Same story, expectations trumped up but actual numbers not so good: Bad: Highlights Just when existing home sales seemed to be showing lift the pending home sales index, which tracks initial contract signings, is down 2.8 percent in the January report. This points to weakness for final resales in February and March. The West is the culprit in January’s data, with contract signings down 9.8 percent in the month for year-on-year contraction of 0.4 percent. The Midwest is also weak, down 5.0 percent in the month for 3.8 percent on-year contraction. The South and the West both show no better than low single digit monthly and yearly gains. Adding to the bad news is a sharp downward revision to the December index, now at plus 0.8 percent vs an initial 1.6 percent. This hints at less strength for February existing home sales, sales that proved strong in last week’s January report which however is now a memory. This setback for resales follows last week’s sharp downward revision for December new home sales and together they point to a housing sector where growth is suddenly struggling. Bad: Highlights Throw out the all the advance indications that show unusual acceleration in the factory sector, because the meat of the January durable goods report only shows the usual volatility behind which are sagging numbers for key readings.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Same story, expectations trumped up but actual numbers not so good:

Bad:

Highlights

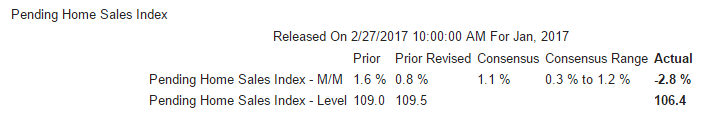

Just when existing home sales seemed to be showing lift the pending home sales index, which tracks initial contract signings, is down 2.8 percent in the January report. This points to weakness for final resales in February and March.

The West is the culprit in January’s data, with contract signings down 9.8 percent in the month for year-on-year contraction of 0.4 percent. The Midwest is also weak, down 5.0 percent in the month for 3.8 percent on-year contraction. The South and the West both show no better than low single digit monthly and yearly gains.

Adding to the bad news is a sharp downward revision to the December index, now at plus 0.8 percent vs an initial 1.6 percent. This hints at less strength for February existing home sales, sales that proved strong in last week’s January report which however is now a memory. This setback for resales follows last week’s sharp downward revision for December new home sales and together they point to a housing sector where growth is suddenly struggling.

Bad:

Highlights

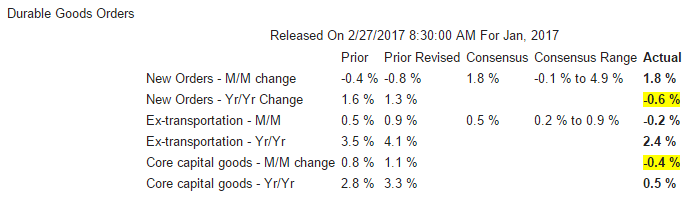

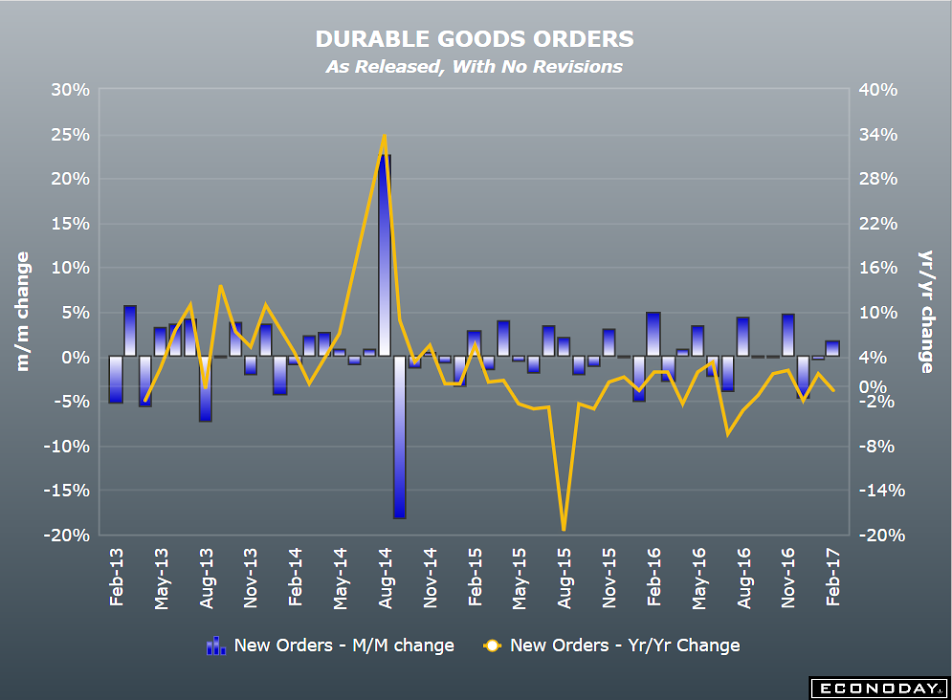

Throw out the all the advance indications that show unusual acceleration in the factory sector, because the meat of the January durable goods report only shows the usual volatility behind which are sagging numbers for key readings. Aircraft, both domestic and defense, skewed durable goods orders sharply higher in January, up 1.8 percent to hit the Econoday consensus. Not hitting the Econoday consensus, however, are orders that exclude aircraft as well as all other transportation equipment. This reading fell 0.2 percent to come in well below Econoday’s low estimate for a 0.2 percent gain.

