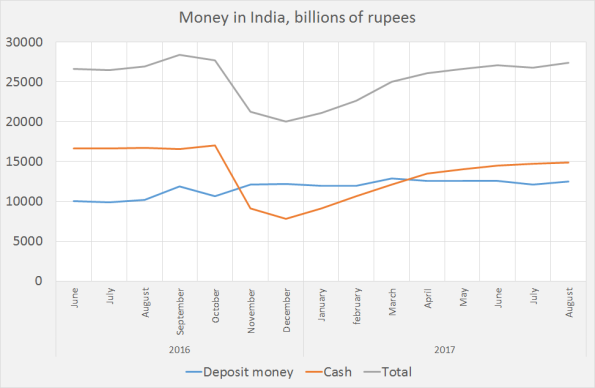

On this blog Jayati Gosh published an excellent post about the monetary folly in India where without any notice overnight large denominations of cash were abolished to force people to use digital bank money. I totally agree with this analysis but I am able to add a little. The author takes cash withdrawals from ATM machines as an indicator of the re-monetization of the economy. The Bank of India however publishes data on the composition of the stock of money in India. See also here. This information enabled me to make the graph above which shows that, as early as January 2017, the failure of this policy was clear. The Bank of India clearly facilitated a rapid re-monetization (defined as an increase of M3 money, i.e. cash plus deposit money). Economic growth has according to official

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

On this blog Jayati Gosh published an excellent post about the monetary folly in India where without any notice overnight large denominations of cash were abolished to force people to use digital bank money. I totally agree with this analysis but I am able to add a little. The author takes cash withdrawals from ATM machines as an indicator of the re-monetization of the economy. The Bank of India however publishes data on the composition of the stock of money in India. See also here. This information enabled me to make the graph above which shows that, as early as January 2017, the failure of this policy was clear. The Bank of India clearly facilitated a rapid re-monetization (defined as an increase of M3 money, i.e. cash plus deposit money). Economic growth has according to official estimates taken less of a hit than expected but especially the (misnamed) ‘informal’ sector seems to have had dire times. Looking at the graph, it seems that the very rapid re-monetization which started after december 2016 might explain this conundrum to an extent (there also was a considerable downward change in the growth rate of the GDP deflator though it kept increasing).

On this blog Jayati Gosh published an excellent post about the monetary folly in India where without any notice overnight large denominations of cash were abolished to force people to use digital bank money. I totally agree with this analysis but I am able to add a little. The author takes cash withdrawals from ATM machines as an indicator of the re-monetization of the economy. The Bank of India however publishes data on the composition of the stock of money in India. See also here. This information enabled me to make the graph above which shows that, as early as January 2017, the failure of this policy was clear. The Bank of India clearly facilitated a rapid re-monetization (defined as an increase of M3 money, i.e. cash plus deposit money). Economic growth has according to official estimates taken less of a hit than expected but especially the (misnamed) ‘informal’ sector seems to have had dire times. Looking at the graph, it seems that the very rapid re-monetization which started after december 2016 might explain this conundrum to an extent (there also was a considerable downward change in the growth rate of the GDP deflator though it kept increasing).

For an analysis of USA involvement in this folly this post by Norbert Häring.