In the wake of a relatively meager 10% sell-off in the stock market we’re seeing the old financial “blame game” play out all over the place. Here’s an article blaming inflation. Here’s an article blaming machines. And you know, there’s probably a shred of truth to all of these articles, but I hate this idea that there’s an antagonist and protagonist in this story. The market is more complex than that. It all kind of reminds me of the financial crisis. The financial crisis blame game still plays out all the time. It makes sense I guess – we want to know whodunit because we want to be able to stop the problem in the future. The problem is, the financial crisis was largely psychological and there were lots of parties to blame. Homeowners got greedy and thought homes couldn’t lose value.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

In the wake of a relatively meager 10% sell-off in the stock market we’re seeing the old financial “blame game” play out all over the place. Here’s an article blaming inflation. Here’s an article blaming machines. And you know, there’s probably a shred of truth to all of these articles, but I hate this idea that there’s an antagonist and protagonist in this story. The market is more complex than that.

It all kind of reminds me of the financial crisis. The financial crisis blame game still plays out all the time. It makes sense I guess – we want to know whodunit because we want to be able to stop the problem in the future. The problem is, the financial crisis was largely psychological and there were lots of parties to blame. Homeowners got greedy and thought homes couldn’t lose value. Banks loosened standards making many of the same assumptions. Investment banks leveraged it all up thinking they’d discovered a new low risk way to securitize risky assets into safe assets. And the government probably had a hand in a lot of it as well because politicians mostly sell seemingly helpful ideas and ideologies to overly emotional and biased voters. The blame can be spread far and wide for the crisis, but at the end of the day it was mostly a bunch of overly emotional, sometimes greedy, sometimes fearful human beings who did things that seemed rational and then corrected it later when it was discovered to be less rational than they thought.

Stock market sell-offs aren’t that different. Stocks rise in value for seemingly rational reasons. The machines do lots of buying. Some people think inflation is going to rise and fall so they decide to buy stocks. Some people think growth is going to be really high so they buy stocks. Some people slept great last night so they decided to buy some stocks. I didn’t step in dog shit this morning so I will buy some stocks. You get the point. There are lots of rational and irrational reasons why the markets might move on any given day. In the long-term the moves are largely correlated to the very real trends in dividends and earnings, but that third factor, multiples, are basically just how emotional people feel. No one really knows why multiples expand and contract. They just do. Just like I don’t know why I am in a better mood than I was yesterday.¹

But here’s the thing that really gets me about all of this. The antagonist we’re really trying to criticize is volatility. And lots of people are trying to find a reason for all this volatility as if it’s a bad thing. But how short the memories of these crazy apes are! After all, we just underwent the least volatile 18 month period in stock market history. And here we are, during a garden variety sell-off complaining about volatility.² But here’s the thing:

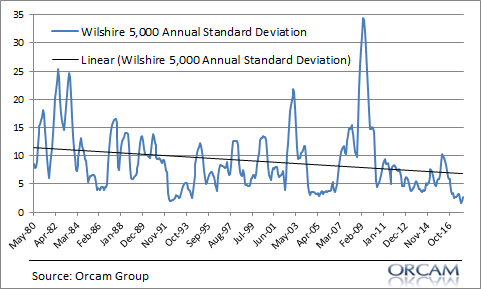

- The stock market is not becoming more volatile. Since the “rise of the robots” markets seem to be getting less volatile.

- Also, this attempt to eliminate or demonize volatility is futile. Volatility is good for the stock market. It literally needs to be volatile because that’s how it earns its risk premium. If the stock market were a perfectly stable high return earning instrument then it wouldn’t be risky. And it wouldn’t command higher returns. People who shun volatility in favor of smooth returns are the most irrational of all because they’re asking these instruments to do something they should not fundamentally do – earn high, low risk returns.

The bottom line is this – the fact that the stock market is turbulent is actually a good thing. We want that volatility. We need that volatility. And more importantly, it’s volatile in part because it’s risky which means that millions of overly emotional human beings will have trouble dealing with it over time. That too makes perfect sense. So, if you need to find a single antagonist for stock market volatility then you probably need to go have a long hard look in the mirror because we’re all to blame for the stock market’s volatility and it’s a glorious thing.³

¹ – Actually, I do know. It’s because I stepped in dog shit yesterday and it took me 45 minutes to clean it off my shoe during which I got some on my hands. If you’d like more details about this tragedy please email me at cullenroche AT gmail.com. You can also call my office hotline where we are helping others deal with the emotional trauma of stepping in dog shit.

² – I used this term “garden variety”, but I honestly don’t know where it comes from or what it means precisely. I could google it, but I am feeling lazy. I kinda know what it means and I assume it means “benign” because I’ve heard other people use it, but the more I think about it the stupider it sounds. Oh yeah, this sell-off might not be so benign. I guess we’ll have that talk later though.

³ – Stock market volatility is benign. Some might say garden variety though I would never use such a stupid term. What’s not normal is structural economic problems and while the stock market’s volatility is totally benign it’s less benign when that volatility is accompanied by a major structural economic problem like the financial crisis. Still, those are not “garden variety” types of events.

NB – Here is a picture of me with the pooping culprit during happier times.