From David Ruccio New technologies—automation, robotics, artificial intelligence—have created a specter of mass unemployment. But, as critical as I am of existing economic institutions, I don’t see that as the issue, at least at the macro level. The real problem is the distribution of the value that is produced with the assistance of the new technologies—in short, the specter of growing inequality. David Autor and Anna Salomons (pdf) are the latest to attempt to answer the question about technology and employment in their contribution to the recent ECB Forum on Central Banking. Their empirical work leads to the conclusion that while “industry-level employment robustly falls as industry productivity rises. . .country-level employment generally grows as aggregate productivity rises.” To

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

New technologies—automation, robotics, artificial intelligence—have created a specter of mass unemployment. But, as critical as I am of existing economic institutions, I don’t see that as the issue, at least at the macro level. The real problem is the distribution of the value that is produced with the assistance of the new technologies—in short, the specter of growing inequality.

David Autor and Anna Salomons (pdf) are the latest to attempt to answer the question about technology and employment in their contribution to the recent ECB Forum on Central Banking. Their empirical work leads to the conclusion that while “industry-level employment robustly falls as industry productivity rises. . .country-level employment generally grows as aggregate productivity rises.”

To me, their results make sense. But for a different reason.

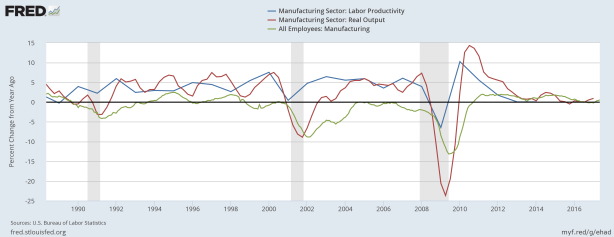

It is clear that, in many sectors—perhaps especially in manufacturing—the growth in output (the red line in the chart above) is due to the growth in labor productivity (the blue line) occasioned by the use of new technologies, which in turn has led to a decline in manufacturing employment (the green line).

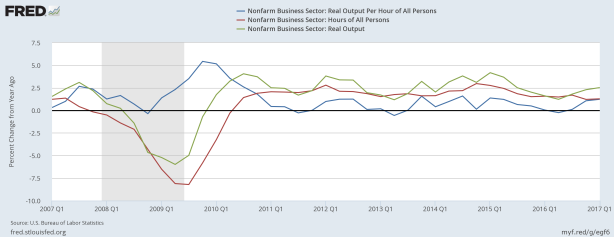

But for the U.S. economy as a whole, especially since the end of the Great Recession, the opposite is true: the growth in hours worked has played a much more important role in explaining the growth of output than has the growth in labor productivity.

The fact is, increases in labor productivity—which stem at least in part from labor-saving technologies—have not, at least in recent years, led to massive unemployment. (The losses in jobs that have occurred are much more a cyclical phenomenon, due to the crash of 2007-08 and the long, uneven recovery.)

But that’s not because, as Autor and Salomons (and mainstream economists generally) would have it, there are “positive spillovers” of technological change to the rest of the economy. It’s because, under capitalism, workers are forced to have the freedom to sell their ability to work to employers. There’s no other choice. If workers are displaced from their jobs in one plant or sector, they can’t just remain unemployed. They have to find jobs elsewhere, often at lower wages than their earned before. That’s how capitalism works.

Much the same holds for workers who don’t lose their jobs but who, as new technologies are adopted by their employers, are deskilled and otherwise become appendages of the new machines. They can’t just quit. They remain on the job, even as their working conditions deteriorate and the value of their ability to work falls—and their employers’ profits rise.

What happens, in other words, is the gains from the new technologies that are adopted are distributed unevenly.

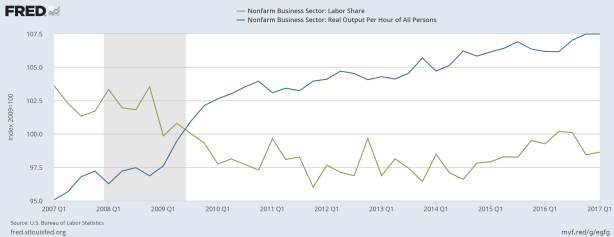

This is clear if we look at labor productivity for the economy as a whole (the blue line in the chart above) since the end of the Great Recession, which has increased by 7.5 percent. However, the wage share (the green line) has barely budged and is actually now lower than it was in 2009.

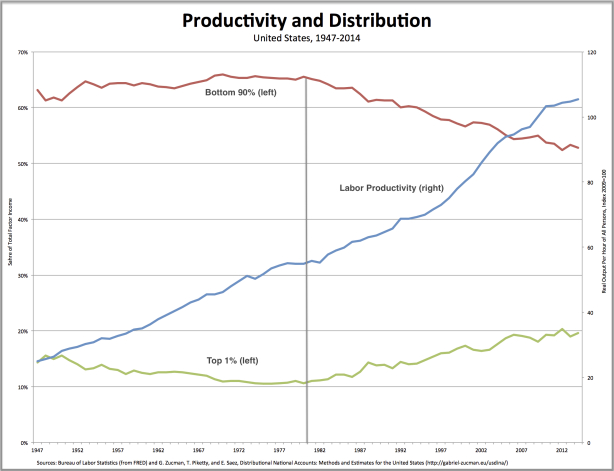

The results are even more dramatic over a long time frame—over periods when labor productivity was growing relatively quickly (from 1947 through the 1970s, and from 1980 until the most recent crash) and when productivity has been growing much more slowly (since 2009).

During the initial period (until 1980), labor productivity (the blue line in the chart) almost doubled while income shares—to the bottom 90 percent (the red line) and the top 1 percent (the green line)—remained relatively constant.

After 1980, however—during periods of first rapid and then slow growth in productivity—the situation changed dramatically: the share of income going to the bottom 90 percent declined, while the share captured by the top 1 percent soared. Even as new technologies were adopted across the economy, the vast majority of people were forced to find work, at stagnant or declining wages, while their employers and corporate executives captured a larger and larger share of the new value that was being created.

Autor and Salomons think they’ve arrived at a conclusion—concerning the “relative neutrality of productivity growth for aggregate labor demand”—that is optimistic.

The conclusions of my analysis are much more disconcerting. The broad sharing of the fruits of technological change, from the end of World War II to the late 1970s, was relatively short-lived. Since then, the conditions within which new technologies have been adopted have created a mass of increasingly desperate workers, who have either been forced to labor in more automated workplaces or have been displaced and thus forced to find employment elsewhere. In both cases, their share of income has declined while the share captured by a tiny group at the top has continued to rise. That’s the “new normal” (from 1980 onward) which looks a lot like the “old normal” of capitalist growth (prior to the first Great Depression), interrupted by a relatively short period (during the three postwar decades) that is becoming increasingly recognized as the exception.

Even more, I can make the case that things would be much better if the adoption of new technologies did in fact displace a large number of labor hours. Then, the decreasing amount of labor that needed to be performed could be spread among all workers, thus lessening the need for everyone to work as many hours as they do today.

But that would require a radically different set of economic institutions, one in which people were not forced to have the freedom to sell their ability to work to someone else. However, that’s not a world Autor and Salomons—or mainstream economists generally—can ever imagine let alone work to create.