Down again, and these are seasonally adjusted: Highlights Purchase applications for home mortgages fell a seasonally adjusted 3 percent in the February 17 week, while refinancing applications decreased by 1 percent to the lowest level since January. Unadjusted, the purchase index rose 2 percent from the prior week and was up 10 percent from the year ago week, which included the President’s Day holiday. The refinancing share of mortgage activity continued to decline and was down 0.7 percentage points to 46.2 percent, the lowest level since November 2008. The average interest rate on 30-year fixed rate conforming mortgages (4,000 or less) rose 4 basis points to 4.36 percent. The second weekly decline in a row for purchase applications could be signalling that home buyers are not as immune to the impact of higher rates as previous data during the post-election rise in mortgage rates indicated. There was a ratcheting back a few years ago followed by slower growth.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

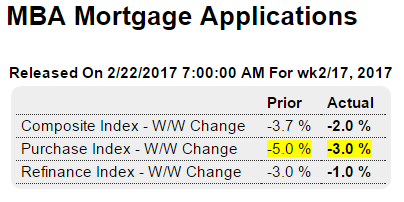

Down again, and these are seasonally adjusted:

Highlights

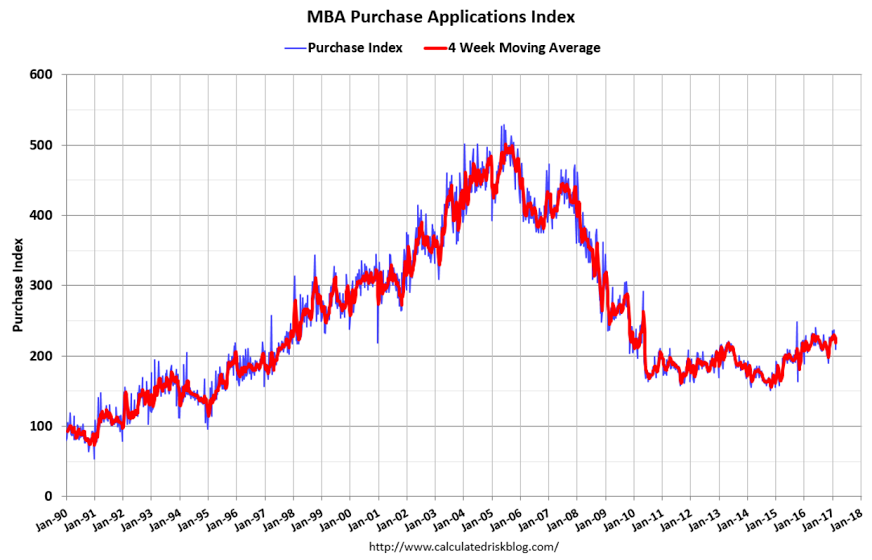

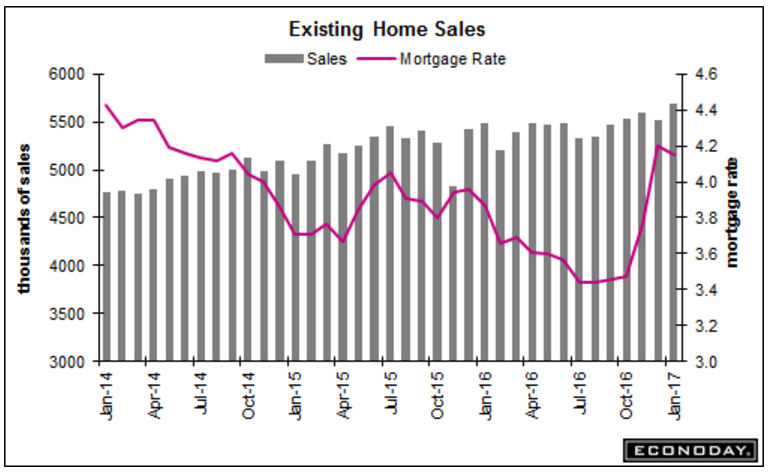

Purchase applications for home mortgages fell a seasonally adjusted 3 percent in the February 17 week, while refinancing applications decreased by 1 percent to the lowest level since January. Unadjusted, the purchase index rose 2 percent from the prior week and was up 10 percent from the year ago week, which included the President’s Day holiday. The refinancing share of mortgage activity continued to decline and was down 0.7 percentage points to 46.2 percent, the lowest level since November 2008. The average interest rate on 30-year fixed rate conforming mortgages ($424,000 or less) rose 4 basis points to 4.36 percent. The second weekly decline in a row for purchase applications could be signalling that home buyers are not as immune to the impact of higher rates as previous data during the post-election rise in mortgage rates indicated.

