Share the post "Let’s Throw Some “Keynesian” Bombs"People really like to throw bombs at “Keynesian” economics because it’s become synonymous with big government and unfettered spending. The really common (and incorrect) understanding of Keynesian economics is that people shouldn’t save and should just consume until they are so fat that the economy is at full employment. The other (slightly less incorrect) version is that the government should help these people get as fat as possible by spending money all the time. As I’ve noted in the past, this is totally wrong and Keynes was much more nuanced than that, but it doesn’t surprise me when I see a layperson misinterpret it. But what I don’t expect is for relatively famous economists to misunderstand it. For instance, here’s Russ Roberts on

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Let’s Throw Some “Keynesian” Bombs"

People really like to throw bombs at “Keynesian” economics because it’s become synonymous with big government and unfettered spending. The really common (and incorrect) understanding of Keynesian economics is that people shouldn’t save and should just consume until they are so fat that the economy is at full employment. The other (slightly less incorrect) version is that the government should help these people get as fat as possible by spending money all the time. As I’ve noted in the past, this is totally wrong and Keynes was much more nuanced than that, but it doesn’t surprise me when I see a layperson misinterpret it. But what I don’t expect is for relatively famous economists to misunderstand it. For instance, here’s Russ Roberts on Twitter:

One of the worst legacies of Keynesianism is the idea that not spending money (saving/investing) is actually bad for the economy. #weird

— Russell Roberts (@EconTalker) September 20, 2017

Keynes was really specific about how he thought the economy worked. Basically, entrepreneurs and businessmen spend money on things that make our lives better (investment spending) and we should hope that consumers demand these goods and services so much that the businessmen feel comfortable hiring all the workers who want to work. And if, for some reason, the economy operates below capacity then the government can tinker with taxes, interest rates and spending to push the capitalists over the top. And if capitalists and consumers get out of control and spend in excess of productive capacity then the government should step on the breaks in a countercyclical fashion so things don’t get out of control. This is Keynesian econ in a nutshell and it’s a very capitalism friendly theory. It’s not socialism at all.

None of that is super controversial. Entrepreneurs are the engine of growth and we should hope they spend and invent and hire, etc. The government’s involvement is a little more controversial, but operating in a countercyclical manner isn’t that crazy in my view. It just kind of makes sense. But one thing we should definitely agree on (and one thing Keynes was 100% right about) was that we need and want businessmen/entrepreneurs to spend.

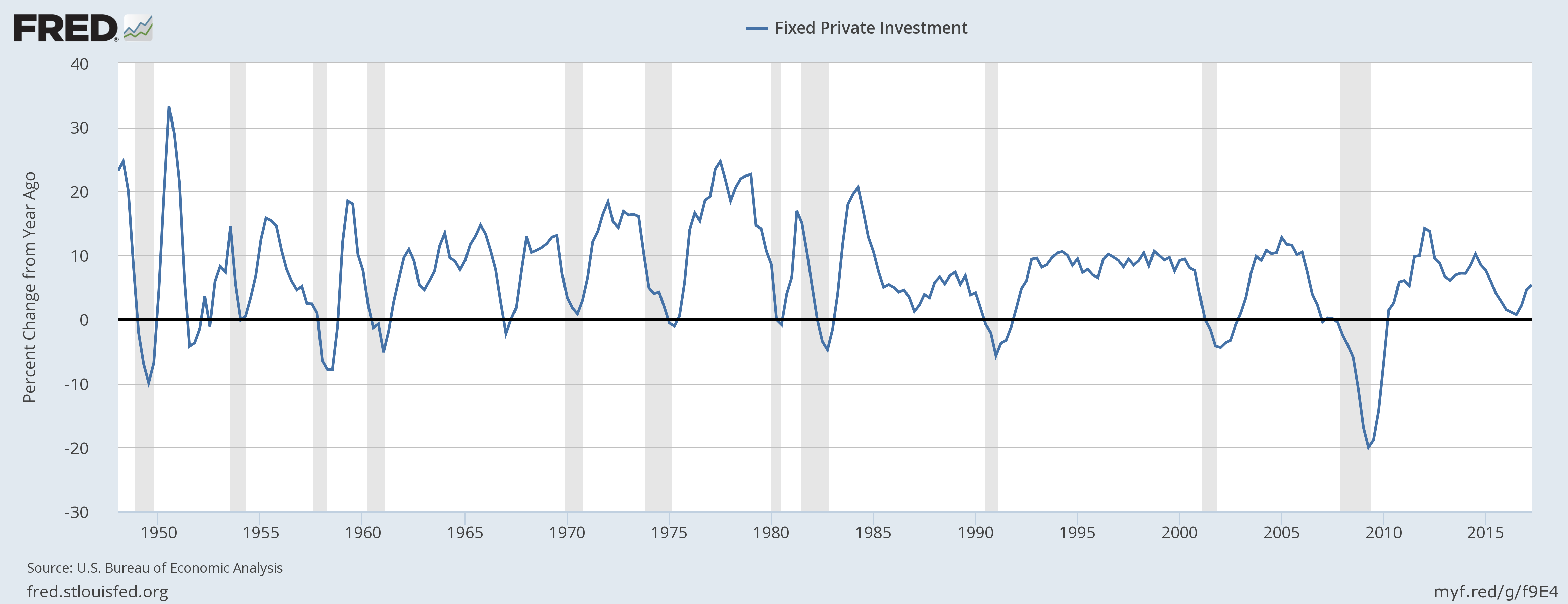

Anyhow, I feel like it’s pretty important to get this right in the current environment because this is precisely the type of environment that would have worried Keynes. While private investment has averaged 6.8% per year since 1950 the rate of change since 2000 has been just 3.4%.

This is primarily the result of corporations spending far too little. So we see these huge cash piles building up at big firms and not enough of that cash gets piled back into the economy. For whatever reason capitalists just don’t feel very comfortable spending on future production (investing) at a rate they once did. And we’ve seen that the government has an extraordinary amount of flexibility in this environment without causing high inflation. So it makes one wonder – if people understood Keynes a little better could we do something like cut taxes or spend more and bolster private investment in a way that might entice capitalists to invest more? I’ve obviously been making that argument for years, but it seems like the problem isn’t just that government officials misunderstand Keynesian economics, but economists seem to misunderstand it as well. And while Keynes would have perfectly understood this environment it seems like a lot people use his name to scare the world about government insolvency in a world where the insolvency and inflation never arrives and growth underperforms…..And so here we are muddling along.

NB – As much as I wanted to join in on the misinformed bomb throwing at Keynesian economics I just couldn’t bring myself to do it. Maybe next time.

Share the post "Let’s Throw Some “Keynesian” Bombs"