Trumped up expectations fading only slowly, as confirmed by stocks, etc: A glimmer of hope seems to have faded: HighlightsThere’s plenty of help-wanted signs but still too few qualified applicants. Job openings in March totaled 5.743 million, up from a revised 5.682 million in February and well ahead of hirings which totaled 5.260 million. Professional & business services, where employers often turn to first when they can’t fill staff themselves, shows a strong rise in openings, to 1.1 million for a 26,000 gain. But hirings for this component are down, 55,000 lower to 989,000 and pointing perhaps to hiring delays but also to lack of strong candidates. Manufacturing shows a 30,000 monthly rise to 394,000 openings with hirings up 26,000 to 322,000. Government also shows

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

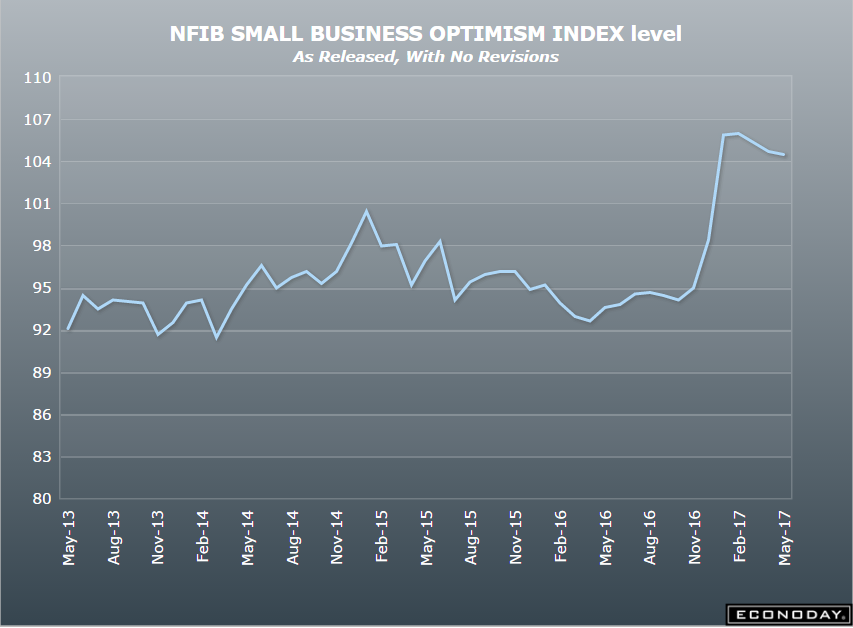

Trumped up expectations fading only slowly, as confirmed by stocks, etc:

A glimmer of hope seems to have faded:

