From Lars Syll Paul Krugman has repeatedly over the years argued that we should continue to use neoclassical hobby horses like IS-LM and AS-AD models. Here’s one example: So why do AS-AD? … We do want, somewhere along the way, to get across the notion of the self-correcting economy, the notion that in the long run, we may all be dead, but that we also have a tendency to return to full employment via price flexibility. Or to put it differently, you do want somehow to make clear the notion (which even fairly Keynesian guys like me share) that money is neutral in the long run. I seriously doubt that Keynes would have been impressed by having his theory being characterized with catchwords like “tendency to return to full employment” and “money is neutral in the long run.” One of Keynes’s central tenets — in clear contradistinction to the beliefs of mainstream neoclassical economists — is that there is no strong automatic tendency for economies to move toward full employment levels in monetary economies. Money doesn’t matter in mainstream neoclassical macroeconomic models. That’s true. According to the ‘classical dichotomy,’ real variables — output and employment — are independent of monetary variables, and so enables mainstream economics to depict the economy as basically a barter system. But in the real world in which we happen to live, money certainly does matter.

Topics:

Lars Pålsson Syll considers the following as important: Economics, Uncategorized, Varia

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Late-winter blessing (personal)

from Lars Syll

Paul Krugman has repeatedly over the years argued that we should continue to use neoclassical hobby horses like IS-LM and AS-AD models. Here’s one example:

So why do AS-AD? … We do want, somewhere along the way, to get across the notion of the self-correcting economy, the notion that in the long run, we may all be dead, but that we also have a tendency to return to full employment via price flexibility. Or to put it differently, you do want somehow to make clear the notion (which even fairly Keynesian guys like me share) that money is neutral in the long run.

I seriously doubt that Keynes would have been impressed by having his theory being characterized with catchwords like “tendency to return to full employment” and “money is neutral in the long run.”

One of Keynes’s central tenets — in clear contradistinction to the beliefs of mainstream neoclassical economists — is that there is no strong automatic tendency for economies to move toward full employment levels in monetary economies.

Money doesn’t matter in mainstream neoclassical macroeconomic models. That’s true. According to the ‘classical dichotomy,’ real variables — output and employment — are independent of monetary variables, and so enables mainstream economics to depict the economy as basically a barter system.

But in the real world in which we happen to live, money certainly does matter. Money is not neutral and money matters in both the short run and the long run:

The theory which I desiderate would deal … with an economy in which money plays a part of its own and affects motives and decisions, and is, in short, one of the operative factors in the situation, so that the course of events cannot be predicted in either the long period or in the short, without a knowledge of the behaviour of money between the first state and the last. And it is this which we ought to mean when we speak of a monetary economy.

J. M. Keynes A monetary theory of production (1933)

Ditch physics envy!

20 April, 2017 at 19:31 | Posted in Economics | 9 Comments

In the 1870s, a handful of aspiring economists hoped to make economics a science as reputable as physics. Awed by Newton’s insights on the physical laws of motion – laws that so elegantly describe the trajectory of falling apples and orbiting moons – they sought to create an economic theory that matched his legacy. And so pioneering economists such as William Stanley Jevons and Léon Walras drew their diagrams in clear imitation of Newton’s style and, inspired by the way that gravity pulls a falling object to rest, wrote enthusiastically of the role played by market forces and mechanisms in pulling an economy into equilibrium.

People and money are not so obedient as gravity, as it turns out, so no such laws exist.

Their mechanical metaphor sounds authoritative, but it was ill-chosen from the start – a fact that has been widely acknowledged since the astonishing fragility and contagion of global financial markets was exposed by the 2008 crash.

The most pernicious legacy of this fake physics has been to entice generations of economists into a misguided search for economic laws of motion that dictate the path of development. People and money are not as obedient as gravity, so no such laws exist. Yet their false discoveries have been used to justify growth-first policymaking.

