When this chart heads lower as it’s doing it’s all over: The chart is well below what in the past were recession levels, and still looking like it can go a lot lower: Highlights The small business optimism index rose 0.8 points in October to 94.9, slightly exceeding expectations and extending a rebound from the 2-year low at 92.6 set in April. Of the 10 components of the index, 5 posted gains, 3 were down and 2 remained unchanged. The largest gain was recorded in plans to increase inventories, which rose a strong 9 points from the September level to a net 2 percent. The net percent of owners considering stocks too low also rose by 3 points to a net negative 4 percent, reflecting stronger consumer spending in the third quarter. And the already tight labor market tightened further, with 28 percent of owners reporting jobs they could not fill, up 4 points from September. A net 25 percent of owners reported raising worker compensation, a 3 point increase from September. Capital outlays, a leading strength of the index recently and important for future growth, remained at a strong 27 percent, the second highest reading of the recovery. But after a 12-point jump in expectations of improvement in business conditions to 0 percent in September, small business owners revised their optimism back down in October, with the index falling 7 points to a net minus 7 percent.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

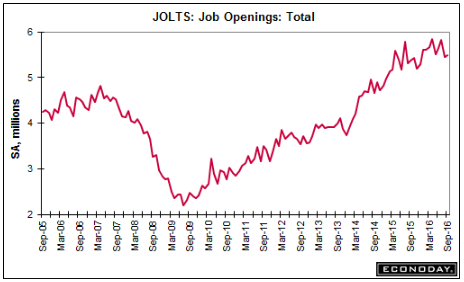

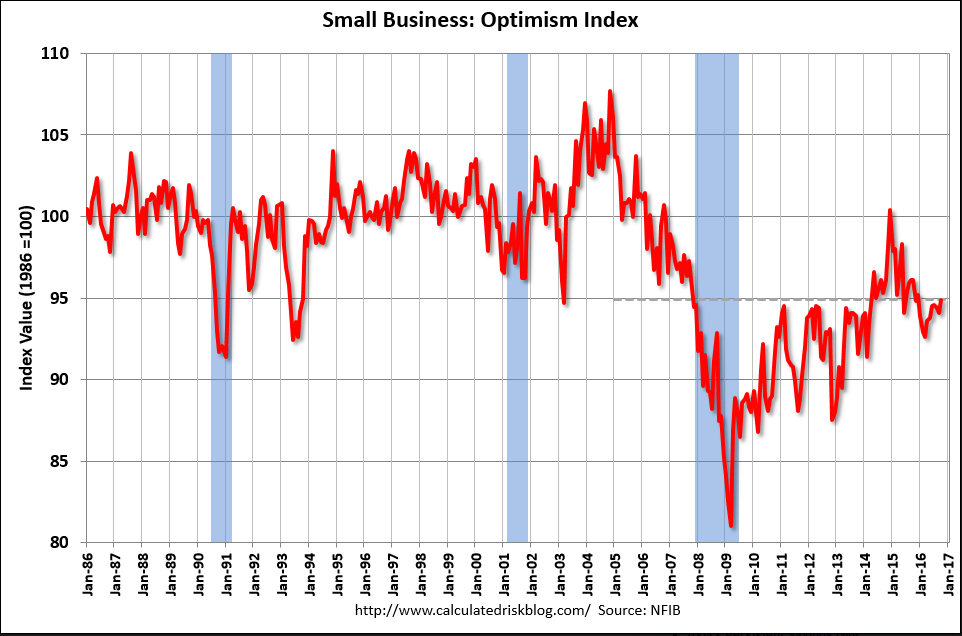

When this chart heads lower as it’s doing it’s all over:

The chart is well below what in the past were recession levels, and still looking like it can go a lot lower:

Highlights

The small business optimism index rose 0.8 points in October to 94.9, slightly exceeding expectations and extending a rebound from the 2-year low at 92.6 set in April. Of the 10 components of the index, 5 posted gains, 3 were down and 2 remained unchanged. The largest gain was recorded in plans to increase inventories, which rose a strong 9 points from the September level to a net 2 percent. The net percent of owners considering stocks too low also rose by 3 points to a net negative 4 percent, reflecting stronger consumer spending in the third quarter. And the already tight labor market tightened further, with 28 percent of owners reporting jobs they could not fill, up 4 points from September. A net 25 percent of owners reported raising worker compensation, a 3 point increase from September. Capital outlays, a leading strength of the index recently and important for future growth, remained at a strong 27 percent, the second highest reading of the recovery.

But after a 12-point jump in expectations of improvement in business conditions to 0 percent in September, small business owners revised their optimism back down in October, with the index falling 7 points to a net minus 7 percent. Expectations of future increases in sales dimmed by 3 points for a net negative 4 percent of owners. Despite this, a net 9 percent still thought that now was a good time to expand, up 2 points from the prior month. Earnings, however, continued as the biggest source of pessimism and the weakest component of the index, worsening by 1 point as a net negative 21 percent of owners reported an improvement in quarter on quarter profits.

Prices remained subdued, as a net 2 percent of owners reported raising prices, up 3 points from September, and a net 15 percent plan to hike prices, down 3 points.

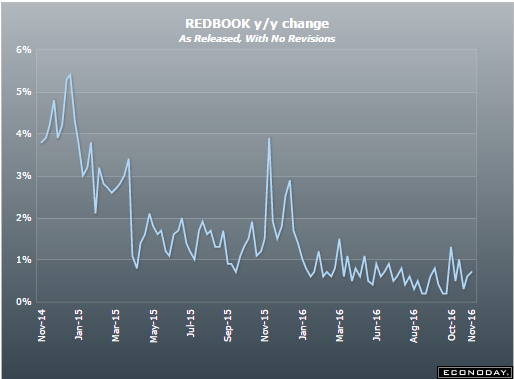

This measure of retail sales remains depressed, maybe because health care premiums have diverted retail consumption?