And without the undesired inventory build due to lower sales, it would have only been up .9% for q4, and .25% lower year over year. Personal Consumption (which includes health insurance premiums) has gone from +q2;s 4.3 to q3’s +3.0 to q4’s +2.5 and we’ve kicked off the new year with a big drop in vehicle sales and a big drop in housing starts, etc: Highlights A perhaps unwanted build in inventories drove up fourth-quarter GDP which, however, could only manage 1.9 percent annualized growth. Inventories added 1 percentage point to the quarter in a build that will have to worked off given weakness in final demand which rose only 0.9 percent and down from 3.0 percent in the third quarter. A positive is personal consumption expenditures which rose at a 2.5 percent pace. Though this is down from 3.0 and 4.3 percent in the prior quarters, it’s still a respectable result that underscores the consumer’s support of the economy. Durable spending showed the most consumer strength in the quarter reflecting strong auto sales. Other positives include strength in residential investment, at a very strong plus 10.2 percent rate, and an unspectacular but very welcome increase in business investment at 2.4 percent for the third gain in a row. A one-time negative in the report is an outsized pull lower from net exports, which subtracted 1.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

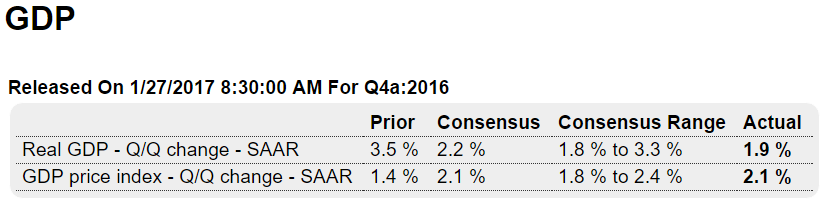

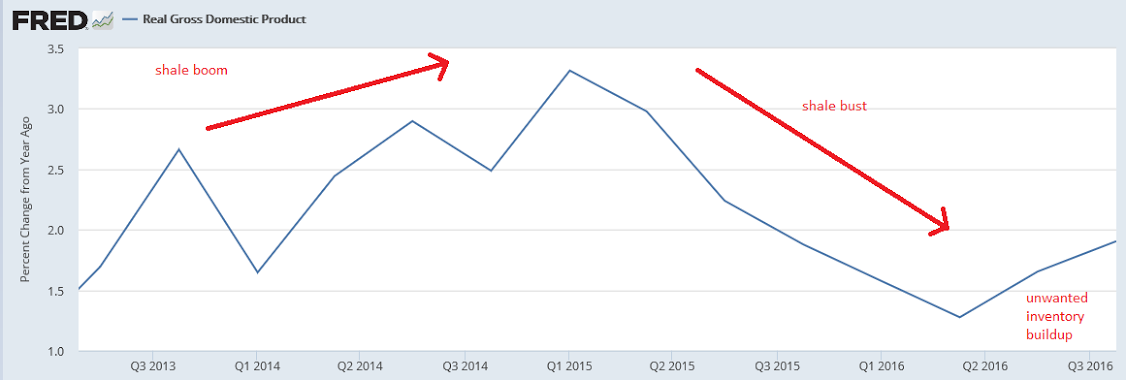

And without the undesired inventory build due to lower sales, it would have only been up .9% for q4, and .25% lower year over year. Personal Consumption (which includes health insurance premiums) has gone from +q2;s 4.3 to q3’s +3.0 to q4’s +2.5 and we’ve kicked off the new year with a big drop in vehicle sales and a big drop in housing starts, etc:

Highlights

A perhaps unwanted build in inventories drove up fourth-quarter GDP which, however, could only manage 1.9 percent annualized growth. Inventories added 1 percentage point to the quarter in a build that will have to worked off given weakness in final demand which rose only 0.9 percent and down from 3.0 percent in the third quarter.

A positive is personal consumption expenditures which rose at a 2.5 percent pace. Though this is down from 3.0 and 4.3 percent in the prior quarters, it’s still a respectable result that underscores the consumer’s support of the economy. Durable spending showed the most consumer strength in the quarter reflecting strong auto sales.

Other positives include strength in residential investment, at a very strong plus 10.2 percent rate, and an unspectacular but very welcome increase in business investment at 2.4 percent for the third gain in a row.

A one-time negative in the report is an outsized pull lower from net exports, which subtracted 1.7 percentage points from the quarter but reflect unusually strong soybean exports in the third quarter.

Heavy inventories will work to pull back production and employment in the ongoing quarter. But the wildcard is still the consumer who, benefiting from a strong jobs market and strong confidence, can still give the first quarter a lift.