Highlights

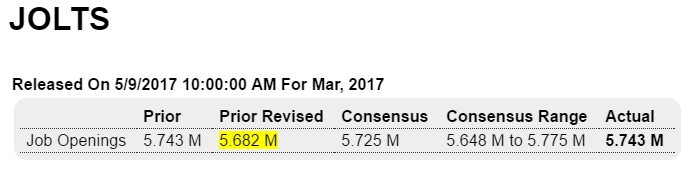

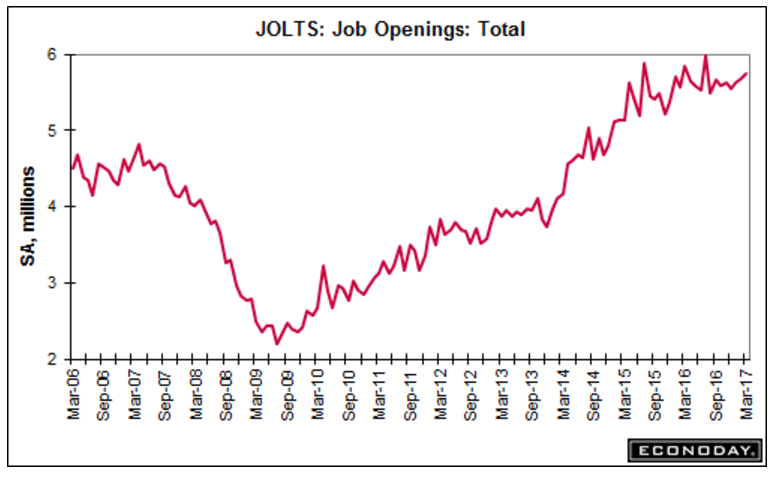

There’s plenty of help-wanted signs but still too few qualified applicants. Job openings in March totaled 5.743 million, up from a revised 5.682 million in February and well ahead of hirings which totaled 5.260 million.Professional & business services, where employers often turn to first when they can’t fill staff themselves, shows a strong rise in openings, to 1.1 million for a 26,000 gain. But hirings for this component are down, 55,000 lower to 989,000 and pointing perhaps to hiring delays but also to lack of strong candidates. Manufacturing shows a 30,000 monthly rise to 394,000 openings with hirings up 26,000 to 322,000. Government also shows a strong gain for openings, up 33,000 to 537,000 and led by state & local education.

This report is consistent with tight conditions in the labor market and hints at the risk, at least for skilled workers, of wage inflation ahead.

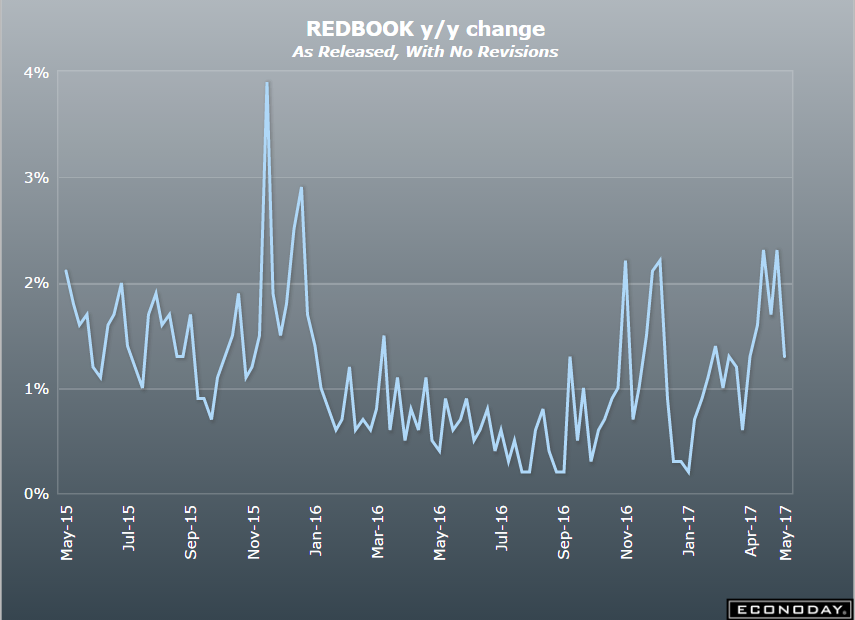

This chart still looks to me like it’s rolling over:

Highlights

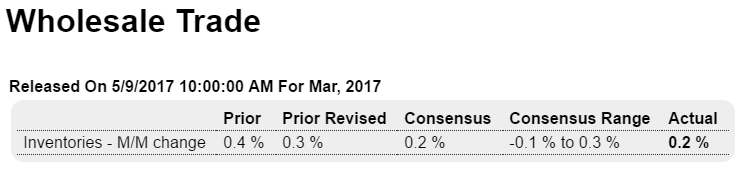

Wholesale inventories came in at a consensus 0.2 percent increase led by a sharp build in autos, excluding which March inventories were unchanged. Sales in the wholesale sector were unchanged in the month though the mismatch with the inventory build does not lift the stock-to-sales ratio which holds at a healthy 1.28. These results will not upset expectations for an incremental 0.1 percent rise in Friday’s business inventories report. Inventories have been moving higher gradually, largely in line with underlying demand.

Looks like there’s already been a recession, and not coming back, but note that it’s also looking like it may have rolled over before reaching the prior highs, and this is not adjusted for inflation:

MMT going mainstream?

The Rock-Star Appeal of Modern Monetary Theory