Highlights Consumer spending was unusually weak in the first quarter and doesn’t look to be improving this quarter. Retail sales fell 0.3 percent in May vs Econoday’s consensus for a 0.1 percent gain. Weakness riddles the report including a 1.0 percent drop for department stores, a 0.2 percent decline for autos, and a 0.1 percent dip for restaurants. Two readings that echo price contraction in this morning’s consumer price report are gasoline stations, down 2.4 percent, and electronics & appliances stores, down 2.8 percent as phone prices continue to come down. Other readings are likewise very weak, at minus 0.3 percent excluding autos and no change when excluding both autos and gasoline. Control group sales are also unchanged (this excludes autos, building materials,

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Highlights

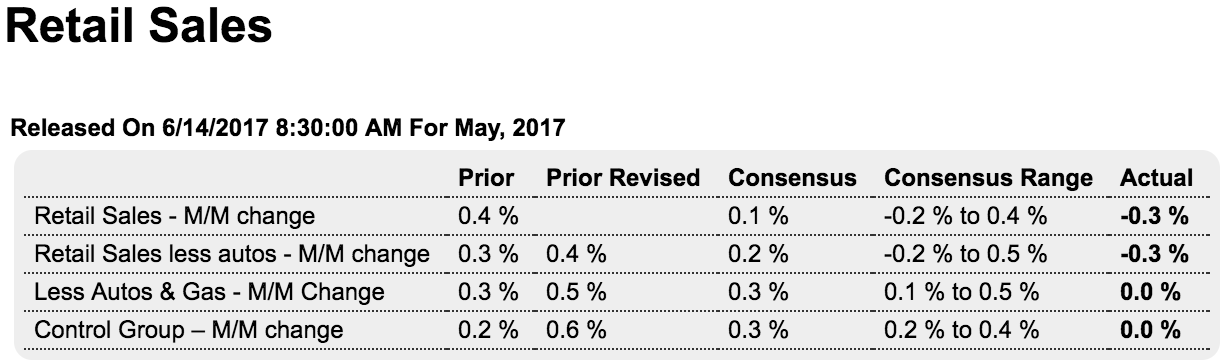

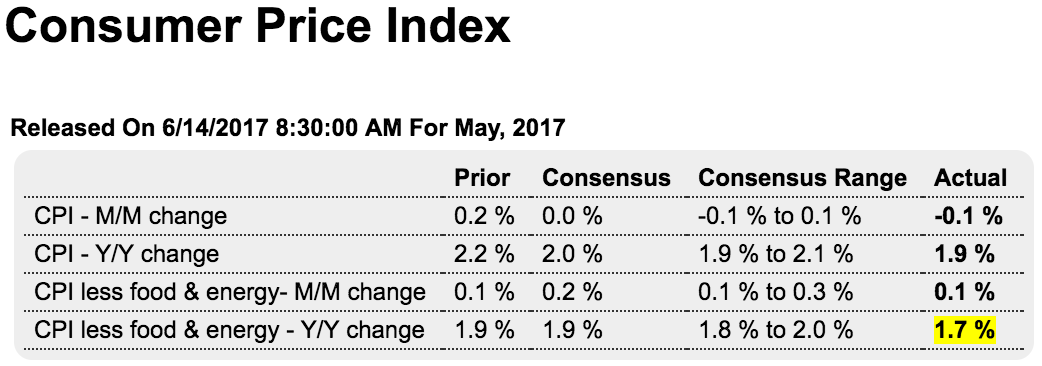

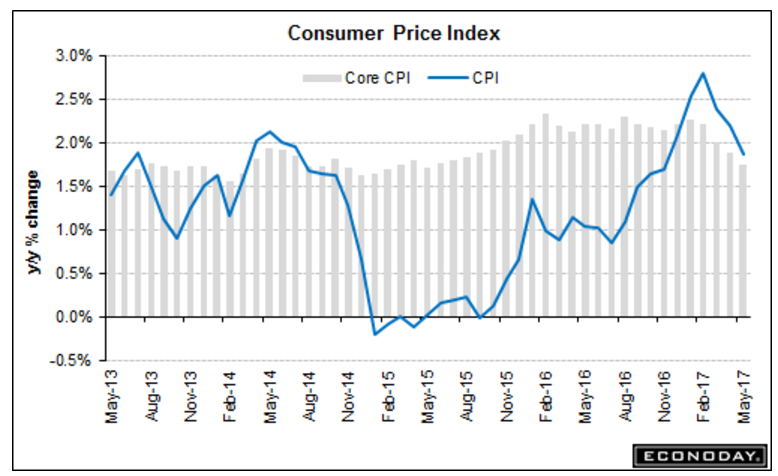

Consumer spending was unusually weak in the first quarter and doesn’t look to be improving this quarter. Retail sales fell 0.3 percent in May vs Econoday’s consensus for a 0.1 percent gain. Weakness riddles the report including a 1.0 percent drop for department stores, a 0.2 percent decline for autos, and a 0.1 percent dip for restaurants. Two readings that echo price contraction in this morning’s consumer price report are gasoline stations, down 2.4 percent, and electronics & appliances stores, down 2.8 percent as phone prices continue to come down.

Other readings are likewise very weak, at minus 0.3 percent excluding autos and no change when excluding both autos and gasoline. Control group sales are also unchanged (this excludes autos, building materials, gasoline and restaurants).