John Tavener

19 April, 2017 at 19:03 | Posted in Varia | Leave a comment

David Ricardo and comparative advantage — a bicentennial assessment

19 April, 2017 at 13:50 | Posted in Economics | 3 Comments

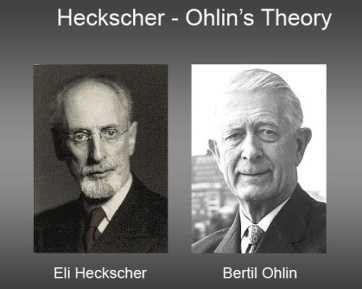

Two hundred years ago, on 19 April 1817, David Ricardo’s Principles was published. In it he presented a theory that was meant to explain why countries trade and, based on the concept of opportunity cost, how the pattern of export and import is ruled by countries exporting goods in which they have comparative advantage and importing goods in which they have a comparative disadvantage.

Although a great accomplishment per se, Ricardo’s theory of comparative advantage, however, didn’t explain why the comparative advantage was the way it was. In the beginning of the 20th century, two Swedish economists — Eli Heckscher and Bertil Ohlin — presented a theory/model/theorem according to which the comparative advantages arose from differences in factor endowments between countries. Countries have a comparative advantages in producing goods that use up production factors that are most abundant in the different countries. Countries would mostly export goods that used the abundant factors of production and import goods that mostly used factors of productions that were scarce.

Although a great accomplishment per se, Ricardo’s theory of comparative advantage, however, didn’t explain why the comparative advantage was the way it was. In the beginning of the 20th century, two Swedish economists — Eli Heckscher and Bertil Ohlin — presented a theory/model/theorem according to which the comparative advantages arose from differences in factor endowments between countries. Countries have a comparative advantages in producing goods that use up production factors that are most abundant in the different countries. Countries would mostly export goods that used the abundant factors of production and import goods that mostly used factors of productions that were scarce.

The Heckscher-Ohlin theorem — as do the elaborations on in it by e.g. Vanek, Stolper and Samuelson — builds on a series of restrictive and unrealistic assumptions. The most critically important — beside the standard market clearing equilibrium assumptions — are

(1) Countries use identical production technologies.

(2) Production takes place with a constant returns to scale technology.

(3) Within countries the factor substitutability is more or less infinite.

(4) Factor-prices are equalised (the Stolper-Samuelson extension of the theorem).

These assumptions are, as almost all empirical testing of the theorem has shown, totally unrealistic. That is, they are empirically false.

That said, one could indeed wonder why on earth anyone should be interested in applying this theorem to real world situations. As so many other mainstream mathematical models taught to economics students today, this theorem has very little to do with the real world.

Using false assumptions, mainstream modelers can derive whatever conclusions they want. Wanting to show that ‘free trade is great’ just e.g. assume ‘all economists from Chicago are right’ and ‘all economists from Chicago consider free trade to be great’ The conclusions follows by deduction — but is of course factually totally wrong. Models and theories building on that kind of reasoning is nothing but a pointless waste of time.

What mainstream economics took over from Ricardo was not only the theory of comparative advantage. The whole deductive-axiomatic approach to economics that is still at the core of mainstream methodology was taken over from Ricardo. Nothing has been more detrimental to the development of economics than going down that barren path.

Ricardo shunted the car of economic science on to the wrong track. Mainstream economics is still on that track. It’s high time to get on the right track and make economics a realist and relevant science.

Is having infinitely many models really a sign of progress in economics?

18 April, 2017 at 17:55 | Posted in Economics | 1 Comment

In Dani Rodrik’s Economics Rules it is argud that ‘the multiplicity of models is economics’ strength,’ and that a science that has a different model for everything is non-problematic, since

economic models are cases that come with explicit user’s guides — teaching notes on how to apply them. That’s because they are transparent about their critical assumptions and behavioral mechanisms.

Hmm …

That is at odds with yours truly’s experience from studying mainstream economic models during four decades.

When — just to take an example — criticizing the basic (DSGE) workhorse macroeconomic model for its inability to explain involuntary unemployment, its defenders maintain that later ‘successive approximations’ and elaborations — especially newer search models — manage to do just that. However, one of the more conspicuous problems with those ‘solutions,’ is that they are as a rule constructed without seriously trying to warrant that the model immanent assumptions and results are applicable in the real world. External validity is more or less a non-existent problematique sacrificed on the altar of model derivations. This is not by chance. These theories and models do not come at all with the transparent and ‘explicit user’s guides.’ And there’s a very obvious reason for that. For how could one even imagine to empirically test assumptions such as ‘wages being determined by Nash bargaining’ or ‘actors maximizing expected utility,’ without coming to the conclusion that this is — in terms of realism and relevance — far from ‘good enough’ or ‘close enough’ to real world situations?

