Dan here…I noticed several articles in the NYT (here is one forcasting Trump/Mulvaneys’ Budget Proposal 2017, contrasting safety net program cuts with the Medicare/Social Security deficit busting programs. In an aside no less. Here we go again…as if deficit spending reduction was important to Republicans, and Social Security was one of the chief problems. I am reposting Bruce’s last piece on Budget and deficit from 2014. Also see this post Social Security: Cost, Solvency, Debt and TF Ratio. by Bruce Webb With the release of Tim Geithner’s new autobiography the old quarrel about whether Social Security does or even can add to “the deficit” has cropped up again. So rather than weigh in let me start from a more neutral spot. CBO produces a document called the

Topics:

Dan Crawford considers the following as important: Journalism, politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Dan here…I noticed several articles in the NYT (here is one forcasting Trump/Mulvaneys’ Budget Proposal 2017, contrasting safety net program cuts with the Medicare/Social Security deficit busting programs. In an aside no less. Here we go again…as if deficit spending reduction was important to Republicans, and Social Security was one of the chief problems. I am reposting Bruce’s last piece on Budget and deficit from 2014. Also see this post Social Security: Cost, Solvency, Debt and TF Ratio.

by Bruce Webb

With the release of Tim Geithner’s new autobiography the old quarrel about whether Social Security does or even can add to “the deficit” has cropped up again. So rather than weigh in let me start from a more neutral spot. CBO produces a document called the Monthly Budget Review and in Nov 2013 it carried this title: Monthly Budget Review—Summary for Fiscal Year 2013 The introductory paragraph of the Summary of this Summary reads as follows:

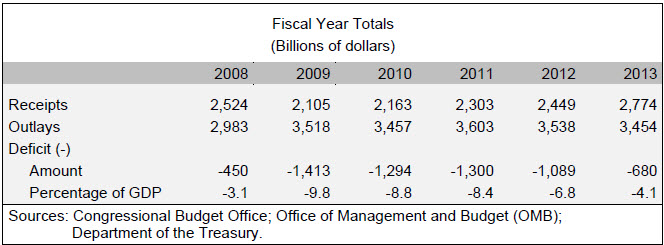

The federal government incurred a budget deficit of $680 billion in fiscal year 2013, which was $409 billion less than the deficit in fiscal year 2012. The fiscal year that just ended marked the first since 2008 that the deficit was under $1 trillion. As a share of the nation’s gross domestic product (GDP), the deficit declined from 6.8 percent in 2012 to 4.1 percent in 2013. (The deficit was 1.1 percent of GDP in 2007, prior to the recent recession.)

and in turn was illustrated with the following graph: Fiscal Year Totals

Now in the normal course of reporting CBO gives figures for any number of ‘deficits’ including ‘on-budget deficit’, ‘off-budget deficit’, and ‘primary deficit’. But here they simply reference THE ‘deficit’ without qualification. So which of the three above adjectivally modified ‘deficits’ is CBO using in this Summary of its Summary of Fiscal Year 2013? Well none of them. Instead it is using a metric which by some measures no longer exists, at least under some readings of current law. Which has led to untold confusion. Confusion which I hope to unravel a bit under the fold.

Defenders of Social Security generally claim that it does not ‘contribute’ to the deficit and indeed can not by law. And they make a fine case, certainly linguistically. Because you would think that the right way to measure THE ‘budget deficit’ would be to include the items that were ‘on budget’ and exclude the items that were ‘off budget’. Because otherwise why use the terms ‘on’ and ‘off’ in relation to the budget to start with? Now it turns out that under current law there are two federal programs that are ‘off budget’ – Social Security and the Post Office. So the case would seem to be open and shut “What part of off-budget don’t you understand?”

On the other hand self-styled ‘Reformers’ of Social Security insist that this is pure nonsense and that what really matters is real world cash flow. They would have it that any time total dedicated tax revenues for Social Security fail to cover all current cost with the difference being made up from the General Fund that it should be considered in deficit. And their case seems fairly linguistically sound because CBO calls the number that gives this particular total the ‘primary deficit’. Which would seem to make any other metric be by definition ‘secondary’. Or as they might say “What part of primary budget deficit don’t you understand?”

Well what I understand is that these two camps will never understand each other. Or for that matter properly interpret CBO’s Summary of its Summary. Because in the above quoted text and table CBO is using a metric that combines ‘on-budget’ and ‘off-budget’ deficits and which ignores ‘primary deficit’ entirely.

Can anyone say ‘incommensurate’? Well I can and have but with very little success. So instead I invite all who might come across this post to link through to the CBO Summary of Fiscal Year 2013 and examine for themselves what is included in ‘outlays’ and ‘revenues’ that in turn gives a combined figure of “$680 billion in fiscal year 2013″.

(Spoiler: it includes Social Security revenues and outlays INCLUDING interest and so doesn’t match EITHER of ‘on-budget’ or ‘primary’ deficit.)