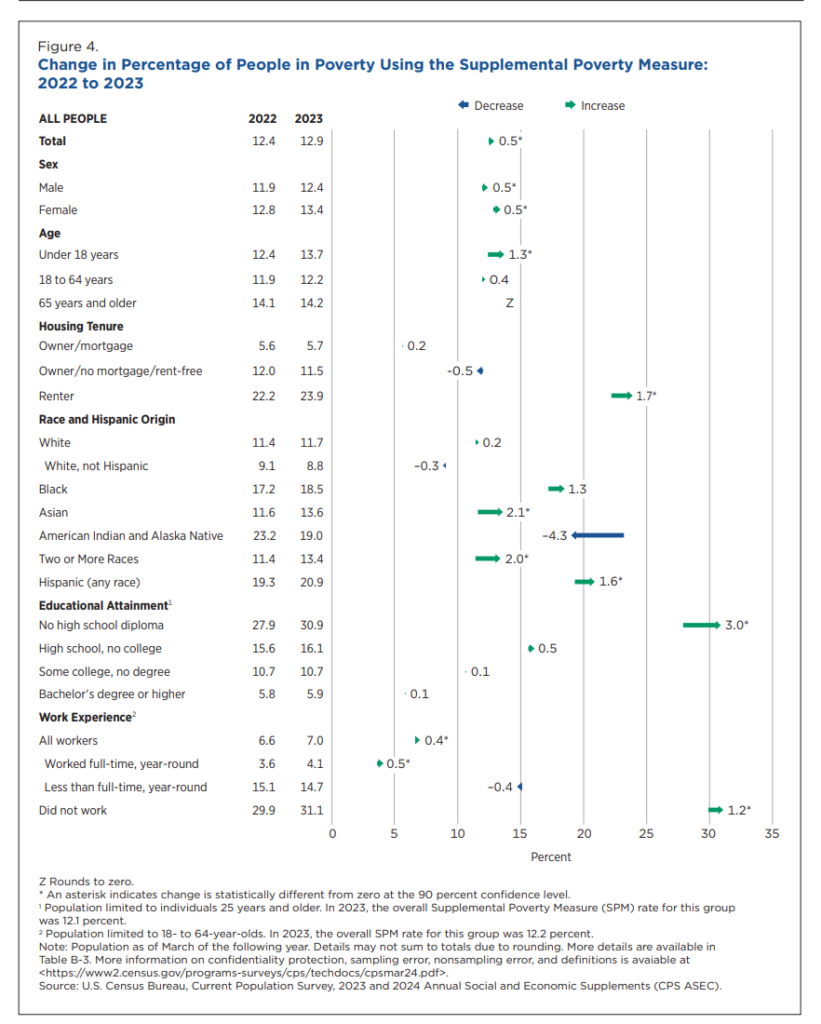

The SPM rate in 2023 was 12.9 percent, an increase of 0.5 percentage points from 2022 (Figure 4 and Table B-3). The SPM child poverty rate increased 1.3 percentage points to 13.7 percent in 2023. The SPM rates for 18- to 64-year-olds and people 65 years and older were not statistically different from 2022 (Figure 4 and Table B-3).

Summary

In 2023, the official poverty rate fell to 11.1 percent, down from 11.5 percent in 2022. This was the first statistically significant change in the official poverty rate since 2020. Of the demographic groups presented in this report, only those reporting Two or More Races had a higher poverty rate in 2023. Official poverty rates for the other demographic groups either decreased or were not statistically

different from 2022.

The SPM accounts for income and payroll taxes, tax credits, noncash benefits, and nondiscretionary expenses. It uses geographically adjusted poverty thresholds that are updated by BLS with recent information on food, clothing, shelter, utility, telephone, and internet expenditures. This results in a poverty measure that accounts for current standards of living as well as short term policy changes in response to current events that operate primarily as noncash benefits or through the tax system.

Together, the two measures provide useful information on the economic well-being (historic and current) that is particularly informative during periods of rapid change. In simple terms, together this report is more reactive to changes which allows government to react quickly (if such can ever be assumed) to those changes.

Poverty in the United States: 2023, census.gov

Income, Poverty and Health Insurance: 2023, census.gov

The Supplemental Poverty Measure (SPM) and Children: How and Why the SPM and Official Poverty Estimates Differ, ssa.gov