The heterodox heritage of economic statistics is underestimated. Too often I encounter the idea that heterodox economics does not provide an alternative to mainstream economics, let alone economic measurement. Ahem. Instead of ignoring (data on) unemployment (Robert Lucas!) or ignoring (data on) money and the monetary system (more on this below), it were heterodox economists who set out to measure it. To quite an extent, economic statistics are the heterodox alternative people want to see, surely when it comes to macro-economics . If alone because unlike mainstream macro it does carefully define variables – modern science! The mainstream equivalent of the tedious statistical manuals which economic statistics use to do this is entirely absent! One example of such data are the Flow of

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The heterodox heritage of economic statistics is underestimated. Too often I encounter the idea that heterodox economics does not provide an alternative to mainstream economics, let alone economic measurement. Ahem. Instead of ignoring (data on) unemployment (Robert Lucas!) or ignoring (data on) money and the monetary system (more on this below), it were heterodox economists who set out to measure it. To quite an extent, economic statistics are the heterodox alternative people want to see, surely when it comes to macro-economics . If alone because unlike mainstream macro it does carefully define variables – modern science! The mainstream equivalent of the tedious statistical manuals which economic statistics use to do this is entirely absent! One example of such data are the Flow of Funds.

The heterodox heritage of economic statistics is underestimated. Too often I encounter the idea that heterodox economics does not provide an alternative to mainstream economics, let alone economic measurement. Ahem. Instead of ignoring (data on) unemployment (Robert Lucas!) or ignoring (data on) money and the monetary system (more on this below), it were heterodox economists who set out to measure it. To quite an extent, economic statistics are the heterodox alternative people want to see, surely when it comes to macro-economics . If alone because unlike mainstream macro it does carefully define variables – modern science! The mainstream equivalent of the tedious statistical manuals which economic statistics use to do this is entirely absent! One example of such data are the Flow of Funds.

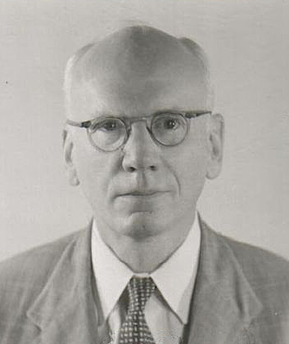

This system was designed and estimated by Morris Copeland, a fierce ‘unreformed institutionalists’ (i.e. someone who understood the economy as an evolving and ever changing system) and a leading anti-neoclassical economist who did not only publish in economic journals but also in ‘journals of philosophy, political science, psychology, statistics and accounting’.

these Flow of Funds data are important and widely used. Look here for an Anne Mayhew article in the Real World Economics Review on Copeland and the importance of the Flow of Funds. Look here and here for ECB articles on the use of the Flow of Funds to investigate the financial health of the economy. Look here for a Bank of Japan overview of the Japanese, USA en Eurozone Flow of Funds data. Look here for the Flow of Funds data of the Central Bank of India. I can go on. Here you will find his defining text about this (kudo’s to the NBER, another institutionalist institution, for making this available online). And yes: people like Minsky, Keen, or Bezemer are indebted to Copeland, just like the central banks, According to the Copeland Wikipedia page (assessed 17-7-2017),

“Copeland shared the institutionalist skepticism of “economic laws” that purport to be applicable outside of specific historical institutional contexts. He viewed orthodox theory more as expressions of doctrine rather than empirical observation. For example, he saw the quantity theory of money as a mathematical device convenient for neoclassical doctrine rather than as a hypothesis that emerged from solid empirical observation of economic data. Rather than base economics on introspection and mental states that cannot be empirically verified, he wished to engage in what he viewed as a more science-based approach which necessarily proceeds first from observations about an economy’s actual behavior… According to Copeland, when you look at the economy from the micro perspective of money flows, it provides a powerful new way making phenomena visible that are simply abstracted away by the orthodox Keynesian and Monetarist models. Copeland’s flow of funds set of accounts provides an alternative framework and analytical insights that is unavailable from either the Keynesian NIPA framework or the monetarist quantity theory of money framework… Copeland is recognized as an early Post Keynesian, presenting the view that ‘the changes Keynes introduced represented modifications of neoclassicism, not its rejection’….For his innovations in money flow theory, many colleagues believed that Copeland should have received the Nobel Prize.

Aside – the modern national accounts often do incorporate important elements of the flow of funds, for instance by accepting that {consumption + net purchase of financial assets} is financed by {income + net borrowing}.

Mainstream economics has neglected such innovations at our peril. After 2008 such ideas came into the limelight again and mainstream economists started to tinker with them, and for good reason. But we should not forget money, again. Which among other things means that we should continue to criticize proto-scientific ideas. And to stress that non-mainstream economists contributed decisively to our body of economic knowledge and the importance of the historical context – which is not just the surrounding which enables economic laws to work but which shapes the laws themselves. Money is, as we speak of it, a nice example. Present day money is not the same thing and does not have the same characteristics and possibilities as nineteenth century money. The same for credit. If the war against cash succeeds money might soon be the tool which enables mass surveillance of citizens… which will make for another economy. The nature of the change might have surprised Copeland. The changing itself: not.