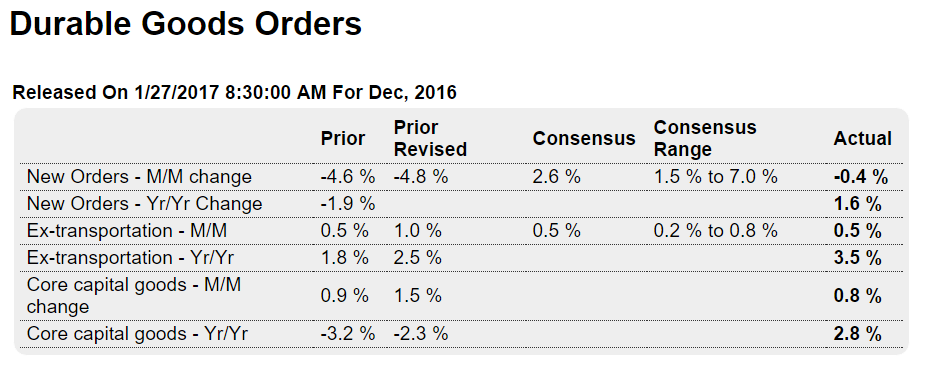

Yes another weak December (post election) release. As previously discussed, however, I expect manufacturing to muddle through with 2-3% growth with weakness in the service sector::

Highlights

Civilian aircraft is the usual culprit behind volatility in the durable goods report but not in December, as defense aircraft makes a second straight appearance. A 64 percent downswing in orders for defense aircraft reversed a similar upswing in November and pulled down total durable goods to a much lower-than-expected 0.4 percent decline in December. But when excluding transportation equipment, orders actually hit the consensus at plus 0.5 percent.

The strength in the report is centered in capital goods where core orders (nondefense ex-aircraft) posted a strong 0.8 percent gain with November’s increase revised 6 tenths higher to 1.5 percent. These gains underscore the increase in the business investment component in this morning’s fourth-quarter GDP report and point to momentum for this closely watched area going into the first quarter.

A significant negative in the report is a 0.6 percent decline in unfilled orders which continue to shrink. Lack of work to do is a negative for employment. Total shipments were strong in December at 1.4 percent with core capital goods also strong at 1.0 percent.

Hard data in sum on the factory sector have not been favorable showing a fizzle, not a burst, at year end. But there are solid hints of strength ahead in this report as well as in regional manufacturing reports which have been on the rise.

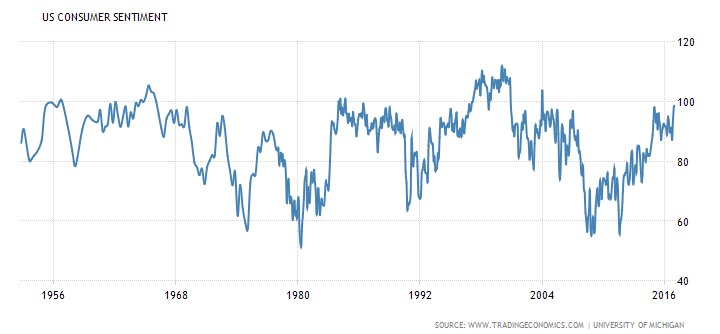

Consumer sentiment remains Trumped up:

Sales and price softening: Luxury home sales continued to slump in the fourth quarter

The worst things you’ll read about Trump come from his own aides

Trump’s own aides seem to dislike him as much Democrats do

In most administrations, senior White House aides save the most embarrassing stories about the presidents they served for their memoirs. That’s not the case with Trump, whose top aides are already giving reporters reams of damaging information about him.

It’s not entirely clear what those aides hope to gain by painting their boss as a conspiracy-minded, easily distracted, TV-obsessed bully prone to paranoia, feelings of inadequacy, and flashes of blind, irrational anger.

Trump pressured Park Service to back his inauguration crowd claims: Report

Trump personally ordered acting NPS director Michael T. Reynolds to produce additional photographs of the crowds on the Mall, according to three individuals with knowledge of the conversation, the report said. The report said the additional photos were secured, but they didn’t support Trump’s assertion, without evidence, that the crowd was larger than the initial photos indicated.

The president also vented anger that the agency used its Twitter account to send side-by-side photos comparing the larger crowd at former President Barack Obama’s 2009 inauguration and Friday’s swearing in, the report said.

And it’s not that he’s acting like a child, it’s that, mentally, seems to me that he actually is a child. Some kind of arrested development, maybe. So laughing at him and ridiculing him is like laughing at the participants in the Special Olympics, for example.