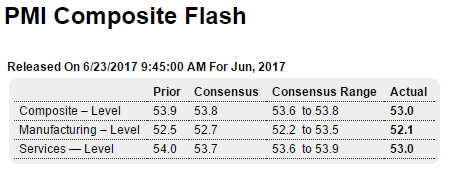

Trumped up expectations continue to revert: Highlights The economy is solid, at least the service sector, but on the whole is losing momentum, based on Markit’s flash data for June. The composite PMI slowed to 53.0 vs Econoday’s consensus for 53.8 with services also at 53.0 and manufacturing at 52.1, both short of expectations. Services offer the best news with new orders and employment solid and optimism on the outlook particularly positive. In a special sign of strength, service companies in the sample are reporting the best gains in selling prices so far this year. Manufacturing, however, moved to its slowest rate since September last year with both new orders and output down, offsetting gains in hiring and also inventories. Input costs slowed with selling prices here

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Trumped up expectations continue to revert:

Highlights

The economy is solid, at least the service sector, but on the whole is losing momentum, based on Markit’s flash data for June. The composite PMI slowed to 53.0 vs Econoday’s consensus for 53.8 with services also at 53.0 and manufacturing at 52.1, both short of expectations.

Services offer the best news with new orders and employment solid and optimism on the outlook particularly positive. In a special sign of strength, service companies in the sample are reporting the best gains in selling prices so far this year.

Manufacturing, however, moved to its slowest rate since September last year with both new orders and output down, offsetting gains in hiring and also inventories. Input costs slowed with selling prices here still weak.

The service strength in this report keeps it from being downbeat, though the weakness in manufacturing, which has been struggling this quarter, is not welcome.

Composite of manufacturing and services:

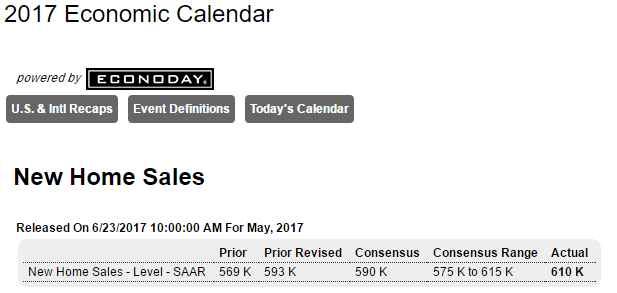

A bit better than expected, but no homes are built without permits, and permits are down.

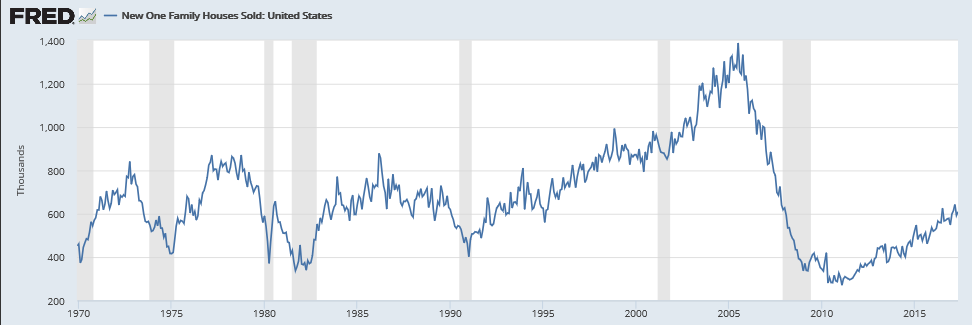

Also, as per the charts, which are not population adjusted, sales have flattened recently and remain historically depressed: