Post election surveys may prove to be a bit ‘trumped up’, just saying… Highlights In another sign of strength for the economy, the ISM non-manufacturing index jumped 2.4 points in November to a 57.2 reading that tops Econoday’s high-end forecast. Employment for ISM’s sample, where growth was soft in October, shot more than 5 points higher to an outsized 58.2. Averaging recent scores for this reading puts the trend at a softer but still very respectable mid-50s rate. New orders are very strong, at 57.0, with export orders also at 57.0 in a reminder of the importance of foreign demand for the nation’s service sector. Business activity is a highlight of November’s report at 6l.7. Based on this report as well as the services PMI released earlier this morning, the great bulk of the economy has posted strong numbers through the first two thirds of the fourth-quarter, indications that support a rate hike at next week’s FOMC meeting.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Post election surveys may prove to be a bit ‘trumped up’, just saying…

Highlights

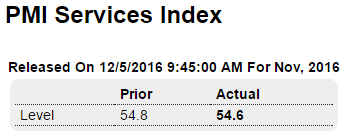

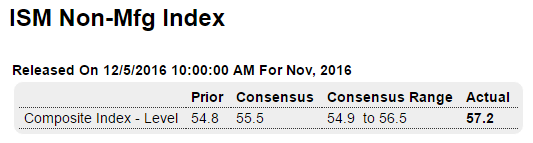

In another sign of strength for the economy, the ISM non-manufacturing index jumped 2.4 points in November to a 57.2 reading that tops Econoday’s high-end forecast. Employment for ISM’s sample, where growth was soft in October, shot more than 5 points higher to an outsized 58.2. Averaging recent scores for this reading puts the trend at a softer but still very respectable mid-50s rate. New orders are very strong, at 57.0, with export orders also at 57.0 in a reminder of the importance of foreign demand for the nation’s service sector. Business activity is a highlight of November’s report at 6l.7.

Based on this report as well as the services PMI released earlier this morning, the great bulk of the economy has posted strong numbers through the first two thirds of the fourth-quarter, indications that support a rate hike at next week’s FOMC meeting.

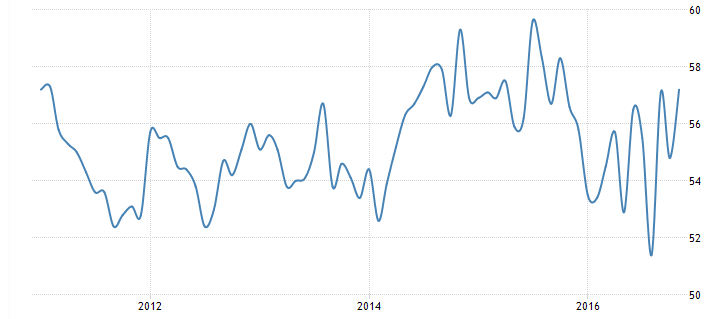

This is the PMI composite PMI which includes both manufacturing and services:

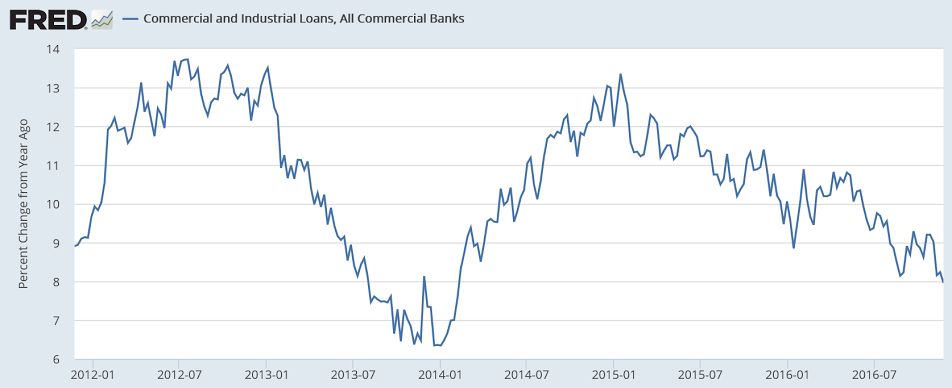

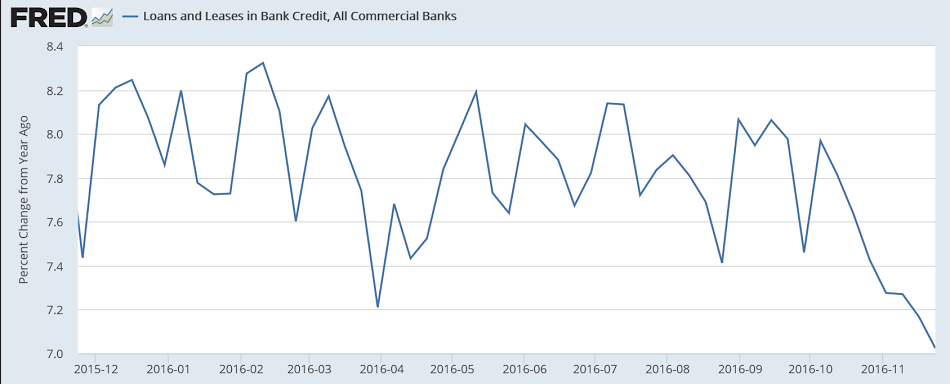

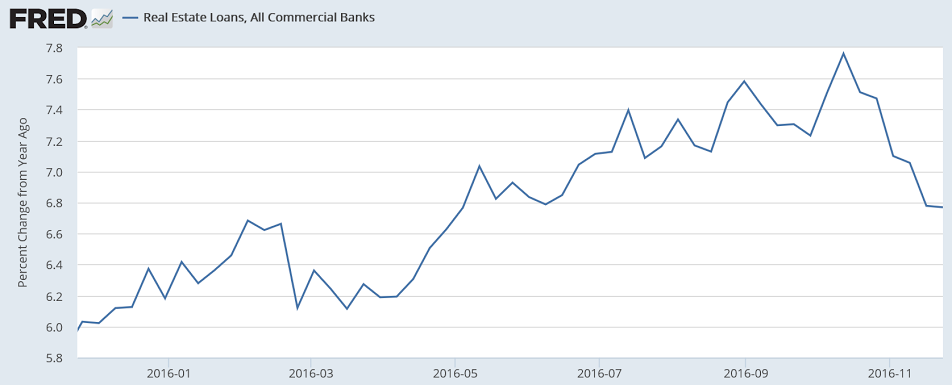

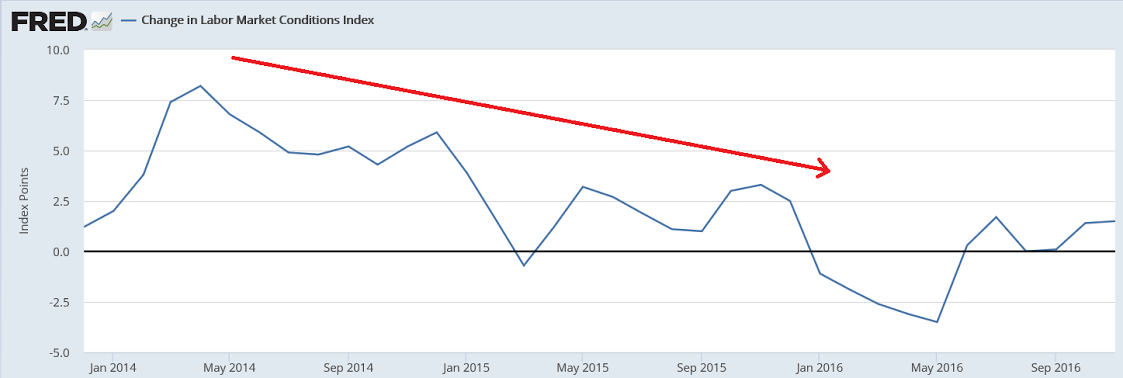

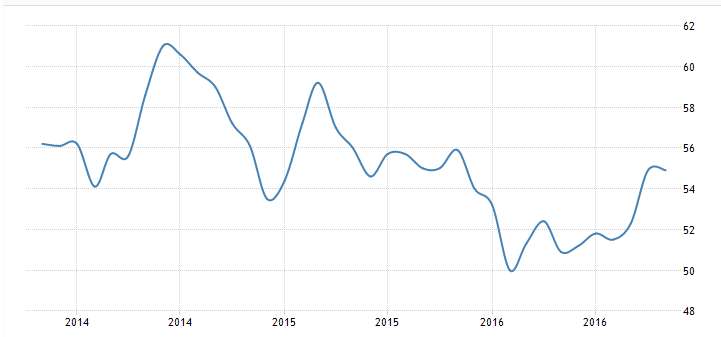

Deceleration continues: