Openings higher than hires tells me employers don’t want to pay up, which is also suggested by low wage growth: Highlights In the latest indications of strong, tight conditions in the labor market, job openings rose to a higher-than-expected 6.170 million in July for a 0.9 percent increase from June. Hirings also rose, up 1.3 percent to 5.501 million which, however, is 669,000 below openings. Openings have been far ahead of hirings for the past several years to indicate that employers are having a hard time filling positions. Other indications are steady to higher with the separation rate at 3.6 percent, the quits rate at 2.2 percent, and the layoff rate at 1.2 percent. The only employment data that aren’t strong, in data however that are not part of the JOLTS report, are

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Openings higher than hires tells me employers don’t want to pay up, which is also suggested by low wage growth:

Highlights

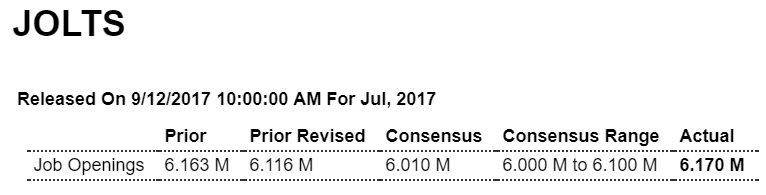

In the latest indications of strong, tight conditions in the labor market, job openings rose to a higher-than-expected 6.170 million in July for a 0.9 percent increase from June. Hirings also rose, up 1.3 percent to 5.501 million which, however, is 669,000 below openings. Openings have been far ahead of hirings for the past several years to indicate that employers are having a hard time filling positions.

Other indications are steady to higher with the separation rate at 3.6 percent, the quits rate at 2.2 percent, and the layoff rate at 1.2 percent. The only employment data that aren’t strong, in data however that are not part of the JOLTS report, are wages, yet job openings in this report are certain to catch the eye of the more hawkish FOMC policy makers who continue to warn that wage-push inflation is inevitable.

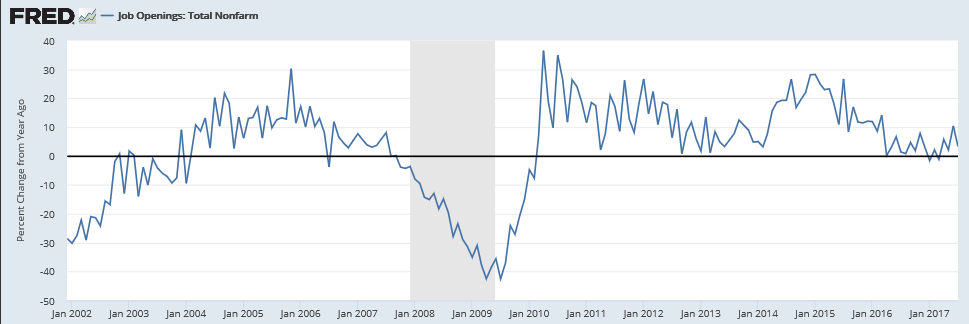

The growth rate of new openings is at stall speed:

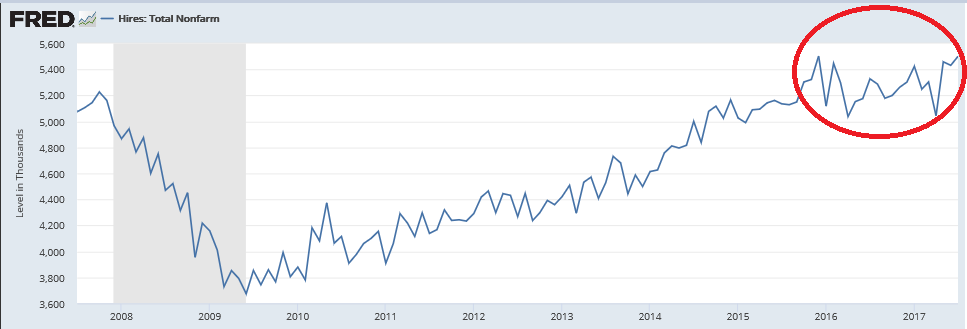

The new hiring has stalled:

