As per the chart, decelerating in line with the deceleration in real estate related bank lending: Highlights Spring 2017 was not the greatest for the nation’s housing sector where data have been mixed at best. Permits have been down and spending data are flat to down with construction spending unchanged in May which hits the very lowest estimate in Econoday’s consensus range. And the weakness is in residential spending, down 0.6 percent overall and including declines for single-family homes, residential improvements, and especially in May for multi-family units. Private nonresidential spending fell 0.7 percent, with declines in transportation, manufacturing, and commercial. An offset is public nonresidential, up sharply after 2 prior months of declines with the gain

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

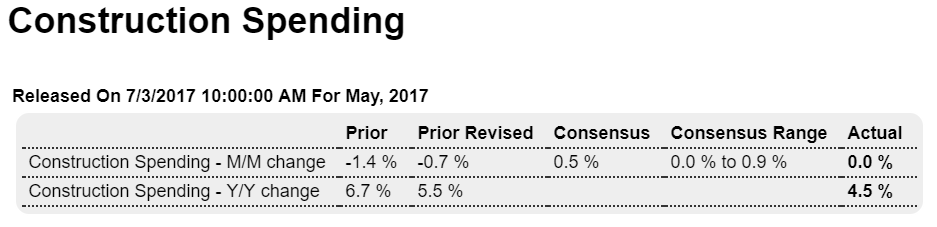

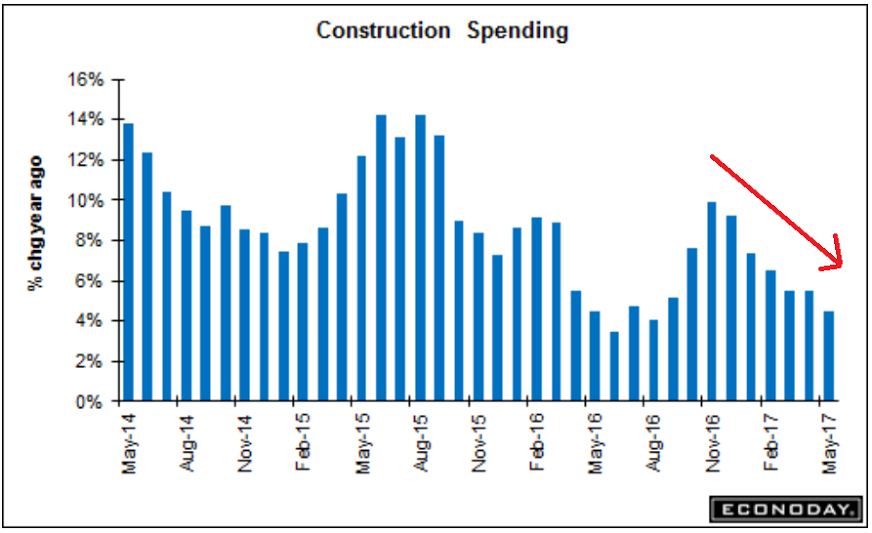

As per the chart, decelerating in line with the deceleration in real estate related bank lending:

Highlights

Spring 2017 was not the greatest for the nation’s housing sector where data have been mixed at best. Permits have been down and spending data are flat to down with construction spending unchanged in May which hits the very lowest estimate in Econoday’s consensus range.

And the weakness is in residential spending, down 0.6 percent overall and including declines for single-family homes, residential improvements, and especially in May for multi-family units.

Private nonresidential spending fell 0.7 percent, with declines in transportation, manufacturing, and commercial. An offset is public nonresidential, up sharply after 2 prior months of declines with the gain centered in education, up 5.1 percent, as roads fell 0.9 percent for a second straight dip.

Public spending in May aside, the slowing in construction spending is not a positive signal for the housing sector nor for second-quarter GDP. The housing sector moved higher at the beginning of the year but has stumbled since.

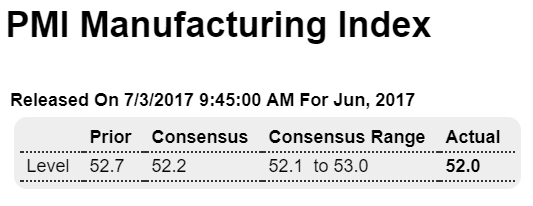

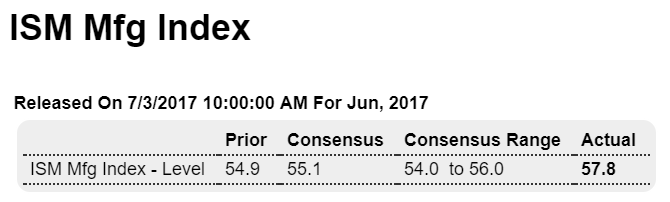

Manufacturing surveys showing modest growth, as previously discussed:

If this report tracked better with government data, expectations would be building for a second-half surge in the factory sector. But this report like other private data, with the notable exclusion of the PMI manufacturing report the latest edition of which was released earlier this morning, have been pointing to unusually strong levels of activity all year long, acceleration that has yet to appear in actual data from the government.