Share the post "A Good Employment Report, but With Risks" Today’s Non-Farm Payrolls report was an overwhelming positive for the US economy. Total payrolls were up 271K with 268K coming from the private sector. There was considerable strength in professional and business services which is consistent with the recent strength we’ve seen in PMI Services data. The unemployment rate was down to 5% and revisions in past months did not play a significant factor. So, all in all, a pretty good report and certainly not consistent with recent recession fears. When compared to the last few years 2015 has actually turned out to be a pretty good year for employment. With the exception of 2014, this year is turning out to be the strongest year of job gains since the recovery started: This is consistent with much of what I’ve been saying lately – while things don’t look so good in foreign markets, there isn’t significant contagion into the US economy. The US is still the best house in a bad global neighborhood. But the real story here is about the Fed and how they’ll respond. It’s looking increasingly likely that the Fed will raise rates in December if we get another strong employment report in November. Given the uncertainty in the economy and the very weak wage growth, I still don’t understand the rush, but it is what it is.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Today’s Non-Farm Payrolls report was an overwhelming positive for the US economy. Total payrolls were up 271K with 268K coming from the private sector. There was considerable strength in professional and business services which is consistent with the recent strength we’ve seen in PMI Services data. The unemployment rate was down to 5% and revisions in past months did not play a significant factor. So, all in all, a pretty good report and certainly not consistent with recent recession fears.

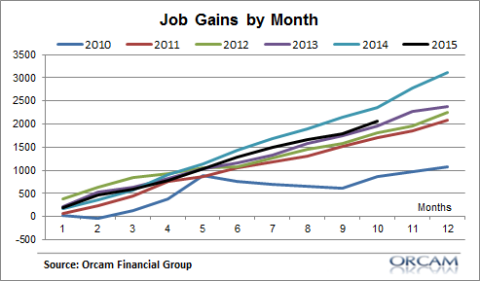

When compared to the last few years 2015 has actually turned out to be a pretty good year for employment. With the exception of 2014, this year is turning out to be the strongest year of job gains since the recovery started:

This is consistent with much of what I’ve been saying lately – while things don’t look so good in foreign markets, there isn’t significant contagion into the US economy. The US is still the best house in a bad global neighborhood. But the real story here is about the Fed and how they’ll respond. It’s looking increasingly likely that the Fed will raise rates in December if we get another strong employment report in November. Given the uncertainty in the economy and the very weak wage growth, I still don’t understand the rush, but it is what it is. The Fed appears to have a good bit of wriggle room here, but they seem antsy perhaps for fear of sparking some financial market instability which I sympathize with.

Now, the tricky part here is how uneven Fed policy has become relative to all other Central Banks. The Fed appears to be on a different page than most other Central Banks. And this has been a big contributor to the rally in the US Dollar which has exacerbated emerging market fears and commodities in particular. Global economies do not appear to be moving in tandem the way we might expect in a more interconnected world. So the Fed has to be careful here. They are the most important Central Bank in the most important global currency in the world. A continued sharp rise in the dollar could cause a very uneven temporal problem in many economies which will exacerbate near-term weakness. They might be wise to emphasize a slow rate of policy maneuvering going forward. The last thing the Fed wants to do here is exacerbate emerging market weakness that could come back to hurt them.