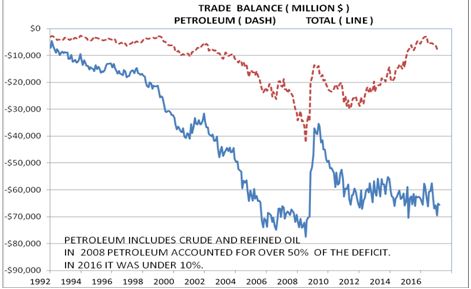

Over the past decade, thanks to fracking, the US has approached self-sufficiency in oil. Since 2008 the trade deficit in oil fell from over half of the overall trade deficit to under 10% in 2016. Surprisingly, however, the massive decline in the oil deficit did not lead to a contraction of the overall trade deficit. Rather, the non-petroleum deficit expanded to offset the improvement in oil. Actually, it should not be a surprise as this is a beautiful example of the standard economic analysis that the current account balance (the trade deficit plus certain capital transactions) equals the gap between domestic savings and investments. When it first became obvious that the Reagan tax cuts were going to lead to a very large structural federal

Topics:

Spencer England considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Over the past decade, thanks to fracking, the US has approached self-sufficiency in oil. Since 2008 the trade deficit in oil fell from over half of the overall trade deficit to under 10% in 2016.

Surprisingly, however, the massive decline in the oil deficit did not lead to a contraction of the overall trade deficit. Rather, the non-petroleum deficit expanded to offset the improvement in oil. Actually, it should not be a surprise as this is a beautiful example of the standard economic analysis that the current account balance (the trade deficit plus certain capital transactions) equals the gap between domestic savings and investments.

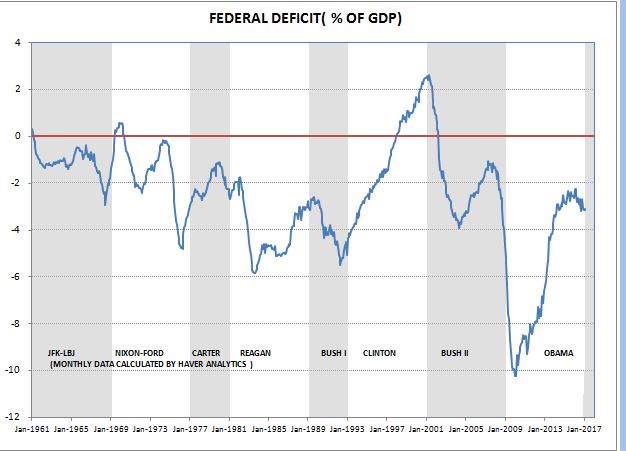

When it first became obvious that the Reagan tax cuts were going to lead to a very large structural federal deficit, main stream economic forecasters started to talk about crowding out. If you look at the US economy as a closed system, domestic investments must equal domestic savings and interest rates are the price that changes to ensure that tat identity holds.

We clearly got a massive increase in the federal deficit as after the Reagan tax cuts the federal deficit exploded from -2% to – 6% of GDP. Moreover, this occurred during the time of very strong economic growth that should have caused the deficit to contract. But interest rates did not rise and the crowding out analysis was discredited. Vice President Cheney even went so far to claim this demonstrated that deficit do not matter.

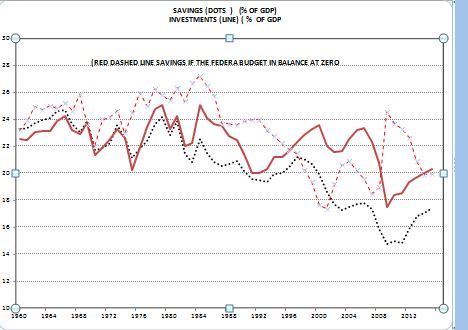

But the view that savings must equal investments only holds in a closed economy. In those days virtually everyone looked at the US economy as a closed system and ignored the international aspects of the economy. In an open economy, however, savings does not have to equal investments because foreign capital inflows can finance a gap between savings and investments. In a closed economy, interest rates adjust to ensure this identity. But in an open economy both interest rates and the currency can move to ensure that economic identity prevails.

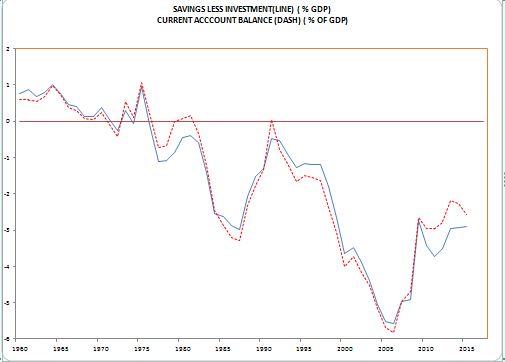

As the chart shows, the US has sustained a large gap between savings and investments since the 1980s. Initially, the large federal deficit following the Reagan tax cut was accompanied by a massive 50% surge in the dollar. This was generated by foreign investors bidding up the dollar as the demand for dollars exceed the supply. But with a lag, the strong deficit lead to an increase in the current account deficit — the supply of dollars–and the supply and demand for dollars balanced without the dollar rising.. But this analysis brings up another identity that hold in an open economy; the domestic savings-investment gap must equal the current account balance.

As the chart shows, the identity that the savings-investment gap must equal the current account deficit has clearly held over the years. We had crowding out after the Reagan tax cuts, it just worked through the dollar to hurt the economic sectors exposed to foreign competition rather than interest rates to impact the interest sensitive sectors. Moreover, as this analysis shows that the trade deficit is not a function of NAFTA or the other things that President Trump claims. If you look at the US as an open economy it is obvious that the large trade deficit and the loss of many manufacturing jobs has been caused by the Republican tax cuts that produced a structural federal deficit, a large domestic-savings gap and the large current account deficit. Moreover, if Trump is able to implement another round of large tax cuts it will lead to a widening of the domestic-savings gap and the current account –trade — deficits. His tax policies will severely damage the American manufacturing worker that elected him in hopes that he could make America great again.