The worst news in the report is a 0.4 percent decline in orders for core capital goods (nondefense ex-aircraft). This ends 3 months of strength for this reading and pulls the rug out from expectations for a first-quarter business investment boom as indicated by business confidence readings.

Pulling the rug out from the whole factory outlook is yet another contraction for unfilled orders, down 0.4 percent and which have now fallen in 7 of the last 8 months. This is the deepest contraction since the recession and points squarely at lack of hiring for the factory sector. In other data, shipments are down 0.1 percent and inventories are unchanged to keep the inventory-to-shipments ratio unchanged at 1.61.

But aircraft is a big positive in this report though monthly gains are not likely to extend far, if at all. Upward revisions to December are a plus for fourth-quarter revisions while another positive is a 0.2 percent January gain for motor vehicles where the outlook however, given the strength of prior sales gains, is uncertain and will pivot on Wednesday’s release of February unit retail sales. Weak exports have been the Achilles heel of the factory sector and today’s report points to continued lack of demand for U.S. factory goods. Watch for advance data on goods exports in tomorrow’s trade report for January.

Ok, but check out the highlights:

Highlights

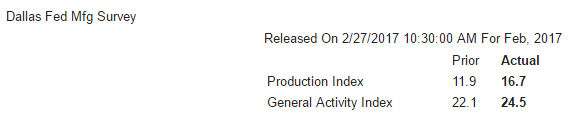

Yet another advance report, in yet another contrast with definitive data, is showing significant strength. Readings are very positive in the Dallas Fed February report including a nearly 5 point gain in production to a very strong 16.7 and a nearly 2-1/2 point gain for general activity to 24.5.

New orders, however, slowed by just more than 4 points to what is a still solid 11.6. Delivery times are taking longer and inventories of inputs are higher, both positive indications of demand. Input costs are up with wage growth solid. Selling prices are even showing traction.

This report may be getting a general lift from easy comparisons as the Dallas factory region is just emerging from 2 years of energy-related weakness. But the wider risk for anecdotal surveys like this one is that, in their low key methodology where respondents often offer general, not numerical, answers to questions, they are picking up improvement in sentiment as opposed to actual measurable improvement in dollars or volumes.

