Recent economic data has bond yields jumping a little bit on the worry of higher future inflation. According to many this is the main concern behind the recent volatility in stock and bond markets so let’s see if we can’t put some of this data in perspective so we can better understand the risks to our portfolios. Secular vs Short-Term Trends in Inflation Inflation is closely correlated to secular macro trends in the economy.While short-term counter-trends will appear worrisome at times it’s important to keep the secular long-term trends in perspective so as to avoid confusing them with a short-term counter-trend that is unlikely to persist. The secular trends in inflation are well established and unlikely to fade in the future in my opinion. These secular trends include: Labor class

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Recent economic data has bond yields jumping a little bit on the worry of higher future inflation. According to many this is the main concern behind the recent volatility in stock and bond markets so let’s see if we can’t put some of this data in perspective so we can better understand the risks to our portfolios.

Secular vs Short-Term Trends in Inflation

Inflation is closely correlated to secular macro trends in the economy.While short-term counter-trends will appear worrisome at times it’s important to keep the secular long-term trends in perspective so as to avoid confusing them with a short-term counter-trend that is unlikely to persist. The secular trends in inflation are well established and unlikely to fade in the future in my opinion. These secular trends include:

- Labor class weakness – regulations, union weakness, innovative efficiencies, cheap labor alternatives and the growing power of corporate America have put tremendous downward pressure on wages.

- Demographic trends are disinflationary. The ageing population and slowing growth in the overall population will tend to reduce aggregate demand and the potential for demand-pull inflation.

- Technology trends are reducing the risk of cost-push inflation as the cost of production declines due to increasing efficiencies.

- Inequality is disinflationary as it puts downward pressure on potential balance sheet expansion. Households are wealthier than ever, but median income relative to liabilities is also near record highs. This reduces the potential increase in the money supply as borrowing cannot expand substantially.

Secular trends are clear – the likelihood of very high inflation is low because the dominant long-term macro trends are disinflationary. So let’s turn to the short-term and see if we can’t put these short-term counter-trends in perspective.