Wages aren’t showing any traction and neither is consumer spending. The consumer just hasn’t been participating this year and will need to accelerate very quickly otherwise second-quarter GDP is in jeopardy. Yet expectations seem fixed that the Fed, despite consumer weakness and despite inflation weakness, is determined to raise rates at today’s FOMC.

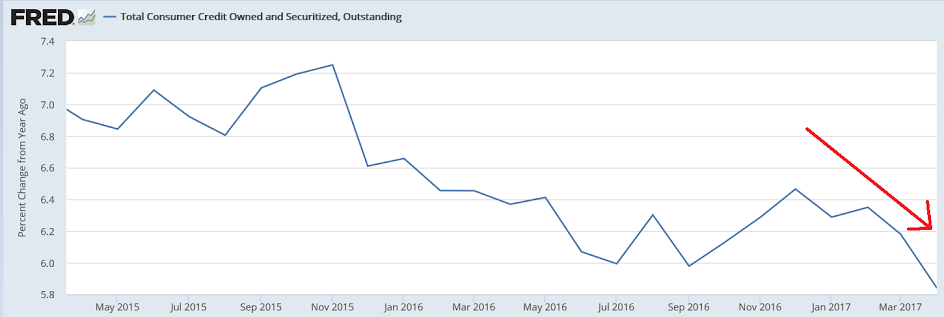

The drop since November concerns me as that’s when all the credit aggregates picked up their pace of deceleration, including consumer credit:

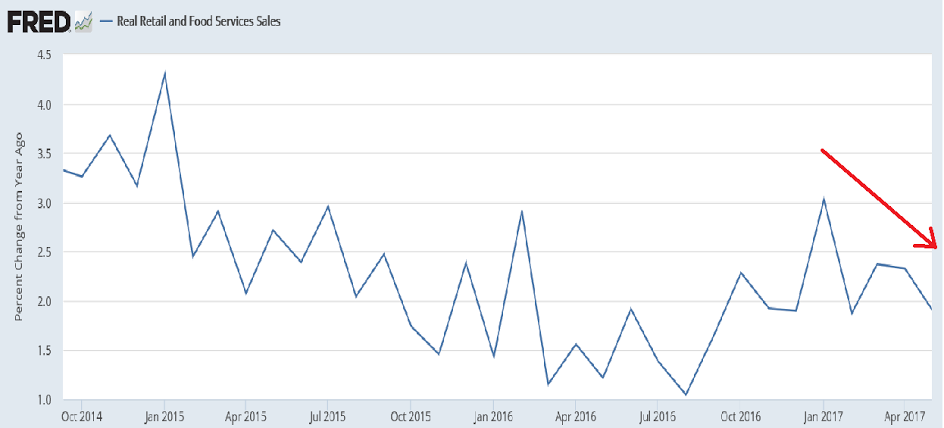

Since November, this has turned south as well:

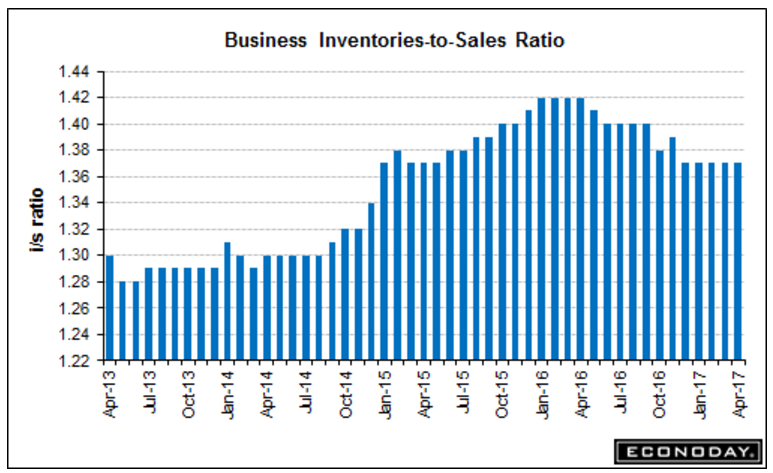

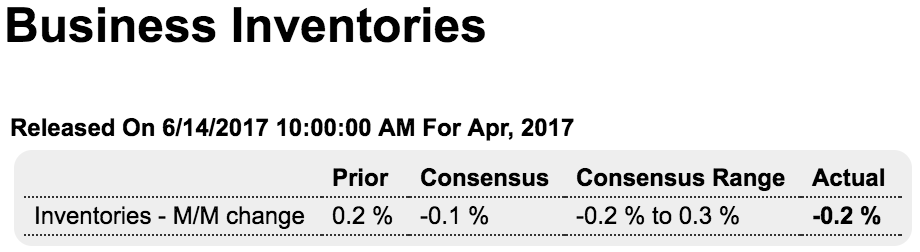

Inventory and sales both dropping, not good:

Highlights

The news on the second quarter continues to darken as business inventories fell 0.2 percent in April which is 1 tenth below Econoday’s consensus. Inventories at retailers also fell 0.2 percent with wholesale inventories down a very sharp 0.5 percent. Factory inventories were positive but only barely, at 0.1 percent. Declining inventories are a possible signal of business caution and a certain negative for second-quarter GDP.