(Dan here….Corrected code to fit the format and reposted) by New Deal Democrat HEADLINES: +261,000 jobs added U3 unemployment rate down -0.1% from 4.2% to 4.1% U6 underemployment rate down -0.3 from 8.2% to7.9% Here are the headlines on wages and the chronic heightened underemployment: Wages and participation rates Not in Labor Force, but Want a Job Now: down -443,000 from 5.628 million to 5.135 million Part time for economic reasons: down -369,000 from 5.122 million to 4.753 million Employment/population ratio ages 25-54: down -0.1% from 78.9% to 78.8% Average Weekly Earnings for Production and Nonsupervisory Personnel: down -$.0.1 from .23 to .22, up +2.4% YoY. (Note: you may be reading different information about wages elsewhere. They

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

- +261,000 jobs added

- U3 unemployment rate down -0.1% from 4.2% to 4.1%

- U6 underemployment rate down -0.3 from 8.2% to7.9%

- Not in Labor Force, but Want a Job Now: down -443,000 from 5.628 million

to 5.135 million - Part time for economic reasons: down -369,000 from 5.122 million to 4.753

million - Employment/population ratio ages 25-54: down -0.1% from 78.9% to 78.8%

- Average Weekly Earnings for Production and Nonsupervisory Personnel: down -$.0.1

from $22.23 to $22.22, up +2.4% YoY. (Note: you may be reading different information about

wages elsewhere. They are citing average wages for all private workers. I use wages for

nonsupervisory personnel, to come closer to the situation for ordinary workers.)

Trump specifically campaigned on bringing back manufacturing and mining jobs.

Is he keeping this promise?

- Manufacturing jobs rose by +24,000 for an average of +14,000 a month vs. the

last seven years of Obama’s presidency in which an average of 10,300 manufacturing jobs were

added each month. - Coal mining jobs were unchanged for an average of +250 a month vs. the last

seven years of Obama’s presidency in which an average of -300 jobs were lost each month

August was revised upward by +39,000. September was also revised upward by +51,000, for a

net change of +90,000.

a few months from now. These were mainly positive.

- The average manufacturing workweek rose +0.2 hours from 40.8 hours to 41.0.

This is one of the 10 components of the LEI. - Construction jobs increased by +11,000. YoY construction jobs are up +187,000.

- Temporary jobs increased by +18,300.

- The number of people unemployed for 5 weeks or less decreased by -97,000 from

2,226,000 to 2,129,000. The post-recession low was set almost two years ago at 2,095,000.

-

- Overtime rose +0.2 hours to 3.5 hours.

- Professional and business employment (generally higher- paying jobs) increased by

+50,000 and is up +546,000 YoY.

- the index of aggregate hours worked in the economy rose by 0.2 from 107.4 to 107.6

- the index of aggregate payrolls rose by 0.8 from 176.5 to 177.3 .

- the alternate jobs number contained in the more volatile household survey

decreased by -484,000 jobs. This represents an increase of 1,959,000 jobs YoY vs. - 2,004,000 in the establishment survey.

- Government jobs rose by 900.

- the overall employment to population ratio for all ages 16 and up fell -0.2%

from 60.4% to 60.2 m/m and is up +0.5% YoY. - The labor force participation rate fell -0.4% m/m and is down -0.1% YoY from

63.1% to 62.7%.

and poor in terms of wages.

persons who want a job now but haven’t looked have nudged us very close to what has been “full

employment” in the past two expansions. We may be as little as 1.5 million jobs away.

per month for the hurricane-affected month and the recovery. This is no better than mediocre or

average.

still only up 2.4% YoY quite simply is awful this late into an expansion.

Bottom line: the late cycle deceleration in YoY employment gains is continuing, and outright

wage deflation come the next recession looms ever larger

— From Bonddad

Here’s my inflation-adjusted 2 cents.

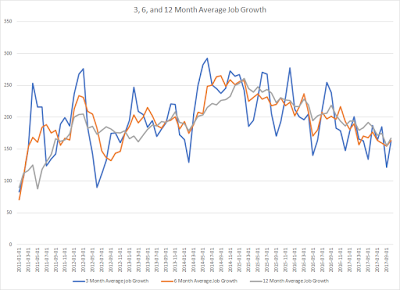

First, the 3, 6 and 12 month moving average of establishment job growth is slightly above

150,000/month:

are now late-in-the-game of this recovery, I wouldn’t expect more than 150,000 average

month growth going forward.

declining Y/Y. Both retail (middle chart) and information jobs (bottom chart) are declining.

income data. Real DPI and real DPI less transfer payments are barely getting about 1% on the

Y/Y basis. Average hourly earnings (bottom chart), which are part of the employment report, are

still weak on a historical basis.