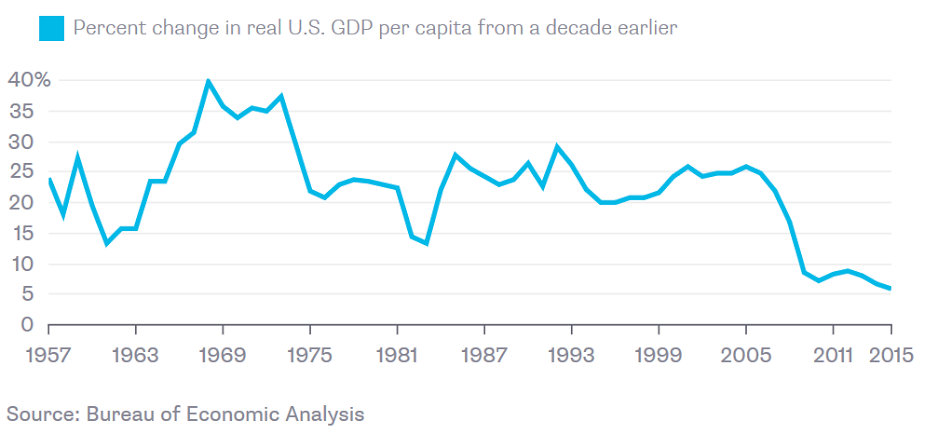

This line shows total GDP growth over the prior 10 years. It makes the point as to just how sudden the latest drop off was and how severe it continues to be. It’s just screaming ‘lack of aggregate demand’ begging a fiscal relaxation of maybe 5% of GDP annually for a while. Bottom line: It’s always an unspent income story. The 2008 financial crisis led to a sharp fall off in private sector deficit spending (credit expansion) that had been offsetting desires to not spend income, which I call ‘savings desires’. And it was in mid 2008, for example, that I proposed a full FICA suspension that would have allowed spending to continue, but from income rather than from debt. However, what happened instead was an attempt to restore private sector credit growth with a zero rate policy that was soon supplemented with quantitative easing, and to date has failed to restore output growth and employment. The Fed, however, believes the spark has been ignited and will likely move to ‘remove accommodation’ with a another small rate hike, even as all the indicators I can see continue to decelerate as previously posted and discussed. http://www.cnbc.com/2016/12/03/rent-prices-show-signs-of-calming-down-with-nyc-san-francisco-and-dc-sliding.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

This line shows total GDP growth over the prior 10 years. It makes the point as to just how sudden the latest drop off was and how severe it continues to be. It’s just screaming ‘lack of aggregate demand’ begging a fiscal relaxation of maybe 5% of GDP annually for a while.

Bottom line: It’s always an unspent income story.

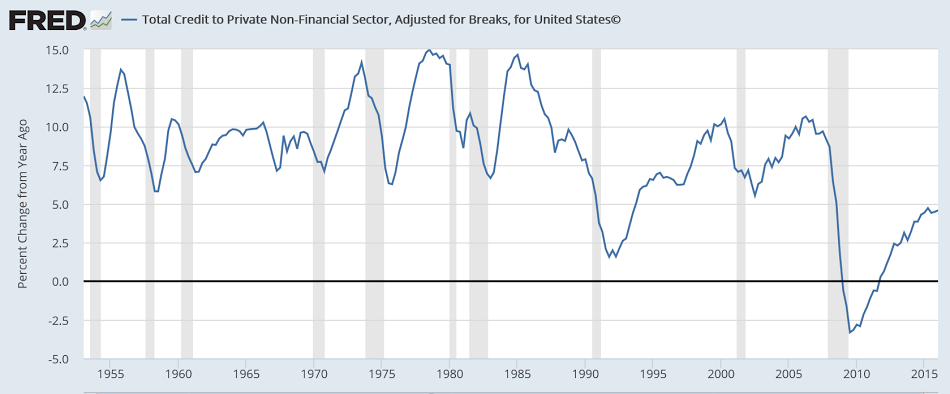

The 2008 financial crisis led to a sharp fall off in private sector deficit spending (credit expansion) that had been offsetting desires to not spend income, which I call ‘savings desires’. And it was in mid 2008, for example, that I proposed a full FICA suspension that would have allowed spending to continue, but from income rather than from debt. However, what happened instead was an attempt to restore private sector credit growth with a zero rate policy that was soon supplemented with quantitative easing, and to date has failed to restore output growth and employment.

The Fed, however, believes the spark has been ignited and will likely move to ‘remove accommodation’ with a another small rate hike, even as all the indicators I can see continue to decelerate as previously posted and discussed.

Frothy rental prices across the nation are showing signs of cooling, recent real estate data show, with the white hot markets of New York City and Washington D.C. offering modest relief to sticker-shocked renters.

In its recent survey of nationwide rent conditions, data from apartment rental site Zumper said that the most expensive markets in the nation saw either flat prices or outright declines—demonstrating evidence of a potential top.“Among the top ten most expensive rental markets, only one city, Seattle, saw median rent prices for one bedrooms rise this past month, up just a modest 0.5 percent,” Zumper wrote. “Several of these rental markets saw falling prices, including in New York and Boston, while both D.C. and Chicago saw even sharper declines of over three percent.”

Zumper’s National Rent Index showed that prices for a one bedroom apartment rose marginally, by 0.3 percent, across the nation. Yet the cost for a two bedroom unit fell slightly, but is still up more than 2 percent on average since 2015.

However, the data showed more worrisome declines at the micro level of certain cities. The Big Apple’s average rent remained relatively flat around $3000 per month for a one bedroom apartment, but showed the sharpest drop of any top 10 U.S. rental market, Zumper added. One bedroom prices are down by more than 7 percent since last year, while two bedrooms have swooned by nearly 8 percent.

Top five cities such as Boston, San Jose and Oakland—the latter two closely linked to Silicon Valley’s fortunes—also saw flat to falling prices, according to Zumper.

In the perpetually hot San Francisco area, rents have now fallen for five consecutive months, Zumper data showed. A one bedroom now costs about $3,330 on average, and $4,500 for a two bedroom. “Overall, one bedroom rents in San Francisco end the year down nearly 5 percent from where they were twelve months ago, as Bay Area renters are beginning to see a bit of relief after years of accelerating rent prices,” Zumper’s study said.

They set price and ‘insider trading’ is not illegal:

Saudi Arabia discussed oil output cut with traders ahead of Opec

Dec 4 (Financial Times) — Saudi Arabia convened private talks with the world’s largest oil traders in Vienna before Opec’s crunch meeting on whether to cut oil output, seeking views about the likely market reaction should they fail to clinch a deal, it has emerged.