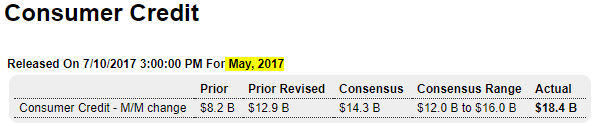

Higher than expected, and last month revised up, however the trend is still lower. This report is only through May. The weekly bank loan report is as of June 28, and shows the down trend continuing, which generally reflects a deceleration in consumer spending: Highlights Consumer spending has been modest but consumers did run up their credit-card debt in May helping to lift consumer credit outstanding by a larger-than-expected .4 billion. Revolving credit, which is where credit cards are tracked, rose .4 billion vs only .2 billion in April. Nonrevolving credit, where auto financing and student loans are the biggest factors, posted yet another sizable increase of .0 billion in May. Credit card debt may not be a plus for long-term consumer health, but it is one

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

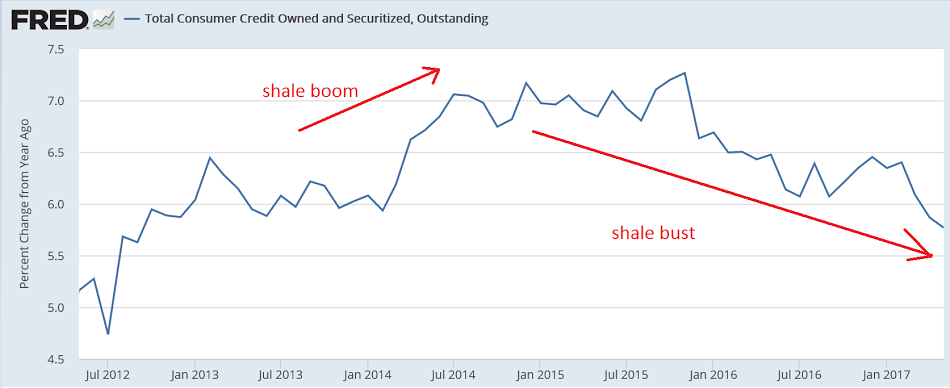

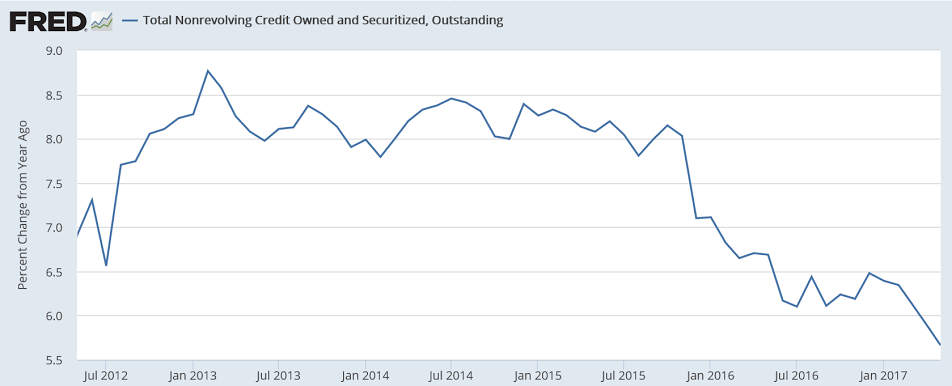

Higher than expected, and last month revised up, however the trend is still lower. This report is only through May. The weekly bank loan report is as of June 28, and shows the down trend continuing, which generally reflects a deceleration in consumer spending:

Highlights

Consumer spending has been modest but consumers did run up their credit-card debt in May helping to lift consumer credit outstanding by a larger-than-expected $18.4 billion. Revolving credit, which is where credit cards are tracked, rose $7.4 billion vs only $1.2 billion in April. Nonrevolving credit, where auto financing and student loans are the biggest factors, posted yet another sizable increase of $11.0 billion in May. Credit card debt may not be a plus for long-term consumer health, but it is one for near-term consumer spending and GDP.

Though May:

Weekly through June 28:

Analysts are looking how the drop in lending might affect banks, but nothing about how the lending deceleration reflects events in the macro economy:

Bank stocks are about to face another major hurdle

As previously discussed, this is more of ‘the beatings will continue until morale improves’ policy:

French deficit pledge will help euro zone budget discussions, ECB’s Coeure says

The French government has committed to stick to plans to cut the deficit to 3 percent of economic output this year despite overspending this year by its predecessor.

“One of the constraints facing the government is to keep its commitments on the budget and in particular on the three percent. This is something that we welcome in part because of the consequences for the rest of Europe,” Coeure said.

Again, this is inline with the deceleration in the weekly bank lending reports:

Weekly Mortgage Market Index Sinks from Year Earlier

Mortgage Market Index down 28%

DALLAS — (July 10, 2017) During the week that included Independence Day, new mortgage activity significantly declined. A substantial drop from a year earlier was also recorded. Jumbo business, however, mostly held up.

As of the week ended July 7, the Mortgage Market Index from Mortgage Daily, which provides insight into upcoming originations based or rate-lock volume by clients of OpenClose, was 107.

That turned out to be the lowest level for the index, which is not adjusted to account for seasonal factors, since the week ended Jan. 6, 2017.

New business plunged 28 percent from the preceding week. Even more telling was the comparison with the same holiday week in 2016, with a 36 percent year-over-year tumble.

Rate locks for adjustable-rate mortgages plummeted from the week ended June 30 by 44 percent — the most of any category. At 7.3 percent, ARM share was thinner than 9.3 percent the previous week.

A 34 percent week-over-week reduction was recorded for refinance business. Refinance share was cut to 28 percent from the previous week’s 30 percent.

After that was the Purchase MMI, which declined 26 percent to 77.The Government MMI was 45, retreating 21 percent from seven days prior. Government share widened to 42 percent from 38 percent.

Sporting the smallest week-over-week drop were rate locks for jumbo mortgages: 2 percent. Jumbo share widened to 10 percent from 7 percent a week earlier. Rates on jumbo mortgages were 17 basis points higher than conforming rates. The jumbo-conforming spread widened from 12 BPS in the preceding report.