From Lars Syll If a demand function for the economy as a whole is to be estimated, just drawing upon the economy’s overall income and the price system, is it legitimate to use the demand system derived for an individual? In other words, can we estimate demand functions independently of the distribution of income and preferences across consumers? Not surprisingly, the answer is no in general, and the conditions for it to be yes are extremely stringent, indeed unrealistically so. Essentially, the economy as a whole needs to consume as it were a single individual with a given income. But if we take income from one consumer and give it to another, the pattern of demand will be different unless those two consumers have the same preferences. So we have to assume that each and every consumer

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

If a demand function for the economy as a whole is to be estimated, just drawing upon the economy’s overall income and the price system, is it legitimate to use the demand system derived for an individual? In other words, can we estimate demand functions independently of the distribution of income and preferences across consumers?

Not surprisingly, the answer is no in general, and the conditions for it to be yes are extremely stringent, indeed unrealistically so. Essentially, the economy as a whole needs to consume as it were a single individual with a given income. But if we take income from one consumer and give it to another, the pattern of demand will be different unless those two consumers have the same preferences. So we have to assume that each and every consumer has the same preferences. However, even this assumption is not enough. Suppose it is true, and take income from a rich person and give it to a poor person. Their patterns of consumption around their initial levels of income are liable to be very different, luxuries as opposed to necessities. So, redistributing the income from rich to poor will not leave demand unchanged but shift it from luxuries to necessities. To have an aggregate demand function as if the economy were a single individual it is necessary both that every individual has the same preferences and that those preferences remain in the same proportions at every level of income (or, to put it another way, once you know one indifference curve for our representative individual, you know them all, not only for that consumer, but for all others as well — all consumers must have the same, so-called homothetic indifference curves). To be sure that the aggregation problem to be negotiated, it is necessary that the economy’s demand be reduced to a singleindifference curve … Significantly, the insurmountable nature of the aggregation problem is well established within the orthodoxy, as a result of what is known as the Sonnenschein-Mantel-Debreu theorem …

Obviously, this is entirely unacceptable …

Indeed, this is, from a scientific point of view, “entirely unacceptable.”

But so what? Why should we care about mainstream economists making assumptions that are totally unwarranted and unjustifiable? Why should we care that people make outrageous assumptions based solely on mathematical tractability and convenience? Why should we care about Sonnenschein-Mantel-Debreu?

Because those assumptions in general — and the assumptions behind Sonnenschein-Mantel-Debreu in particular — ultimately explains why New Classical, Real Business Cycles, Dynamic Stochastic General Equilibrium (DSGE) and ‘New Keynesian’ microfounded macromodels are such bad substitutes for real macroeconomic analysis!

These models try to describe and analyze complex and heterogeneous real economies with a single rational-expectations-robot-imitation-representative-agent. That is, with something that has absolutely nothing to do with reality. And — worse still — something that is not even amenable to the kind of general equilibrium analysis that they are thought to give a foundation for, since Hugo Sonnenschein (1972) , Rolf Mantel (1976) and Gerard Debreu (1974) unequivocally showed that there did not exist any sustainable condition by which assumptions on individuals would guarantee either stability or uniqueness of the equlibrium solution.

Opting for cloned representative agents that are all identical is of course not a real solutionto the aggregation problem that the Sonnenschein-Mantel-Debreu theorem points to. Representative agent models are — as I have argued at length here — rather an evasionwhereby issues of distribution, coordination, heterogeneity — everything that really defines macroeconomics — are swept under the rug.

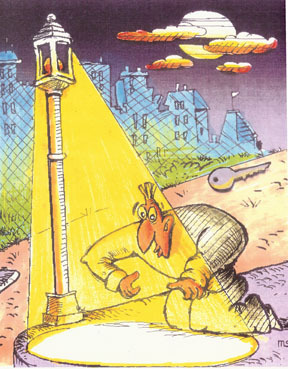

Of course, most macroeconomists know that to use a representative agent is a flagrantly illegitimate method of ignoring real aggregation issues. They keep on with their business, nevertheless, just because it significantly simplifies what they are doing. It reminds — not so little — of the drunkard who has lost his keys in some dark place and deliberately chooses to look for them under a neighbouring street light just because it is easier to see there …

Mainstream microeconomics is full of blatant inadequacies. Trying to ‘save’ it by assuming fantasy things like representative agents and homothetic indifference curves, is a sure sign of a deductive-axiomatic research programme gone terribly wrong.