Typical mainstream neoclassical modeling assumptions — with or without due pragmatic considerations — can not in any relevant way be considered anything else but imagined model worlds assumptions that has nothing at all to do with the real world we happen to live in.

Here is no real transparency as to the deeper significance and role of the chosen set of axiomatic assumptions.

Here is no explicit user’s guide or indication of how we should be able to, as Rodrik puts it, ‘discriminate’ between the ‘bewildering array of possibilities’ that flow out of such outlandish and known to be false assumptions.

Theoretical models building on piles of known to be false assumptions are in no way close to being scientific explanations. On the contrary. They are untestable and a fortiori totally worthless from the point of view of scientific relevance.

And — as Noah Smith noticed the other day — it certainly isn’t unproblematic to portray having infinitely many models as something laudable:

One thing I still notice about macro … is the continued proliferation of models. Almost every macro paper has a theory section. Because it takes more than one empirical paper to properly test a theory, this means that theories are being created in macro at a far greater rate than they can be tested.

That seems like a problem to me. If you have an infinite collection of models sitting on the shelves, how does theory inform policy? If policy advisers have an endless list of models to choose from, how do they pick which one to use? It seems like a lot of the time it’ll come down to personal preference, intuition, or even ideology …

It seems to me that if you want to make a field truly empirical, you don’t just need to look at data – you need to use data to toss out models, and model elements like the Euler equation … I also think macro people in general could stand to be more proactive about using new data to critically reexamine canonical assumptions … That seems like it’ll raise the chances that the macro consensus gets the next crisis right before it happens, rather than after.

Nicholas Georgescu-Roegen

17 April, 2017 at 23:48 | Posted in Economics | 2 Comments

C’est vraiment incroyable que l’économie orthodoxe ait toujours négligé The Entropy Law and the Economic Process, un ouvrage fondamental et aussi important dans l’histoire de la pensée économique que General Theory de Keynes.

Cutting wages is no panacea

15 April, 2017 at 12:32 | Posted in Economics | Leave a comment

Falling wages might provide a short-term boost to corporate profits, but the reduced purchasing power of working people would soon cause people to buy less. That is disastrous in advanced capitalist countries, where consumer spending generally accounts for anywhere from 60 to 70 percent of gross domestic product …

Falling wages were a reality during the Great Depression, but that didn’t help matters. By 1933 in the United States, manufacturing wages fell 34 percent and unemployment rose to about 25 percent. The Canadian economy contracted by more than 40 percentand unemployment reached 30 percent in 1933. Collapses in wages did not bring better times; only the massive government spending to wage World War II put an end to the Depression.

Moreover, already existing low wages come at a high cost. A 2015 study by the researchers at the University of California Berkeley Center for Labor Research and Education found that public benefits given to people who have jobs but can’t live on their meager wages cost the public more than $150 billion annually in the United States — more than half of total public-assistance spending by federal and state governments. Wal-Mart alone costs taxpayers an estimated $6 billion per year subsidizing the retailer’s low pay and paltry benefits at the same time it pays out similar amounts in dividends, half of which go to the Walton family.

As all of you doing the jobs of two or three people at your place of employment have undoubtedly noticed, more work is not being rewarded with more pay. The average U.S. household earns about $18,000 less than it would had wages kept pace with productivity gains, and the average Canadian household is short at least $10,000 per year because of pay lagging productivity gains. Workers across Europe, including in Britain, Germany and Spain, have also seen pay lag productivity.

Learning to think like an economist

14 April, 2017 at 09:01 | Posted in Economics | Leave a comment

It takes some courage, maturity, and perception for the self-discovery that one is engaged in a fraudulent enterprise … Our teachers never talked about ideologies or the larger issues, and seemed content with discussing arcane mathematics — DELIBERATE deception involves knowing the truth and then using lies to hide it.This does not seem to be the modus operandi. Rather, after the initial discomfort of swallowing certain absurd framing ideas wears off, one learns to believe these lies. Much like the experiments with reversing glasses, those who wear them are disoriented at first because the glasses turn the world upside down. However, after a little while the mind adjusts and re-interprets the world so that the upside down image becomes right side up. Then, if they take the glasses off, the world appears upside down. This is what is meant by “learning to think like an economist.”