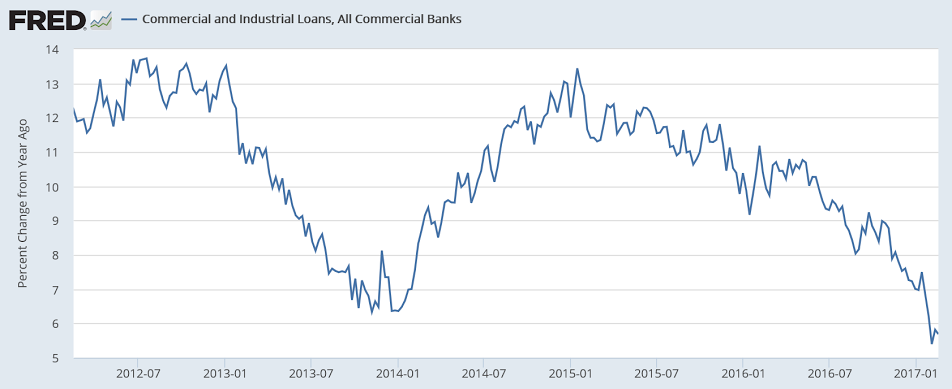

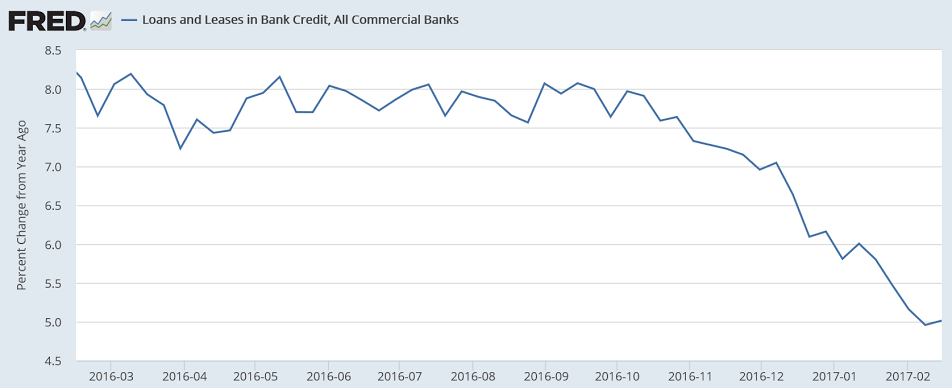

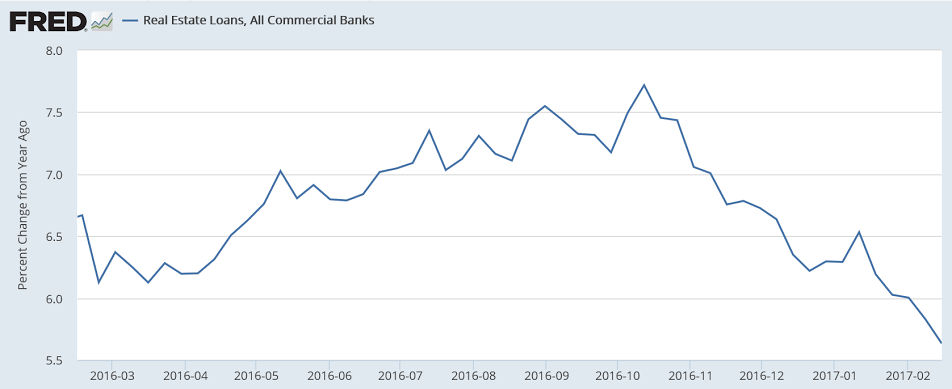

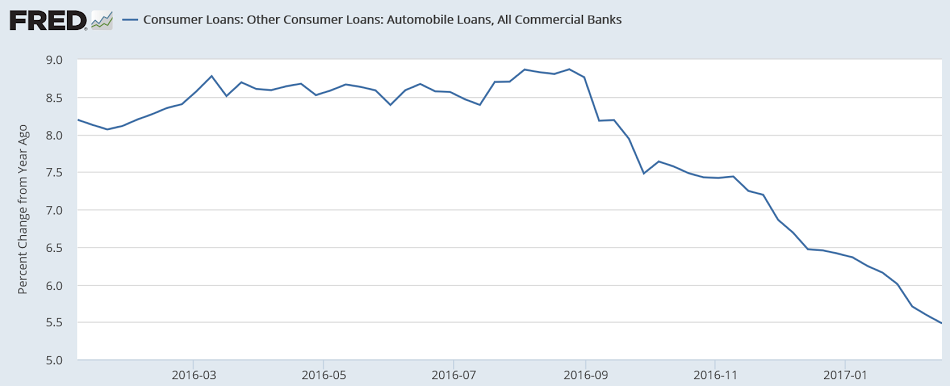

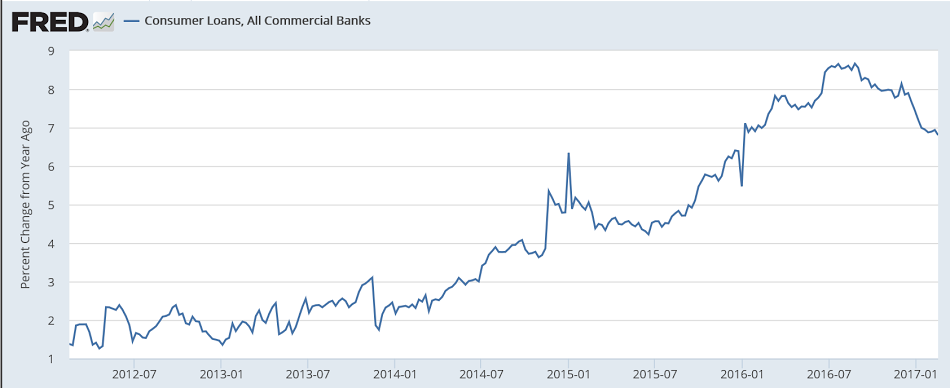

Still in deceleration mode:

Who would’ve thought ‘monetary policy’ doesn’t work (anywhere):

The World’s Most Radical Experiment in Monetary Policy Isn’t Working

Feb 26 (WSJ) — Japan is nearly four years into a Central Bank stimulus effort involving printing trillions of yen and guiding interest rates into negative territory. Bank of Japan governor Haruhiko Kuroda’s shock-and-awe stimulus, launched in April 2013, fizzled after a short-lived spurt of growth and rising prices. Japan fell back into deflation last year. In November, Mr. Kuroda postponed his goal of reaching 2% inflation. He said in a series of speeches last year that an entrenched “deflationary mind-set” stifled hope that wages or prices will rise, limiting the impact of monetary policies such as negative rates.