Summary:

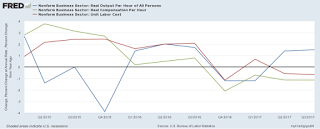

If you read the business press in the United States (e.g., the Wall Street Journal), you’ll find something along the lines of the following argument: the fact that U.S. worker productivity rebounded in the third quarter while hourly wages rose moderately is a sign “the economy is strengthening.” But look at the numbers. Nonfarm business sector productivity (the blue line in the chart above) rose 1.5 percent (from the same quarter a year ago) while real hourly compensation (the green line) fell 1.1 percent.* The result is that unit labor costs (the red line) fell 0.7 percent. According to Stephen Stanley of Amherst Pierpont Securities, lighter regulation under the Trump administration and the prospect of a .4 trillion tax-cut package being passed by Congress are likely factors that

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

If you read the business press in the United States (e.g., the Wall Street Journal), you’ll find something along the lines of the following argument: the fact that U.S. worker productivity rebounded in the third quarter while hourly wages rose moderately is a sign “the economy is strengthening.” But look at the numbers. Nonfarm business sector productivity (the blue line in the chart above) rose 1.5 percent (from the same quarter a year ago) while real hourly compensation (the green line) fell 1.1 percent.* The result is that unit labor costs (the red line) fell 0.7 percent. According to Stephen Stanley of Amherst Pierpont Securities, lighter regulation under the Trump administration and the prospect of a .4 trillion tax-cut package being passed by Congress are likely factors that

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

If you read the business press in the United States (e.g., the Wall Street Journal), you’ll find something along the lines of the following argument: the fact that U.S. worker productivity rebounded in the third quarter while hourly wages rose moderately is a sign “the economy is strengthening.”

But look at the numbers. Nonfarm business sector productivity (the blue line in the chart above) rose 1.5 percent (from the same quarter a year ago) while real hourly compensation (the green line) fell 1.1 percent.* The result is that unit labor costs (the red line) fell 0.7 percent.

According to Stephen Stanley of Amherst Pierpont Securities,

lighter regulation under the Trump administration and the prospect of a $1.4 trillion tax-cut package being passed by Congress are likely factors that have led companies to boost investment and become more productive.

Corporations may have chosen to boost investment and become more productive—but they have also chosen not to compensate their workers.

The only possible conclusion is that the Trump recovery is a recovery for employers but not for their employees.

Let’s see if Trump or someone in his administration will tweet that!

*Hours worked rose 1.5 percent and hourly compensation only 0.8 percent in the third quarter. As a result, real hourly compensation was -1.1 percent.

https://anticap.wordpress.com/2017/12/06/whose-recovery-2/