Share the post "Value Investing is Dead, Long Live Value Investing!"Here’s a great piece by Wes Gray discussing the viability of value investing. Here’s the money shot showing the relative performance of value investing strategies versus the S&P 500. We’re in the middle of one of the longest droughts on record for the value guys:I’ve made myself pretty clear on factor strategies – they usually sell alpha (market beating hopes) at greater than the cost of beta (a low cost index fund) and do worse than beta after taxes and fees. I’ve also discussed how I think value is dynamic and difficult to measure. But none of this means that a value investing approach is stupid. After all, I think we’re all value investors at the end of the day – we’re all trying to buy something that’s priced in a way

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Value Investing is Dead, Long Live Value Investing!"

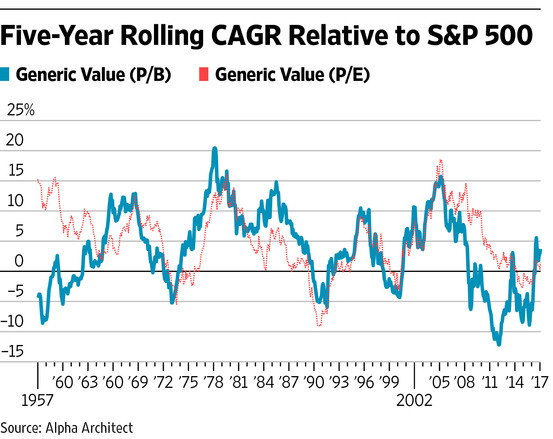

Here’s a great piece by Wes Gray discussing the viability of value investing. Here’s the money shot showing the relative performance of value investing strategies versus the S&P 500. We’re in the middle of one of the longest droughts on record for the value guys:

I’ve made myself pretty clear on factor strategies – they usually sell alpha (market beating hopes) at greater than the cost of beta (a low cost index fund) and do worse than beta after taxes and fees. I’ve also discussed how I think value is dynamic and difficult to measure. But none of this means that a value investing approach is stupid. After all, I think we’re all value investors at the end of the day – we’re all trying to buy something that’s priced in a way so that it will reflect much greater value in the future.¹ But how we do that is highly contingent not on how well the strategy will “beat the market”, but how the strategy will conform to our personal needs.

I am not a big fan of “alpha” chasing strategies for a simple reason – beating the market is not a financial goal. Yeah, it would be great to do it, but no prudent financial planner looks at a financial plan and says, “our main goal is to beat the market”. No, your goal is to generate a certain return while taking a certain degree of risk so that you have a high probability of having a certain amount of money when you actually need it. If the stock market does 10% per year and you only achieve 6% of that return, but you do it while taking far less risk and beating your required 4% return needs then you certainly did not fail. You didn’t beat the market, but you met your own financial goals.

That said, most of us probably don’t need to bother trying to pick which components of the stock market are the best parts to be in across time. As I’ve shown before, it’s smarter to own the whole market rather than engage in the guessing game about which parts to own while taking the risk that you might own too much of the parts that underperform. Instead, by owning the whole market you guarantee that you’ll own the best performing parts and the worst performing parts and this helps reduce the risk that you don’t meet your financial goals because you only owned the poor performing parts.

None of this means it is imprudent to manage the risk in your equity slice based on how expensive the stock slice is. For instance, when the stock market is expensive we know that it tends to generate lower risk adjusted returns going forward. So a 60/40 stock/bond portfolio today is quite different from a 60/40 in 2009 because the equity piece is likely to expose you to very different risks. Is it prudent to own the same 60/40 that you owned in 2009? I say perhaps not. And based on this understanding it is prudent to rebalance your portfolio to account for this. So, instead of trying to guess which parts of the equity market are the best to own you can own the whole thing, but still use a value investing approach to reduce your risk relative to your expected flight path. So you might be 50/50 stocks/bonds today because you think the stock market is expensive and likely to expose you to lower risk adjusted returns in the future. And if this portfolio’s expected return is still consistent with your financial goals then rebalancing to this lower equity slice is very prudent. In this sense, you can use a market cap weighted strategy combined with a value investing approach that simply accounts for your risk profile relative to current market conditions. In my opinion this strategy just makes sense and I eat my own cooking.²

Value investing is far from dying. But as investors are exposed to more options about how to implement their investment strategies I suspect they’ll continue to move away from promises about “market beating” returns and move towards strategies that are more focused on the appropriate returns and not false promises about the optimal returns.

¹ – Yeah, I know I know – I am bastardizing some definitions of “value” investing.

² – Countercyclical Indexing is a value approach in that it accounts for the higher expected risks in the markets across time, however, it is not a traditional value investing approach in that it is not designed to capture alpha. In fact, we know that there is a high probability that rebalancing away from the equity market across time will, on average, underperform a more aggressive stock allocation portfolio. However, it is more consistent with the risk profile of the actual investor across the same time horizon.

Share the post "Value Investing is Dead, Long Live Value Investing!"