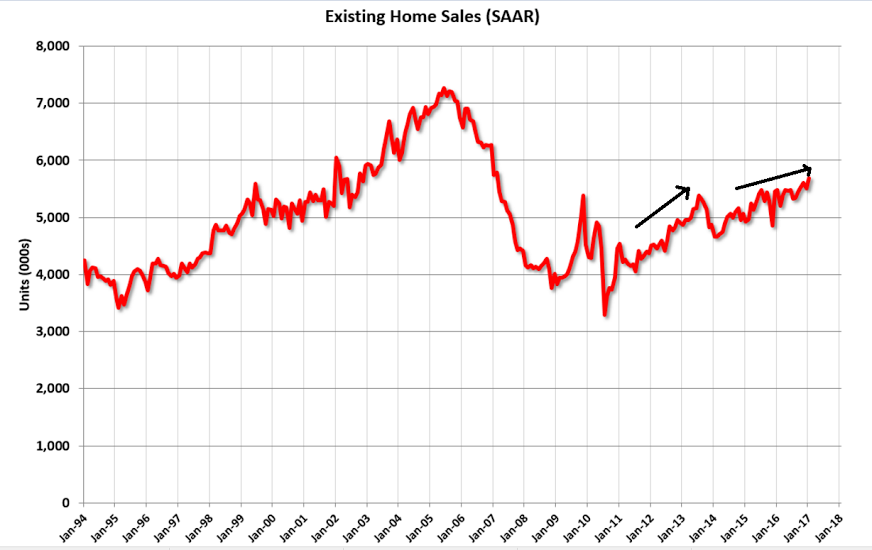

There was a ratcheting back a few years ago followed by slower growth. I now wonder if we’ve got another setback in the works:

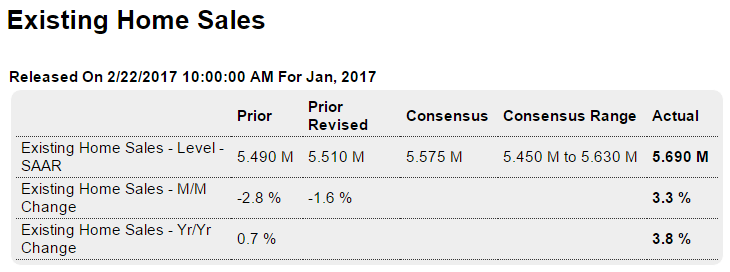

And this is not population adjusted:

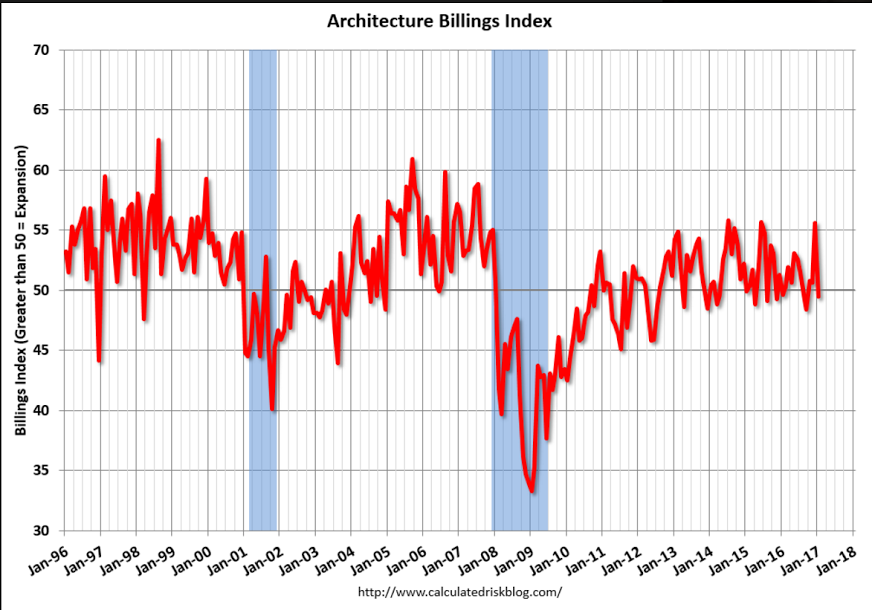

Dip into negative territory: