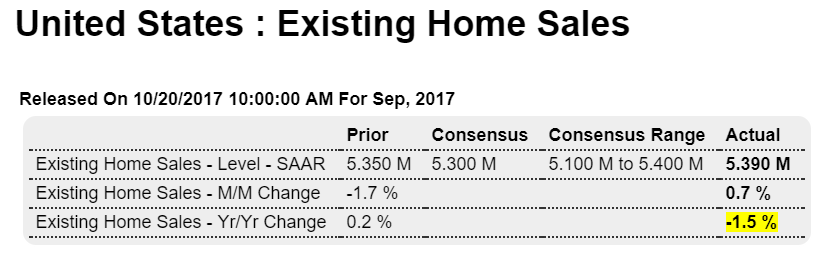

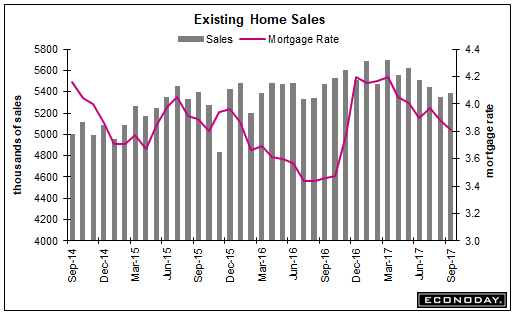

Now down year over year, and in line with the deceleration in bank mortgage lending: Highlights Existing home sales posted their first gain in four months, rising 0.7 percent in September to a 5.390 million annualized rate that is near Econoday’s top forecast. Hurricane effects are hard to gauge with the National Association of Realtors reporting that sales in Florida were down substantially though sales in Houston have already recovered. The sales gain came at a price discount as the median fell 3.2 percent to 5,100 for what is still, however, a respectable 4.2 percent year-on-year gain. Supply is still very tight, at 1.900 million resales on the market which makes for a useful 1.6 percent gain though the yearly rate is down 6.4 percent. On a sales basis, supply is

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Now down year over year, and in line with the deceleration in bank mortgage lending:

Highlights

Existing home sales posted their first gain in four months, rising 0.7 percent in September to a 5.390 million annualized rate that is near Econoday’s top forecast. Hurricane effects are hard to gauge with the National Association of Realtors reporting that sales in Florida were down substantially though sales in Houston have already recovered.

The sales gain came at a price discount as the median fell 3.2 percent to $245,100 for what is still, however, a respectable 4.2 percent year-on-year gain. Supply is still very tight, at 1.900 million resales on the market which makes for a useful 1.6 percent gain though the yearly rate is down 6.4 percent. On a sales basis, supply is unchanged at only 4.2 months.

Sales in the South fell 0.9 percent in September and follow August’s 5.7 percent decline. These may be hurricane effects but they’re not overly substantial given mixed readings in other regions. All regions are either slightly lower to flat year-on-year.

And overall sales are flat, down 1.5 percent compared to September last year. Yet this report is positive for what is a lukewarm housing sector. Watch for sales of new homes and pending sales of existing homes on next week’s calendar.

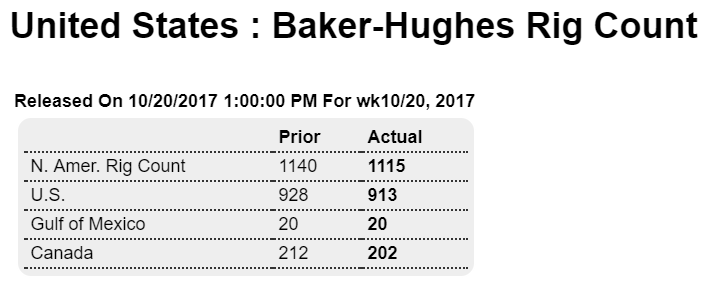

This peaked a while back and continues to fade:

Highlights

The Baker Hughes North American rig count is down 25 rigs in the October 20 week to 1,115. The U.S. rig count is down 15 rigs at 913 but is up 360 rigs from last year at this time. The Canadian count is down 10 rigs from last week at 202 but compared to last year is up 59 rigs.

For the U.S. count, rigs classified as drilling for oil are down 7 rigs at 736 while gas rigs are down 8 at 177. For the Canadian count, oil rigs are down 5 at 107 and gas rigs are also down 5, at 95 rigs.

The week’s large drop is the fourth consecutive weekly decline in the count, and is partly caused by seasonality as cold weather begins to curtail operations in northern regions, and partly probably by lingering hurricane damages, with Texas down 8 rigs to 436.

Schlumberger, Baker Hughes Warn Of N. America Slowdown

Oct 20 (Reuters) — Schlumberger Ltd and Baker Hughes, the world’s top two oilfield services firms, warned on Friday of a slowdown in North America and a challenging year ahead as crude oil prices stay volatile.

Schlumberger said investments in North America were moderating as energy companies increasingly shied away from chasing higher production at the cost of financial returns.

“Oil prices remain volatile and, as a result, our customers remain cautious,” Baker Hughes Chief Executive Lorenzo Simonelli said.

The company, in its first report to include GE Co’s oil and gas business since their merger, reported a quarterly profit that missed analysts estimates by a wide margin.

Schlumberger reported a 53 percent jump in revenue from North America, its biggest market, in the latest quarter, but cautioned that activity had been slowing.

“In the U.S. Gulf of Mexico, activity continued to weaken in the third quarter, and the outlook remains bleak for this region based on current customer plans,” Schlumberger said.

The company’s results and warnings come amid slowing drilling activity in North America.