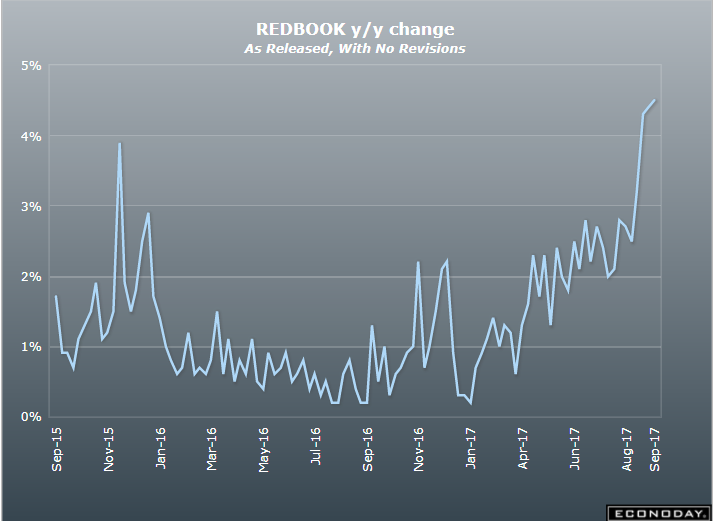

Moving higher again, as previously discussed:

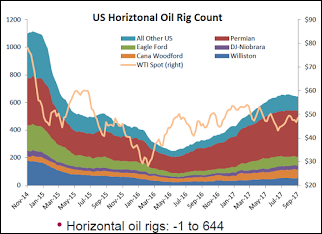

Looks like the increases in new drilling are behind us, and new wells are costing a lot less than before the shale bust, so it’s all adding that much less to GDP:

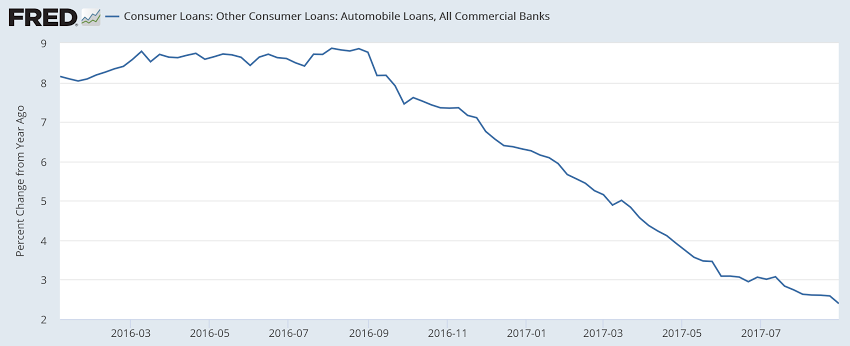

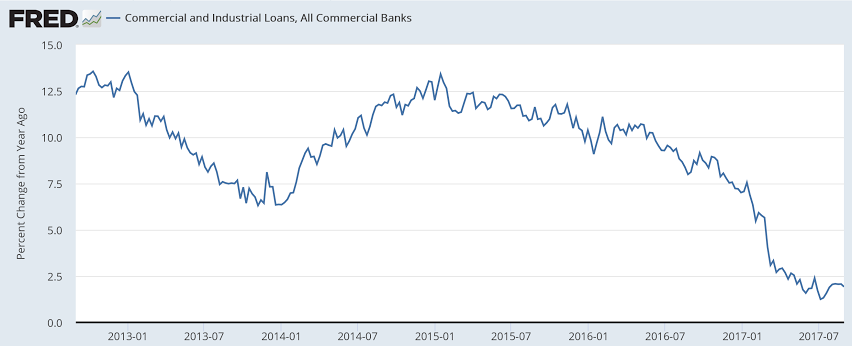

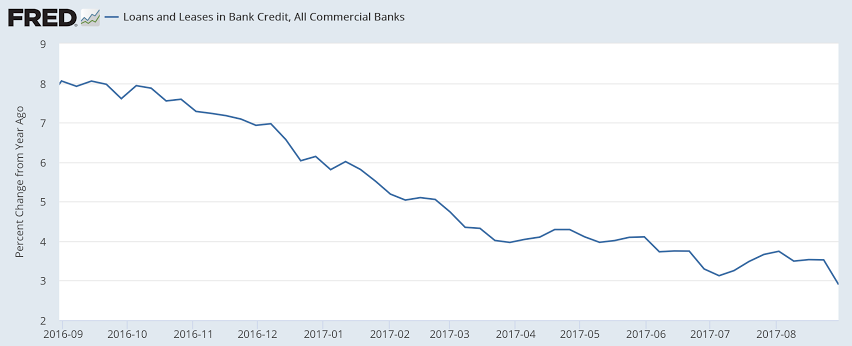

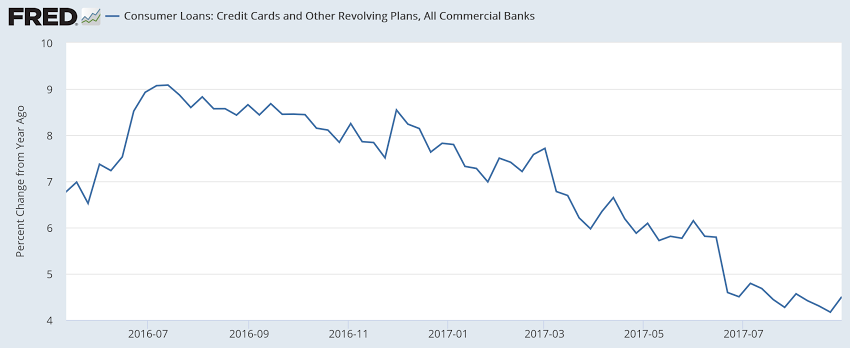

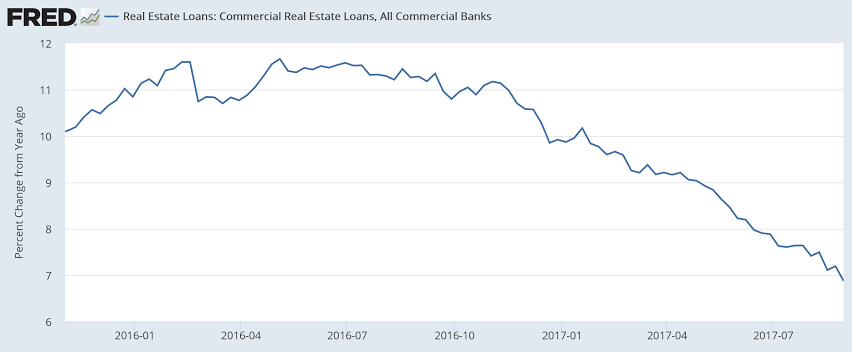

Not to kick a dead horse, but gdp growth is getting less support from credit growth than it did last year. And that reduction appears to be over 2% of GDP. So far GDP has held up from consumers dipping into savings, which looks to me to be an unsustainable process:

I’m thinking I’d tell North Korea that if they don’t abandon their nukes will give China a green light to annex them… ;)

China urges North Korea to ‘take seriously’ bid to halt nuclear program

Sept 12 (Reuters) — China’s U.N. Ambassador Liu Jieyi called on North Korea to “take seriously the expectations and will of the international community” to halt its nuclear and ballistic missile development, and called on all parties to remain “cool-headed” and not stoke tensions. Liu said relevant parties should resume negotiations “sooner rather than later.” To kick-start talks, China and Russia have proposed a dual suspension of North Korea’s nuclear and ballistic missile testing as well as U.S. and South Korean military exercises. U.S. Ambassador to the United Nations Nikki Haley has called the proposal insulting.