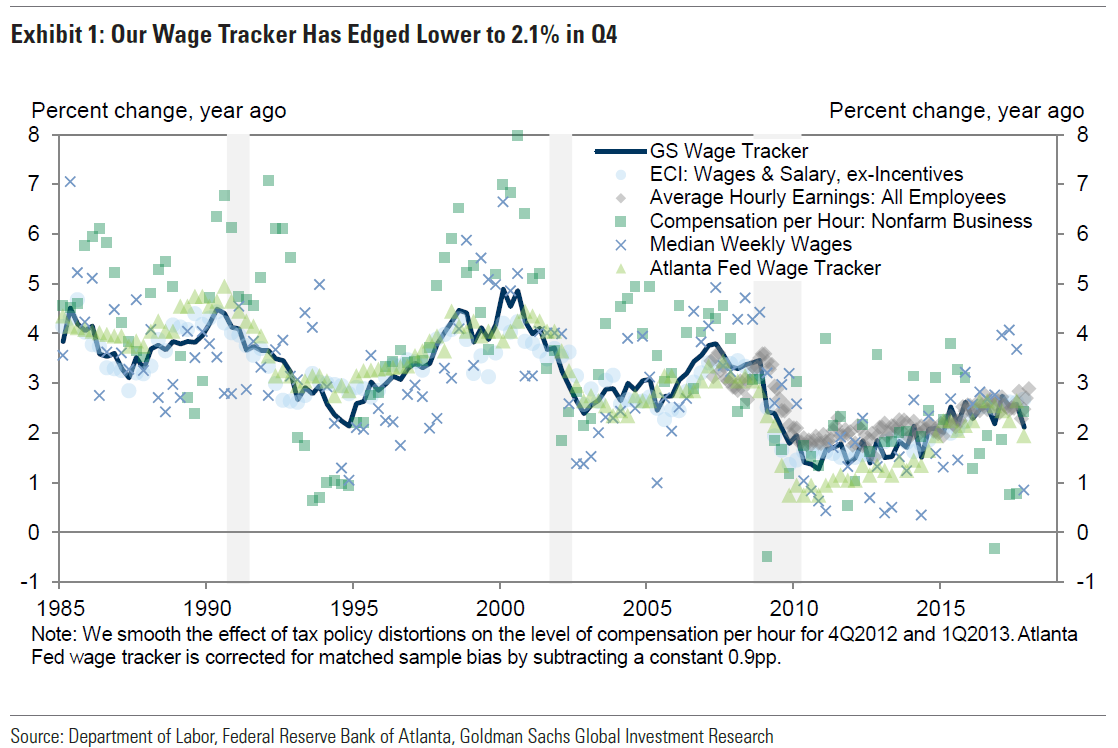

Wage Trends are Mixed

Goldman Sachs puts together an excellent wage tracker that shows the trends across multiple different sources. Despite some slow improvement in certain indicators like the Employment Cost Index, the broader trends are mixed at best and still historically low. Goldman’s wage tracker actually moved lower in Q4 to just 2.1%.

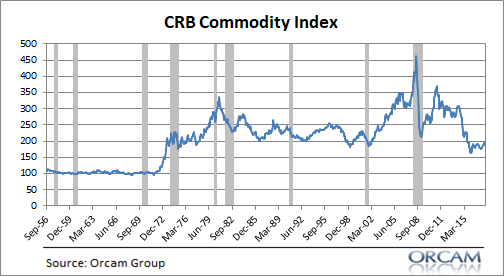

Commodity Price Trends

Commodity prices have been a reasonable historical leading indicator of future inflation. The current year over year rate of change of 1.05% is inconsistent with a worrisome rise in future inflation. Commodity prices are near 50 year lows. The secular trends appear to be putting firm downward pressure on commodity prices and there is only limited signs of a short-term counter-trend in commodity price inflation.

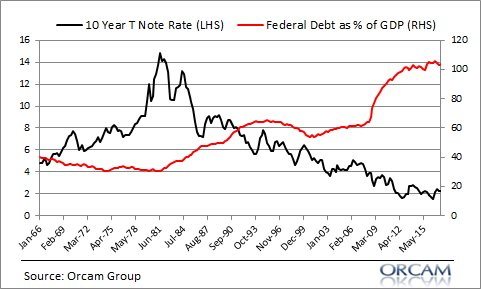

Federal Debt Trends

Many of the recent concerns have to do with the latest federal budget and the Trump tax cut. The deficit is expected to surge back to $1.1T by 2020. While popular opinion is that the federal debt drives up inflation and interest rates the data tells the opposite story. If anything, expansions in the federal debt tend to have an inverse relationship with interest rates.

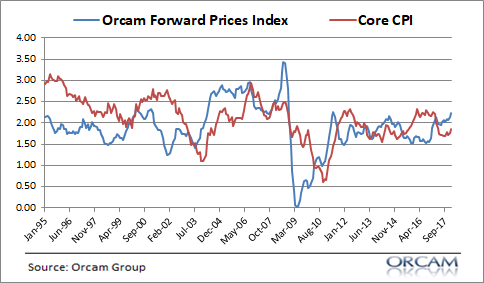

Broader Price Trends

The Orcam Forward Prices Index is my preferred measure of near-term inflation trends. It tends to lead core CPI by 12 months and the current reading is consistent with a rise in the Core CPI to 2.3%. This implies a 0.5% increase over the most recent levels of Core CPI and above the Fed’s target of 2%.

In Summary

Secular macro trends are clear – the risk of high inflation is low. The short-term trends are less clear, however, there does appear to be somewhat limited upside risk at present in future inflation. A rise in the Core CPI to 2.3% would not be surprising and will very likely keep pressure on the Fed to continue raising rates thru 2018. On the other hand, the secular trends remain firmly in place and will likely cap any potential rise in future inflation.